Exam 4: Activity-Based Costing

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting256 Questions

Exam 4: Activity-Based Costing230 Questions

Exam 5: Process Costing6 Cost-Volume-Profit Relationships139 Questions

Exam 6: Cost-Volume-Profit Relationships260 Questions

Exam 7: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 8: Master Budgeting236 Questions

Exam 10: Performance Measurement in Decentralized Organizations180 Questions

Exam 11: Differential Analysis: The Key to Decision Making203 Questions

Exam 12: Capital Budgeting Decisions179 Questions

Exam 9: Flexible Budgets Standard Costs and Variance Analysis461 Questions

Exam 13: Statement of Cash Flows132 Questions

Exam 14: Financial Statement Analysis289 Questions

Exam 15: Job-Order Costing: Cost Flows and External Reporting28 Questions

Exam 16: Process Costing6 Cost-Volume-Profit Relationships100 Questions

Exam 17: Cost-Volume-Profit Relationships82 Questions

Exam 18:Flexible Budgets, Standard Costs, and Variance Analysis177 Questions

Exam 19: Flexible Budgets, Standard Costs, and Variance Analysis140 Questions

Exam 20: A Capital Budgeting Decisions16 Questions

Exam 21: A Statement of Cash Flows56 Questions

Select questions type

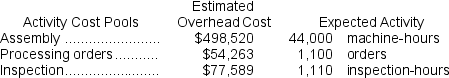

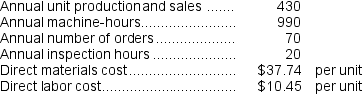

The unit product cost of Product B7 under activity-based costing is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

The total overhead applied to Product P4 under activity-based costing is closest to:

(Multiple Choice)

4.7/5  (35)

(35)

The activity rate for the Production Orders activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

In activity-based costing, departmental overhead rates are used to apply overhead to products.

(True/False)

4.9/5  (38)

(38)

The overhead applied to each unit of Product Z6 under activity-based costing is closest to:

(Multiple Choice)

4.7/5  (34)

(34)

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following statements concerning the unit product cost of Product I5 is true?

(Multiple Choice)

4.8/5  (36)

(36)

A department's overhead costs are generally caused by a variety of factors including the range of products processed in the department, the number of batch set-ups that are required, and the complexity of the products.

(True/False)

4.8/5  (35)

(35)

In activity-based costing, a separate activity rate (i.e., predetermined overhead rate)is computed for each activity cost pool by dividing the estimated overhead cost in the activity cost pool by the total expected activity for the activity cost pool.

(True/False)

4.9/5  (39)

(39)

The unit product cost of Product T6 under the company's traditional costing method in which all overhead is allocated on the basis of direct labor-hours is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Facility-level costs cannot be traced on a cause-and-effect basis to individual products.

(True/False)

4.8/5  (43)

(43)

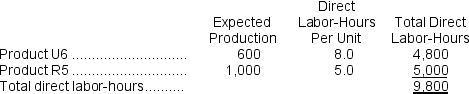

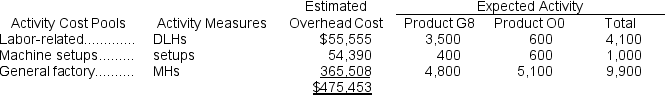

Lillich, Inc., manufactures and sells two products: Product U6 and Product R5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $27.10 per DLH.The direct materials cost per unit for each product is given below:

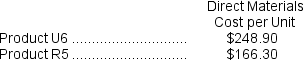

The direct labor rate is $27.10 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Which of the following statements concerning the unit product cost of Product U6 is true?

Which of the following statements concerning the unit product cost of Product U6 is true?

(Multiple Choice)

4.7/5  (33)

(33)

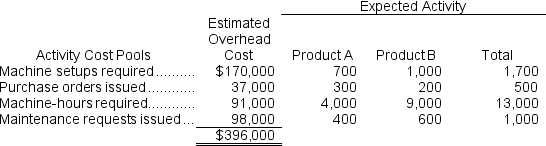

Flyer Corporation manufactures two products, Product A and Product B.Product B is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product A.Product B is the more complex of the two products, requiring three hours of direct labor time per unit to manufacture compared to one and one-half hours of direct labor time for Product A.Product B is produced on an automated production line.

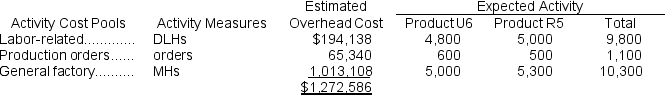

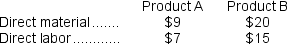

Overhead is currently assigned to the products on the basis of direct-labor-hours.The company estimated it would incur $396,000 in manufacturing overhead costs and produce 5,500 units of Product B and 22,000 units of Product A during the current year.Unit costs for materials and direct labor are:  Required:

a.Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.

b.The company's overhead costs can be attributed to four major activities.These activities and the amount of overhead cost attributable to each for the current year are given below:

Required:

a.Compute the predetermined overhead rate under the current method of allocation and determine the unit product cost of each product for the current year.

b.The company's overhead costs can be attributed to four major activities.These activities and the amount of overhead cost attributable to each for the current year are given below:  Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year.

(Essay)

4.9/5  (39)

(39)

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

(Multiple Choice)

4.9/5  (35)

(35)

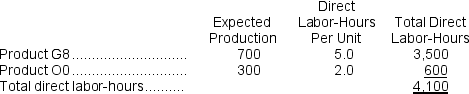

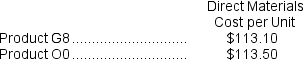

Eliezrie, Inc., manufactures and sells two products: Product G8 and Product O0.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $22.10 per DLH.The direct materials cost per unit for each product is given below:

The direct labor rate is $22.10 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Which of the following statements concerning the unit product cost of Product G8 is true?

Which of the following statements concerning the unit product cost of Product G8 is true?

(Multiple Choice)

4.9/5  (27)

(27)

Product-level activities relate to specific products and typically must be carried out whenever a batch is run or a unit of the product is made.

(True/False)

4.8/5  (27)

(27)

Ravelo Corporation has provided the following data from its activity-based costing system:  Data concerning the company's product L19B appear below:

Data concerning the company's product L19B appear below:  According to the activity-based costing system, the unit product cost of product L19B is closest to:

According to the activity-based costing system, the unit product cost of product L19B is closest to:

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following statements concerning the unit product cost of Product I4 is true?

(Multiple Choice)

4.8/5  (45)

(45)

The total overhead applied to Product A7 under activity-based costing is closest to:

(Multiple Choice)

4.7/5  (46)

(46)

The activity rate for the General Factory activity cost pool under activity-based costing is closest to:

(Multiple Choice)

4.7/5  (39)

(39)

Showing 201 - 220 of 230

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)