Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities59 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments66 Questions

Exam 3: Governmental Operating Statement Accounts Budgetary Accounting80 Questions

Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements86 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects82 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service72 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments75 Questions

Exam 8: Accounting for Fiduciary Activitiesagency and Trust Funds63 Questions

Exam 9: Financial Reporting of State and Local Governments65 Questions

Exam 10: Analysis of Governmental Financial Performance59 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations65 Questions

Exam 12: Budgeting and Performance Measurement59 Questions

Exam 13: Accounting for Not-For-Profit Organizations74 Questions

Exam 14: Not-For-Profit Organizationsregulatory, Taxation, and Performance Issues54 Questions

Exam 15: Accounting for Colleges and Universities61 Questions

Exam 16: Accounting for Health Care Organizations59 Questions

Exam 17: Accounting and Reporting for the Federal Government Glossary65 Questions

Select questions type

An interfund transfer occurs when one fund of government pays another fund of the same government for services provided.

(True/False)

4.7/5  (36)

(36)

The Estimated Revenues account of a government is debited when:

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following assets would appropriately be reported on the governmental funds balance sheet?

(Multiple Choice)

4.9/5  (37)

(37)

Under the modified accrual basis of accounting,revenues should be recognized when

(Multiple Choice)

4.8/5  (40)

(40)

If state law requires that local governments prepare General Fund and special revenue fund budgets on a basis that differs from the basis of accounting required by GAAP,then the budgetary comparison schedule or statements should

(Multiple Choice)

4.8/5  (29)

(29)

Vehicles used by the Culture and Recreation Department should be reported in the governmental fund financial statements.

(True/False)

4.9/5  (32)

(32)

A contribution was received by the city for the purchase of playground equipment.The contribution would not be recognized as revenue by the permanent fund until the playground equipment has been purchased.

(True/False)

4.8/5  (39)

(39)

The earnings on the assets of a permanent fund are to be used to support the city's library (special revenue fund).How would the earnings be recorded?

(Multiple Choice)

5.0/5  (38)

(38)

The City of Island Grove uses encumbrance accounting and its fiscal year ends on June 30.On May 6,a purchase order was approved and issued for supplies in the amount of $6,000.Island Grove received these supplies on June 2,and the $6,000 invoice was approved for payment.What General Fund journal entry should Island Grove make on May 6,to record the approved purchase order? Debits

Credits

a)

Encumbrances

6,000

Appropriations

6,000

b)

Supplies

6,000

Vouchers Payable

6,000

c)

Encumbrances

6,000

Encumbrances Outstanding

6,000

d)

Expenditures

6,000

Encumbrances

6,000

(Multiple Choice)

4.9/5  (38)

(38)

Vacation City was awarded a $500,000 federal operating grant for use in Year 2. On December 1 of year 1,half of the grant money was received by the City.The journal entry to record receipt of the grant funds will include:

(Multiple Choice)

4.9/5  (40)

(40)

Under the consumption method for recording supplies that are maintained on a perpetual inventory system,the adjusting entry made at year end would affect which of the following accounts?

(Multiple Choice)

4.9/5  (41)

(41)

Some governments choose to sell the collection rights to unpaid property taxes in tax lien public auctions and therefore will not have property tax balances reported within the financial statements.

(True/False)

4.9/5  (30)

(30)

The voters of the city passed an ordinance to increase their sales tax by ¼ percent.The proceeds of the sales tax are to be used for culture and recreation.In the governmental activities journal,how would the ¼ percent sales tax revenue be recorded?

(Multiple Choice)

4.7/5  (36)

(36)

The Town of Loveland levied property taxes in the amount of $1,600,000.The town estimates that 1 percent will be uncollectible.The journal entry to record the tax levy will include

(Multiple Choice)

4.7/5  (37)

(37)

Under current GASB standards the revenue from property taxes should be recorded in the amounts collected during the current period.

(True/False)

4.7/5  (46)

(46)

The following are key terms in Chapter 4 that relate to exchange and nonexchange transactions:

A.Derived tax revenues

B.Exchange transactions

C.Nonexchange transactions

D.Imposed nonexchange transactions

E.Voluntary nonexchange transactions

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

_____ 1. Transactions in which the donor derives no direct tangible benefits from the recipient agency

_____ 2. A classification of nonexchange transaction,such as income or sales taxes

_____ 3. A category of nonexchange transaction that includes certain grants and entitlements and most donations

_____ 4. A category of nonexchange transactions,such as property taxes and most fines and forfeitures.

B. Exchange transactions

C. Nonexchange transactions

D. Imposed nonexchange transactions

E. Voluntary nonexchange transactions

For each of the following definitions, indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

_____ 1. Transactions in which the donor derives no direct tangible benefits from the recipient agency

_____ 2. A classification of nonexchange transaction, such as income or sales taxes

_____ 3. A category of nonexchange transaction that includes certain grants and entitlements and most donations

_____ 4. A category of nonexchange transactions, such as property taxes and most fines and forfeitures.

(Short Answer)

4.8/5  (30)

(30)

A tourist tax that is restricted for use on maintenance projects in the historic downtown district should be recorded as general revenues in the governmental activities journal.

(True/False)

4.8/5  (35)

(35)

Under GASB standards,Revenues must be credited for the total amount of the property tax levy.

(True/False)

4.8/5  (40)

(40)

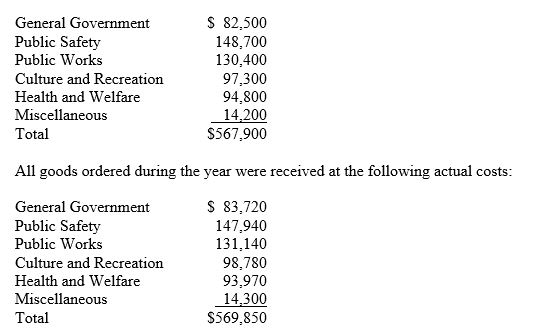

During fiscal year 2017,the Town of Tonawanda issued purchase orders to various vendors in the amounts shown for the following functions of the town:

What is the fund balance as of June 30,2017,after all closing entries have been made? Show your work.

a.Prepare a summary journal entry in the General Fund general journal to record the issuance of purchase orders during fiscal year 2017. (Subsidiary detail may be omitted.)

b.Prepare summary journal entries in the General Fund general journal to record the receipt of and payment for goods during fiscal year 2017.(Subsidiary detail may be omitted.)

What is the fund balance as of June 30,2017,after all closing entries have been made? Show your work.

a.Prepare a summary journal entry in the General Fund general journal to record the issuance of purchase orders during fiscal year 2017. (Subsidiary detail may be omitted.)

b.Prepare summary journal entries in the General Fund general journal to record the receipt of and payment for goods during fiscal year 2017.(Subsidiary detail may be omitted.)

(Essay)

4.7/5  (32)

(32)

Showing 41 - 60 of 86

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)