Exam 27: Accounting for Group Structures

Exam 1: An Overview of the Australian External Reporting Environment70 Questions

Exam 2: The Conceptual Framework of Accounting and Its Relevance to Financial Reporting72 Questions

Exam 3: Theories of Accounting76 Questions

Exam 4: An Overview of Accounting for Assets77 Questions

Exam 5: Depreciation of Property, plant and Equipment77 Questions

Exam 6: Revaluations and Impairment Testing of Non-Current Assets76 Questions

Exam 7: Inventory75 Questions

Exam 8: Accounting for Intangibles77 Questions

Exam 9: Accounting for Heritage Assets and Biological Assets76 Questions

Exam 10: An Overview of Accounting for Liabilities78 Questions

Exam 11: Accounting for Leases81 Questions

Exam 12: Accounting for Employee Benefits84 Questions

Exam 14: Accounting for Financial Instruments90 Questions

Exam 15: Revenue Recognition Issues79 Questions

Exam 16: The Statement of Comprehensive Income and Statement of Changes in Equity77 Questions

Exam 18: Accounting for Income Taxes80 Questions

Exam 19: The Statement of Cash Flows77 Questions

Exam 20: Accounting for the Extractive Industries75 Questions

Exam 21: Accounting for General Insurance Contracts73 Questions

Exam 22: Accounting for Superannuation Plans77 Questions

Exam 23: Events Occurring After the End of the Reporting Period77 Questions

Exam 24: Segment Reporting77 Questions

Exam 25: Related Party Disclosures77 Questions

Exam 27: Accounting for Group Structures87 Questions

Exam 28: Further Consolidation Issues I: Accounting for Intragroup Transactions60 Questions

Exam 29: Further Consolidation Issues II: Accounting for Non-Controlling Interests44 Questions

Exam 30: Further Consolidation Issues IV: Accounting for Changes in the Degree of Ownership of a Subsidiary49 Questions

Exam 31: Accounting for Equity Investments,including Investments in Associates and Joint Arrangements70 Questions

Exam 32: Accounting for Foreign Currency Transactions78 Questions

Exam 33: Translating the Financial Statements of Foreign Operations52 Questions

Exam 34: Accounting for Corporate Social Responsibility73 Questions

Select questions type

One important aim of releasing AAS 24 in 1991 and amendments made to The Corporations Law in the same year was to:

(Multiple Choice)

4.9/5  (34)

(34)

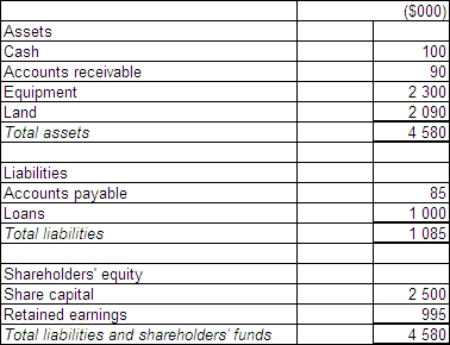

Arthur Ltd acquires all the issued capital of Martha Ltd for a cash payment of $3 000 000 on 30 June 2015.The statement of financial position of Martha Ltd at purchase date is:  Assuming the assets are at fair value,what is the goodwill or excess on consolidation?

Assuming the assets are at fair value,what is the goodwill or excess on consolidation?

(Multiple Choice)

4.8/5  (23)

(23)

Discuss how the subsidiary's post-acquisition earnings are accounted for on consolidation.

(Essay)

4.8/5  (45)

(45)

Control is defined in AASB 10 as the 'capacity to manage the policies of another entity'.

(True/False)

4.9/5  (36)

(36)

Which of the following statements is not in accordance with AASB 3 Business Combinations?

(Multiple Choice)

4.8/5  (42)

(42)

'Control' over a subsidiary,once determined as being in existence,can only be lost with a change in the level of ownership.

(True/False)

4.8/5  (37)

(37)

As prescribed in AASB 3 Business Combinations,when an acquirer makes a bargain purchase,the acquirer recognises the excess as goodwill on acquisition date.

