Exam 7: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting256 Questions

Exam 4: Activity-Based Costing230 Questions

Exam 5: Process Costing6 Cost-Volume-Profit Relationships139 Questions

Exam 6: Cost-Volume-Profit Relationships260 Questions

Exam 7: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 8: Master Budgeting236 Questions

Exam 10: Performance Measurement in Decentralized Organizations180 Questions

Exam 11: Differential Analysis: The Key to Decision Making203 Questions

Exam 12: Capital Budgeting Decisions179 Questions

Exam 9: Flexible Budgets Standard Costs and Variance Analysis461 Questions

Exam 13: Statement of Cash Flows132 Questions

Exam 14: Financial Statement Analysis289 Questions

Exam 15: Job-Order Costing: Cost Flows and External Reporting28 Questions

Exam 16: Process Costing6 Cost-Volume-Profit Relationships100 Questions

Exam 17: Cost-Volume-Profit Relationships82 Questions

Exam 18:Flexible Budgets, Standard Costs, and Variance Analysis177 Questions

Exam 19: Flexible Budgets, Standard Costs, and Variance Analysis140 Questions

Exam 20: A Capital Budgeting Decisions16 Questions

Exam 21: A Statement of Cash Flows56 Questions

Select questions type

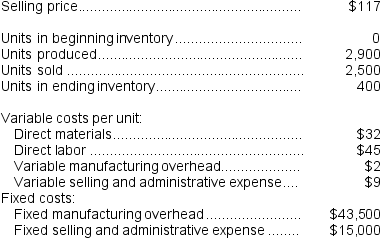

The net operating income (loss)under variable costing in Year 2 is closest to:

(Multiple Choice)

4.8/5  (30)

(30)

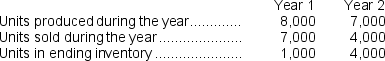

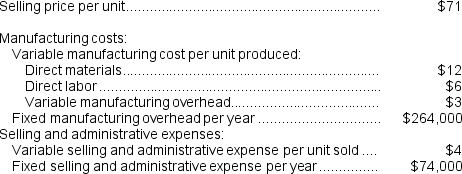

Shun Corporation manufactures and sells a hand held calculator.The following information relates to Shun's operations for last year:  What is Shun's absorption costing unit product cost for last year?

What is Shun's absorption costing unit product cost for last year?

(Multiple Choice)

5.0/5  (35)

(35)

Corbel Corporation has two divisions: Division A and Division B.Last month, the company reported a contribution margin of $60,000 for Division A.Division B had a contribution margin ratio of 40% and its sales were $300,000.Net operating income for the company was $40,000 and traceable fixed expenses were $80,000.Corbel Corporation's common fixed expenses were:

(Multiple Choice)

4.8/5  (45)

(45)

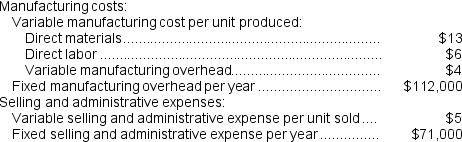

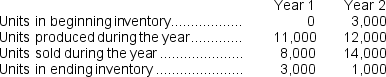

Boylston Corporation has provided the following data for its two most recent years of operation.The company makes a product that it sells for $75 per unit.It began Year 1 with no units in beginning inventory.

Required:

a.Assume the company uses absorption costing.Compute the unit product cost in each year.

b.Assume the company uses variable costing.Compute the unit product cost in each year.

c.Assume the company uses absorption costing.Prepare an income statement for each year.

d.Assume the company uses variable costing.Prepare an income statement for each year.

Required:

a.Assume the company uses absorption costing.Compute the unit product cost in each year.

b.Assume the company uses variable costing.Compute the unit product cost in each year.

c.Assume the company uses absorption costing.Prepare an income statement for each year.

d.Assume the company uses variable costing.Prepare an income statement for each year.

(Essay)

4.8/5  (36)

(36)

The total contribution margin for the month under variable costing is:

(Multiple Choice)

4.8/5  (40)

(40)

A properly constructed segmented income statement in a contribution format would show that the segment margin of the East business segment is:

(Multiple Choice)

4.8/5  (36)

(36)

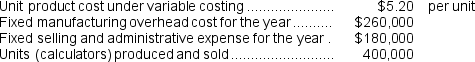

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:  The total gross margin for the month under absorption costing is:

The total gross margin for the month under absorption costing is:

(Multiple Choice)

4.9/5  (41)

(41)

Miscavage Corporation has two divisions: the Beta Division and the Alpha Division.The Beta Division has sales of $580,000, variable expenses of $301,600, and traceable fixed expenses of $186,500.The Alpha Division has sales of $510,000, variable expenses of $178,500, and traceable fixed expenses of $222,100.The total amount of common fixed expenses not traceable to the individual divisions is $235,500.What is the company's net operating income?

(Multiple Choice)

4.8/5  (38)

(38)

Under absorption costing, the cost of goods sold for the year would be:

(Multiple Choice)

4.7/5  (42)

(42)

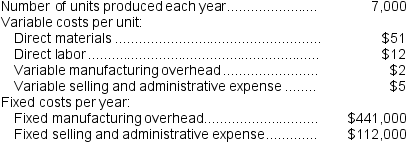

Mullee Corporation produces a single product and has the following cost structure:  The absorption costing unit product cost is:

The absorption costing unit product cost is:

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following is true of a company that uses absorption costing?

(Multiple Choice)

4.9/5  (27)

(27)

What was the absorption costing net operating income last year?

(Multiple Choice)

4.9/5  (37)

(37)

Corbett Corporation manufactures a single product.Last year, variable costing net operating income was $72,000.The fixed manufacturing overhead costs deferred in inventory under absorption costing amounted to $29,000.

Required:

Determine the absorption costing net operating income last year.Show your work!

(Essay)

4.8/5  (34)

(34)

The net operating income (loss)under absorption costing in Year 1 is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

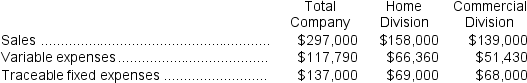

Clouthier Corporation has two divisions: Home Division and Commercial Division.The following report is for the most recent operating period:  The company's common fixed expenses total $29,700.

Required:

a.What is the Home Division's break-even in sales dollars?

b.What is the Commercial Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

The company's common fixed expenses total $29,700.

Required:

a.What is the Home Division's break-even in sales dollars?

b.What is the Commercial Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

(Essay)

4.9/5  (37)

(37)

Variable costing net operating income is usually closer to the net cash flow of a period than is absorption costing net operating income.

(True/False)

4.9/5  (31)

(31)

Homeyer Corporation has provided the following data for its two most recent years of operation:

The net operating income (loss)under absorption costing in Year 1 is closest to:

The net operating income (loss)under absorption costing in Year 1 is closest to:

(Multiple Choice)

4.8/5  (42)

(42)

Sipho Corporation manufactures a single product.Last year, the company's variable costing net operating income was $90,900.Fixed manufacturing overhead costs released from inventory under absorption costing amounted to $21,900.What was the absorption costing net operating income last year?

(Multiple Choice)

4.7/5  (37)

(37)

The net operating income (loss)under variable costing in Year 1 is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 201 - 220 of 291

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)