Exam 6: The Meaning and Measurement of Risk and Return

Exam 1: An Introduction to the Foundations of Financial Management127 Questions

Exam 2: The Financial Markets and Interest Rates148 Questions

Exam 3: Understanding Financial Statements and Cash Flows110 Questions

Exam 4: Evaluating a Firms Financial Performance148 Questions

Exam 5: The Time Value of Money162 Questions

Exam 6: The Meaning and Measurement of Risk and Return147 Questions

Exam 7: The Valuation and Characteristics of Bonds145 Questions

Exam 8: The Valuation and Characteristics of Stock128 Questions

Exam 9: The Cost of Capital135 Questions

Exam 10: Capital-Budgeting Techniques and Practice155 Questions

Exam 11: Cash Flows and Other Topics in Capital Budgeting155 Questions

Exam 12: Determining the Financing Mix151 Questions

Exam 13: Dividend Policy and Internal Financing164 Questions

Exam 14: Short-Term Financial Planning141 Questions

Exam 15: Working-Capital Management165 Questions

Exam 16: Current Asset Management181 Questions

Exam 17: International Business Finance134 Questions

Select questions type

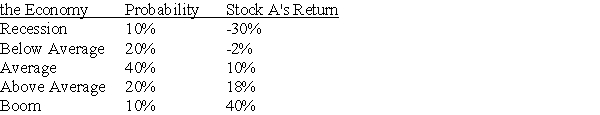

Stock A has the following returns for various states of the economy:

State of

Stock A's expected return is

Stock A's expected return is

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

C

An all-stock portfolio is more risky than a portfolio consisting of all bonds.

Free

(True/False)

5.0/5  (37)

(37)

Correct Answer:

True

Portfolio risk is typically measured by ________ while the risk of a single investment is measured by ________.

(Multiple Choice)

4.8/5  (37)

(37)

Redesign Corp is considering a new strategy that would increase its expected return from 12% to 13.9%,but would also increase its beta from 1.2 to 1.8.If the risk free rate is 5% and the return on the market is expected to be 10%,should Redesign change its strategy?

(Essay)

4.9/5  (29)

(29)

For a well-diversified investor,an investment with an expected return of 10% with a standard deviation of 3% dominates an investment with an expected return of 10% with a standard deviation of 5%.

(True/False)

4.9/5  (41)

(41)

Which of the following is the slope of the security market line?

(Multiple Choice)

4.8/5  (41)

(41)

The slope of the characteristic line of a security is that security's Beta.

(True/False)

4.7/5  (37)

(37)

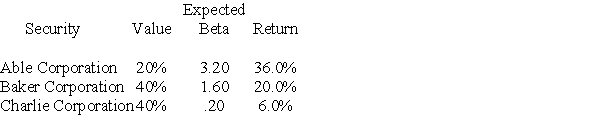

You hold a portfolio made up of the following stocks:

If the market's expected return is 14%,and the risk free rate of return is 5%,what is the expected return of the portfolio?

If the market's expected return is 14%,and the risk free rate of return is 5%,what is the expected return of the portfolio?

(Multiple Choice)

4.8/5  (34)

(34)

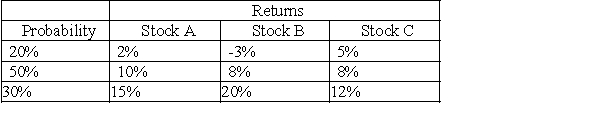

You hold a portfolio with the following securities:

What is the expected return for the portfolio?

What is the expected return for the portfolio?

(Multiple Choice)

4.8/5  (36)

(36)

Assume that you expect to hold a $20,000 investment for one year.It is forecasted to have a yearend value of $21,000 with a 30% probability; a yearend value of $24,000 with a 45% probability; and a yearend value of $30,000 with a 25% probability.What is the standard deviation of the holding period return for this investment?

(Multiple Choice)

4.9/5  (29)

(29)

The relevant risk to an investor is that portion of the variability of returns that cannot be diversified away.

(True/False)

4.8/5  (40)

(40)

You are considering the three securities listed below.

a.Calculate the expected return for each security.

b.Calculate the standard deviation of returns for each security.

c.Compare Stock A with Stocks B and C.Is Stock A preferred over the others?

a.Calculate the expected return for each security.

b.Calculate the standard deviation of returns for each security.

c.Compare Stock A with Stocks B and C.Is Stock A preferred over the others?

(Essay)

5.0/5  (43)

(43)

Asset allocation is not recommended by financial planners because mixing different types of assets,such as stocks with bonds,makes it more difficult to track performance and adjust portfolios to changing market conditions.

(True/False)

4.7/5  (28)

(28)

Assume that an investment is forecasted to produce the following returns: a 10% probability of a $1,400 return; a 50% probability of a $6,600 return; and a 40% probability of a $10,500 return.What is the expected amount of return this investment will produce?

(Multiple Choice)

4.8/5  (39)

(39)

Beta represents the average movement of a company's stock returns in response to a movement in the market's returns.

(True/False)

4.8/5  (42)

(42)

Which of the following statements is most correct concerning diversification and risk?

(Multiple Choice)

4.8/5  (38)

(38)

Investment A and Investment B both have the same expected return,but Investment A is more risky than Investment B.In the technical jargon of modern portfolio theory,Investment A is said to "dominate" Investment B.

(True/False)

4.8/5  (43)

(43)

Showing 1 - 20 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)