Exam 4: Management Fraud and Audit Risk

Exam 1: Auditing and Assurance Services62 Questions

Exam 2: Professional Standards83 Questions

Exam 3: Engagement Planning78 Questions

Exam 4: Management Fraud and Audit Risk69 Questions

Exam 5: Risk Assessment: Internal Control Evaluation67 Questions

Exam 6: Employee Fraud and the Audit of Cash41 Questions

Exam 7: Revenue and Collection Cycle112 Questions

Exam 8: Acquisition and Expenditure Cycle131 Questions

Exam 9: Production Cycle97 Questions

Exam 10: Finance and Investment Cycle116 Questions

Exam 11: Completing the Audit59 Questions

Exam 12: Reports on Audited Financial Statements91 Questions

Exam 13: Other Public Accounting Services54 Questions

Exam 14: Professional Ethics46 Questions

Exam 15: Legal Liability54 Questions

Exam 16: Internal Audits, Governmental Audits, and Fraud Examinations109 Questions

Exam 17: Overview of Sampling95 Questions

Exam 18: Attributes Sampling106 Questions

Exam 19: Variables Sampling104 Questions

Exam 20: Auditing and Information Technology32 Questions

Select questions type

While performing an audit of the financial statements of a company for the year ended December 31,year 1,the auditor notes that the company's sales increased substantially in December,year 1,with a corresponding decrease in January,year 2.In assessing the risk of fraudulent financial reporting or misappropriation of assets,what should be the auditor's initial indication about the potential for fraud in sales revenue?

(Multiple Choice)

4.8/5  (33)

(33)

An audit team uses the assessed risk of material misstatement to

(Multiple Choice)

4.8/5  (36)

(36)

Generally accepted auditing standards states that analytical procedures

(Multiple Choice)

4.9/5  (36)

(36)

An auditor's analytical procedures indicate a lower than expected return on an equity method investment.This situation most likely could have been caused by

(Multiple Choice)

4.8/5  (41)

(41)

The existence of audit risk is recognized by the statement in the auditor's standard report that the

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following would not be considered an analytical procedure?

(Multiple Choice)

4.9/5  (35)

(35)

An auditor assesses the risk of material misstatement because it

(Multiple Choice)

4.9/5  (37)

(37)

For audits of financial statements made in accordance with generally accepted auditing standards,the use of analytical procedures is required to some extent.

(Multiple Choice)

4.8/5  (35)

(35)

Why is it important for auditors to understand their clients' business risks?

(Essay)

4.8/5  (43)

(43)

If an auditor encounters significant risks at the client,the auditor should do all of the following except

(Multiple Choice)

4.7/5  (46)

(46)

Jones,CPA,is auditing the financial statements of XYZ Retailing Inc.What assurance does Jones provide that direct effect noncompliance that is material to XYZ's financial statements,and noncompliance that has a material,but indirect effect on the financial statements will be detected?

(Multiple Choice)

4.9/5  (30)

(30)

Which of the following is an acceptable response to fraud risks related to sales that were identified in an audit?

(Multiple Choice)

5.0/5  (39)

(39)

Which of the following pieces of information discovered by an auditor when performing substantive tests of account balances would most likely raise red flags about the possible existence of material fraudulent financial reporting?

(Multiple Choice)

4.8/5  (34)

(34)

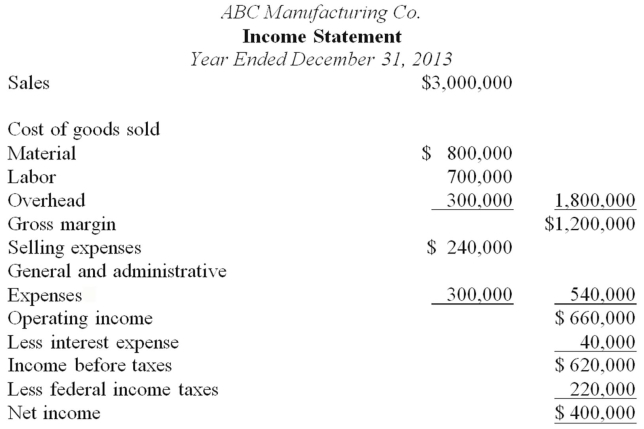

Analytical procedures are evaluations of financial information made by a study of plausible relationships among financial and nonfinancial data.Understanding and evaluating such relationships are essential to the audit process.

The following financial statements were prepared by ABC Manufacturing Co.for the year ended December 31,2013.Also presented are various financial statement ratios for Holiday as calculated from the prior year's financial statements.Sales represent net credit sales.The total assets and the receivables and inventory balances at December 31,2013,were the same as at December 31,2012.

Required:

Items 1 through 9 below represent financial ratios that the auditor calculated during the prior year's audit.For each ratio,calculate the current year's ratio from the financial statements presented above.

A B C ManufacturingCo. Balance Sheet December 31,2013

Assets Cash \ 240,000 Receivables 400,000 Inventory 600,000 Total current assets \ 1,240,000 Plant and equipment-net 760,000 Total assets \2 ,000,000 Liabilities and Capital Accounts payable \ 160,000 Notes payable 100,000 Other current liabilities 140,000 Total current liabilities \ 400,000 Long-term debt 350,000 Common stock 750,000 Retained earnings 500,000 Total liabilities and capital \

Calculation 1. Current ratio 2.5 2. Quick ratio 1.3 3. Accounts receivable turnover 5.5 4. Inventory turnover 2.5 5. Total asset turnover 1.2 6. Gross margin percentage 35\% 7. Net operating margin \% 25\% 8. Times interest earned 10.3 9. Total debt to equity 50\%

Calculation 1. Current ratio 2.5 2. Quick ratio 1.3 3. Accounts receivable turnover 5.5 4. Inventory turnover 2.5 5. Total asset turnover 1.2 6. Gross margin percentage 35\% 7. Net operating margin \% 25\% 8. Times interest earned 10.3 9. Total debt to equity 50\%

(Essay)

4.8/5  (36)

(36)

Analytical procedures are one type of evidence gathering procedure.According to auditing standards,there are five general forms of analytical procedures.Auditing standards also provide examples of five sources of information for analytical procedures.

(Essay)

4.8/5  (41)

(41)

An auditor who discovers that client employees have committed an illegal act that has a material effect on the client's financial statements most likely would withdraw from the engagement if

(Multiple Choice)

4.9/5  (36)

(36)

Showing 21 - 40 of 69

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)