Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory

Exam 1: Financial Statements and Business Decisions124 Questions

Exam 2: Investing and Financing Decisions and the Balance Sheet120 Questions

Exam 3: Operating Decisions and the Income Statement119 Questions

Exam 4: Adjustments,Financial Statements,and the Quality of Earnings135 Questions

Exam 5: Communicating and Interpreting Accounting Information111 Questions

Exam 6: Reporting and Interpreting Sales Revenue, Receivables, and Cash123 Questions

Exam 7: Reporting and Interpreting Cost of Goods Sold and Inventory127 Questions

Exam 8: Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles125 Questions

Exam 9: Reporting and Interpreting Liabilities117 Questions

Exam 10: Reporting and Interpreting Bonds101 Questions

Exam 11: Reporting and Interpreting Owners Equity101 Questions

Exam 12: Reporting and Interpreting Investments in Other Corporations110 Questions

Exam 13: Statement of Cash Flows120 Questions

Exam 14: Analyzing Financial Statements119 Questions

Select questions type

A company provided the following data:

Sales,$500,000; beginning inventory,$40,000; ending inventory,$45,000; and gross margin,$150,000.What was the amount of inventory purchased during the year?

(Multiple Choice)

4.9/5  (35)

(35)

On March 15,2010,Ryan Company purchased $10,000 of merchandise on credit subject to terms of 2/10,n/30.Ryan Company records its purchases using the gross amount.The periodic inventory system is used.Which of the following journal entries is correct when Ryan Company pays for these goods on March 20,2010?

(Multiple Choice)

4.9/5  (41)

(41)

The LIFO inventory method allocates the most recent inventory purchase costs to cost of goods sold.

(True/False)

4.9/5  (37)

(37)

QV-TV,Inc.provided the following items in their footnotes for the year-end 2010:

Cost of goods sold was $22 billion under FIFO costing and their inventory value under FIFO costing was $2.1 billion.The LIFO Reserve for year-end 2009 was a $0.6 billion credit balance and at year-end 2010 it had increased to a credit balance of $0.8 billion.How much is the 2010 LIFO cost of goods sold?

(Multiple Choice)

4.7/5  (41)

(41)

Inventory inspection costs incurred at the time of purchase are reported as operating expenses on the income statement.

(True/False)

4.8/5  (37)

(37)

Which of the following costs is not included as inventory on the balance sheet?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following costs does not become a part of cost of goods manufactured?

(Multiple Choice)

4.8/5  (45)

(45)

Hollander Company hired some students to help count inventory during their semester break.Unfortunately,the students added incorrectly and the 2010 ending inventory was overstated by $5,000.What would be the effect of this error in ending inventory?

(Multiple Choice)

4.9/5  (36)

(36)

How much were inventory purchases when cost of goods sold was $250,000,beginning inventory was $20,000,and ending inventory was $25,000?

(Not Answered)

This question doesn't have any answer yet

Freeman Company uses the periodic inventory system and applied LIFO inventory costing.At the end of the annual accounting period,December 31,2009,the accounting records in inventory showed Beginning inventory, Jan. 1, 2009 300 \ 20 Purchase, Feb. 1 500 21 Sale, March 15 (sold at \2 0 each) (400) Purchase, May 15 400 22 Sale, July 31 (sold at \2 5 each) (500) Calculate the following:

(round to the nearest dollar.)

1.Cost of goods available for sale

2.Ending inventory

3.Cost of goods sold

(Short Answer)

4.8/5  (40)

(40)

An understatement of the ending inventory in Year 1,if not corrected,will cause which of the following?

(Multiple Choice)

4.8/5  (34)

(34)

Carr Corporation has provided the following information for its most recent month of operation:

Sales $8,000; beginning inventory $1,000; ending inventory $2,000 and gross profit $5,000.How much were Carr's inventory purchases during the period?

(Multiple Choice)

4.8/5  (29)

(29)

RJ Corporation has provided the following information about one of their inventory items:

Date Transaction 1/1 Beginning Inventory 6/6 Purchase 9/10 Purchase 11/15 Purchase Number of Units Cost per Unit 400 \ 3,200 800 \ 3,600 1,200 \ 4,000 800 \ 4,200

During the year,3,000 units were sold. What was ending inventory using the LIFO cost flow assumption?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following journal entries is not consistent with the use of a perpetual inventory system?

(Multiple Choice)

4.9/5  (41)

(41)

Carrie Company sold merchandise with an invoice price of $1,000 to Underwood,Inc.,with terms of 2/10,n/30.Which of the following is the correct entry to record the payment by Underwood Inc.,within the 10 days if the company uses the periodic inventory system and the gross method to record purchases?

(Multiple Choice)

4.9/5  (26)

(26)

Under the FIFO cost flow assumption during a period of inflation,which of the following is false?

(Multiple Choice)

4.9/5  (42)

(42)

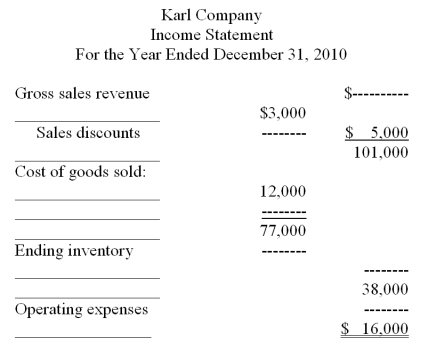

The following income statement is complete except for a few captions with bold lines on the left,and amounts with dotted lines on the right.You are to fill in the most likely captions and amounts (ignore income taxes):

(Not Answered)

This question doesn't have any answer yet

Under the LIFO cost flow assumption during a period of inflation,which of the following is false?

(Multiple Choice)

4.8/5  (40)

(40)

The records of Jimmy Company show 2010 purchases of $90,000.An actual count revealed a 2010 ending inventory of $8,000.The 2010 beginning inventory was $5,000.What was cost of goods sold for 2010?

(Short Answer)

4.9/5  (35)

(35)

The LIFO inventory method will result in the highest gross margin when costs are increasing in comparison to the specific identification,FIFO and weighted average inventory methods.

(True/False)

4.9/5  (35)

(35)

Showing 41 - 60 of 127

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)