(True/False)

4.8/5  (42)

(42)

In the consolidated financial statements of the parent entity and its controlled entities only transactions with assets and liabilities relating to parties external to the economic entity will be reflected.

(True/False)

4.7/5  (41)

(41)

AASB 10 notes that in preparing consolidated financial statements,an entity combines the financial statements of the parent and the subsidiaries line by line by adding together,in proportion to the degree of ownership,like items of assets,liabilities,income and expenses; but not equity balances.

(True/False)

4.8/5  (41)

(41)

On 1 July 2012,Carol Ltd acquires all shares in Alice Ltd for $400 000.The fair value of net assets acquired is $320 000 comprising $200 000 in share capital and $120 000 in retained earnings.On the date of purchase,a contingent liability is not recorded in the books of the acquiree but assumed by the acquirer.The contingent liability is estimated at $20 000 and likely to eventuate after acquisition.What is the appropriate elimination entry for this investment that is in accordance with AASB 3 Business Combinations and AASB 10 Consolidated Financial Statements?

(Multiple Choice)

4.7/5  (34)

(34)

In a situation where the net assets acquired in the controlled entity are not recorded at fair value,approaches that may be taken to account for this include:

(Multiple Choice)

4.9/5  (37)

(37)

The first step in the consolidation process is substituting the assets and liabilities of the subsidiary for the investment account that currently exists in the parent company.

(True/False)

4.8/5  (35)

(35)

Richer Ltd is owed a material amount by Poorer Partnership.Poorer is heavily in debt to Richer Ltd,but due to an unexpected economic downturn is unable to make repayments according to schedule.The board of Richer Ltd believes that Poorer has a good chance of trading out of its current economic difficulties as its management and product are sound and the current problems stem from external factors that are expected to pass within the next 12 to 18 months.Richer Ltd enters into an arrangement with Poorer to manage its finances until the economic situation reverses.At this stage it is not perceived as necessary for Richer Ltd to be otherwise involved in the running of Poorer.Given the situation described,what is Richer Ltd most likely to be required to do to account for Poorer under AASB 10?

(Multiple Choice)

4.9/5  (37)

(37)

AASB 10 requires the parent company to have control of another entity in order for that entity's consolidation into the group accounts to be required.

(True/False)

4.7/5  (27)

(27)

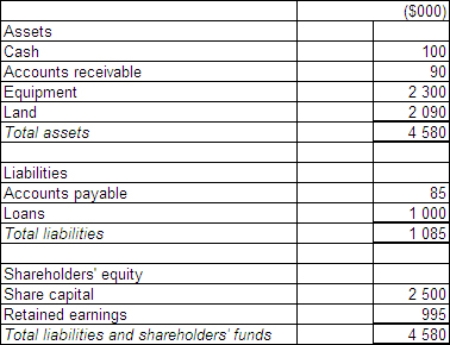

Banderas Ltd acquires all the issued capital of Ryan Ltd for a cash payment of $2 900 000 on 30 June 2014.The statement of financial position of Ryan Ltd at purchase date is:  Assuming the assets are at fair value,what is the consolidation entry to eliminate the investment in Ryan Ltd?

Assuming the assets are at fair value,what is the consolidation entry to eliminate the investment in Ryan Ltd?

(Multiple Choice)

4.7/5  (44)

(44)

Which of the following statements is an accurate description of the difference between a legal entity and an economic entity?

(Multiple Choice)

4.7/5  (40)

(40)

In the situation in which a subsidiary is only controlled temporarily,AASB 10 requires:

(Multiple Choice)

4.8/5  (48)

(48)

The factors that are taken into consideration in determining whether or not an entity should be consolidated under AASB 10 include:

(Multiple Choice)

4.9/5  (32)

(32)

Discuss the treatment as required in AASB 10 Consolidated Financial Statements for potential voting rights when considering whether one entity controls another entity.

(Essay)

4.8/5  (38)

(38)

Showing 61 - 80 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)