Exam 6: The Meaning and Measurement of Risk and Return

Exam 1: An Introduction to the Foundations of Financial Management137 Questions

Exam 2: The Financial Markets and Interest Rates152 Questions

Exam 3: Understanding Financial Statements and Cash Flows117 Questions

Exam 4: Evaluating a Firms Financial Performance147 Questions

Exam 5: The Time Value of Money162 Questions

Exam 6: The Meaning and Measurement of Risk and Return147 Questions

Exam 7: The Valuation and Characteristics of Bonds145 Questions

Exam 8: The Valuation and Characteristics of Stock128 Questions

Exam 9: The Cost of Capital130 Questions

Exam 10: Capital-Budgeting Techniques and Practice153 Questions

Exam 11: Cash Flows and Other Topics in Capital Budgeting154 Questions

Exam 12: Determining the Financing Mix150 Questions

Exam 13: Dividend Policy and Internal Financing164 Questions

Exam 14: Short-Term Financial Planning141 Questions

Exam 15: Working-Capital Management158 Questions

Exam 16: International Business Finance109 Questions

Exam 17: Cash,receivables,and Inventory Management179 Questions

Select questions type

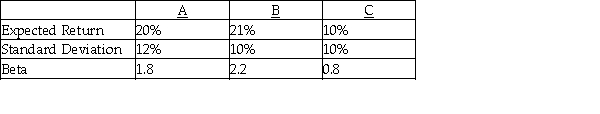

Answer the questions below using the following information on stocks A,B,and C.  Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

(Essay)

4.9/5  (43)

(43)

Company unique risk can be virtually eliminated with a portfolio consisting of approximately 20 securities.

(True/False)

4.8/5  (42)

(42)

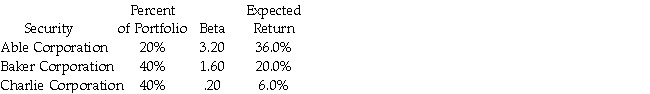

You hold a portfolio with the following securities:  What is the expected return for the market,according to the CAPM?

What is the expected return for the market,according to the CAPM?

(Multiple Choice)

4.8/5  (30)

(30)

Decker Corp.common stock has a required return of 17.5% and a beta of 1.75.If the expected risk free return is 3%,what is the expected return for the market based on the CAPM?

(Multiple Choice)

4.9/5  (39)

(39)

Assume that an investment is forecasted to produce the following returns: a 30% probability of a 12% return; a 50% probability of a 16% return; and a 20% probability of a 19% return.What is the expected percentage return this investment will produce?

(Multiple Choice)

4.8/5  (40)

(40)

You are considering investing in Ford Motor Company.Which of the following are examples of diversifiable risk?

I.Risk resulting from possibility of a stock market crash.

II.Risk resulting from uncertainty regarding a possible strike against Ford.

III.Risk resulting from an expensive recall of a Ford product.

IV.Risk resulting from interest rates decreasing.

(Multiple Choice)

4.8/5  (47)

(47)

A well-diversified portfolio typically has systematic risk equal to about 40% of the portfolio's total risk.

(True/False)

4.8/5  (32)

(32)

Showing 141 - 147 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)