Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities59 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments66 Questions

Exam 3: Governmental Operating Statement Accounts Budgetary Accounting80 Questions

Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements86 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects82 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service72 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments75 Questions

Exam 8: Accounting for Fiduciary Activitiesagency and Trust Funds63 Questions

Exam 9: Financial Reporting of State and Local Governments65 Questions

Exam 10: Analysis of Governmental Financial Performance59 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations65 Questions

Exam 12: Budgeting and Performance Measurement59 Questions

Exam 13: Accounting for Not-For-Profit Organizations74 Questions

Exam 14: Not-For-Profit Organizationsregulatory, Taxation, and Performance Issues54 Questions

Exam 15: Accounting for Colleges and Universities61 Questions

Exam 16: Accounting for Health Care Organizations59 Questions

Exam 17: Accounting and Reporting for the Federal Government Glossary65 Questions

Select questions type

When revenues are legally restricted by external resource providers or committed by enabling legislation for particular operating purposes,a private purpose trust fund is created.

(True/False)

4.8/5  (39)

(39)

The types of funds that may be used in governmental accounting are classified into the three categories of governmental,proprietary,and fiduciary.

(True/False)

4.7/5  (38)

(38)

Which of the following is not a characteristic of a fund as defined by GASB standards?

(Multiple Choice)

4.8/5  (36)

(36)

Explain the nature of the three major activity categories of a state or local government: governmental activities,business-type activities,and fiduciary activities.Provide examples of each.

(Essay)

4.8/5  (41)

(41)

Which of the following governmental funds must be reported as a major fund?

(Multiple Choice)

4.9/5  (36)

(36)

A major governmental fund is one that has one or more elements (e.g.,assets,liabilities,revenues,or expenditures)that is at least:

(Multiple Choice)

4.8/5  (35)

(35)

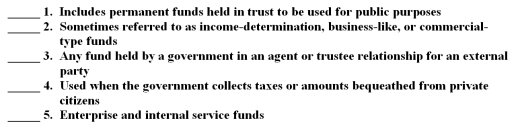

The following are categories of funds described in Chapter 2:

A.Governmental funds

B.Proprietary funds

C.Fiduciary funds

For each of the following descriptive phrases,indicate the type of fund from the list above that best matches by placing the appropriate letter in the blank space next to the phrase.

(Short Answer)

4.7/5  (30)

(30)

A permanent endowment is an example of a nonspendable fund balance.

(True/False)

4.8/5  (40)

(40)

In accordance with GASB standards,a deferred inflow of resources is reported on the financial statements the same as an unearned revenue.

(True/False)

5.0/5  (37)

(37)

Because budgetary accounts are used by governments,government financial statements can never be said to be in accord with generally accepted accounting principles.

(True/False)

4.9/5  (48)

(48)

Capital assets used by departments accounted for by the General Fund of a governmental unit should be accounted for in

(Multiple Choice)

4.8/5  (31)

(31)

Governments can,in part,demonstrate operational accountability by reporting proprietary and fiduciary fund financial information,as well as all government-wide financial information,using an economic resources measurement focus and the accrual basis of accounting.

(True/False)

4.8/5  (26)

(26)

Which of the following would be reported as a nonspendable fund balance?

(Multiple Choice)

4.9/5  (28)

(28)

The maximum sets of fund financial statements a government would present are three.

(True/False)

4.8/5  (38)

(38)

Capital assets used by an enterprise fund should be accounted for in the

(Multiple Choice)

4.8/5  (35)

(35)

Economic resources are cash or items expected to be converted into cash during the current period,or soon enough thereafter to pay current period liabilities.

(True/False)

4.8/5  (36)

(36)

A deferred inflow of resources is defined as "an acquisition of net assets by the government that is applicable to a future reporting period."

(True/False)

4.9/5  (34)

(34)

Showing 41 - 60 of 66

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)