Exam 12: Return, Risk, and the Security Market Line

Exam 1: A Brief History of Risk and Return100 Questions

Exam 2: The Investment Process100 Questions

Exam 3: Overview of Security Types94 Questions

Exam 4: Mutual Funds101 Questions

Exam 5: The Stock Market106 Questions

Exam 6: Common Stock Valuation104 Questions

Exam 7: Stock Price Behavior and Market Efficiency82 Questions

Exam 8: Behavioral Finance and the Psychology of Investing84 Questions

Exam 9: Interest Rates100 Questions

Exam 10: Bond Prices and Yields95 Questions

Exam 11: Diversification and Risky Asset Allocation84 Questions

Exam 12: Return, Risk, and the Security Market Line84 Questions

Exam 13: Performance Evaluation and Risk Management91 Questions

Exam 14: Futures Contracts97 Questions

Exam 15: Stock Options100 Questions

Exam 16: Option Valuation72 Questions

Exam 17: Projecting Cash Flow and Earnings100 Questions

Exam 18: Corporate Bonds85 Questions

Exam 19: Government Bonds84 Questions

Exam 20: Mortgage-Backed Securities92 Questions

Select questions type

The stock of Healthy Eating, Inc., has a beta of .88. The risk-free rate is 3.8 percent and the market return is 9.6 percent. What is the expected return on Healthy Eating's stock?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

C

Which one of the following terms is the measure of the tendency of two things to move or vary together?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

E

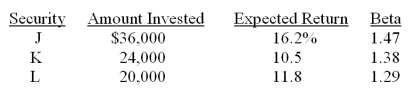

The following portfolio has an expected return of _____ percent and a beta of _____.

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

D

Which one of the following statements applies to unsystematic risk?

(Multiple Choice)

4.8/5  (42)

(42)

According to the systematic risk principle, the reward for bearing risk is based on which one of the following types of risk?

(Multiple Choice)

4.9/5  (33)

(33)

Stock A is a risky asset that has a beta of 1.4 and an expected return of 13.2 percent. Stock B is also a risky asset and has a beta of 1.25. The risk-free rate is 5.5 percent. Assuming both stocks are correctly priced, what is the expected return on stock B?

(Multiple Choice)

4.9/5  (43)

(43)

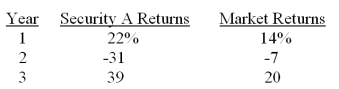

What is the covariance of security A to the market given the following information?

(Multiple Choice)

4.9/5  (41)

(41)

Which one of the following has the highest expected risk premium?

(Multiple Choice)

4.7/5  (40)

(40)

Where will a security plot in relation to the security market line (SML) if it has a beta of 1.1 and is overvalued?

(Multiple Choice)

4.8/5  (39)

(39)

A stock with which one of the following betas has an expected return that most resembles the overall market expected rate of return?

(Multiple Choice)

4.8/5  (34)

(34)

Which one of the following announcements is most apt to cause the price of a firm's stock to increase?

(Multiple Choice)

4.8/5  (33)

(33)

Stocks D, E, and F have actual reward-to-risk ratios of 7.1, 6.8, and 7.4, respectively. Given this, you know for certain that:

(Multiple Choice)

4.9/5  (37)

(37)

Uptown Markets stock has a standard deviation of 16.8 percent and a covariance with the market of .0178. The market has a standard deviation of 13.6 percent. What is the correlation of this stock with the market?

(Multiple Choice)

4.9/5  (45)

(45)

A risky security has a variance of .035109 and a covariance with the market of .0222. The variance of the market is .019538. What is the correlation of the risky security to the market?

(Multiple Choice)

4.9/5  (40)

(40)

Which one of the following terms is another name for systematic risk?

(Multiple Choice)

4.7/5  (35)

(35)

The market has a standard deviation of 10.8 percent (0.108) while a risky security has a standard deviation of 22.5 (0.225) percent. The covariance of the stock with the market is .0149. What is the beta of the stock?

(Multiple Choice)

4.9/5  (38)

(38)

The market has an expected return of 11.4 percent and a risky asset with a beta of 1.18 has an expected return of 13 percent. Based on this information, what is the pure time value of money?

(Multiple Choice)

4.8/5  (36)

(36)

The common stock of Industrial Technologies has an expected return of 15.6 percent. The market return is 11.2 percent and the risk-free return is 4.6 percent. What is the stock's beta?

(Multiple Choice)

4.8/5  (35)

(35)

A security has a zero covariance with the market. This means that:

(Multiple Choice)

4.8/5  (34)

(34)

Which two of the following determine how sensitive a security is relative to movements in the overall market?

I. the standard deviation of the security

II. correlation between the security's return and the market return

III. the volatility of the security relative to the market

IV. the amount of unsystematic risk inherent in the security

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)