Exam 7: Fiduciary Trustfunds

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Organizations144 Questions

Exam 2: Overview of Financial Reporting for State and Local Governments143 Questions

Exam 3: Modified Accrual Accounting: Including the Role of Fund Balances and Budgetary Authority154 Questions

Exam 4: Accounting for the General and Special Revenue Funds128 Questions

Exam 5: Accounting for Other Governmental Fund Types: Capital Projects, debt Service, and Permanent170 Questions

Exam 6: Proprietary Funds143 Questions

Exam 7: Fiduciary Trustfunds162 Questions

Exam 8: Government-Wide Statements, capital Assets, long-Term Debt162 Questions

Exam 9: Advanced Topics for State and Local Governments104 Questions

Exam 10: Accounting for Private Not-For-Profit Organizations154 Questions

Exam 11: College and University Accounting128 Questions

Exam 12: Accounting for Hospitals and Other Health Care Providers99 Questions

Exam 13: Auditing, tax-Exempt Organizations, and Evaluating Performance144 Questions

Exam 14: Financial Reporting by the Federal Government68 Questions

Select questions type

The Accrual Basis and Economic Resource Focus are used for Private-Purpose,Investment Trust and Pension Funds.

(True/False)

4.8/5  (35)

(35)

When a contributor and a government agree that the principle and/or income of trust assets is for the benefit of individuals,organizations,or other governments,an agency trust has been formed.

(True/False)

4.7/5  (35)

(35)

Which of the following is true regarding the reporting of investments by state and local governmental units?

(Multiple Choice)

4.8/5  (36)

(36)

If a government is liable for payment of special assessment debt in the event of default by the property owners,then an agency fund must be used.

(True/False)

4.8/5  (42)

(42)

Investment pools invested from external parties are recorded in Investment Trust Funds.

(True/False)

4.8/5  (45)

(45)

An employee enrolls in a pension plan that will pay out 3% of the employee's average salary for the last 3 years the employee worked.What type of pension plan does the employee have?

(Multiple Choice)

4.7/5  (35)

(35)

Pension trust funds are required to present a Schedule of Funding Progress and a Schedule of Employer Contributions as required supplementary information.

(True/False)

4.8/5  (31)

(31)

Defined contribution plans usually report unfunded actuarial liabilities.

(True/False)

4.8/5  (24)

(24)

A fund that exists when the government is the sponsor of a multigovernment investment pool and accounts for the external portion of the trust assets is a(n):

(Multiple Choice)

4.9/5  (41)

(41)

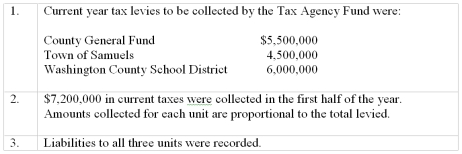

Washington County assumed the responsibility of collecting property taxes for all governments within its boundaries.In order to reimburse the county for expenditures for administering the Tax Agency Fund,the Tax Agency Fund is to deduct two percent from the collections from the city and school district.The total amount deducted is to be added to the collections for the county and remitted to the County General Fund.You are to record the following transactions in the accounts of the Washington County Tax Agency Fund.

(Essay)

4.9/5  (31)

(31)

Which of the following is not an example of the function of an Agency Fund?

(Multiple Choice)

4.8/5  (36)

(36)

Private-purpose trust funds account for donated resources that benefit the general citizenry.

(True/False)

4.7/5  (35)

(35)

Ford County levies for its General Fund $2,000,000 in property taxes.In addition,the county is responsible for collecting $4,000,000 in property taxes for the consolidated school district and $1,000,000 in property taxes for a town within the county.2% of all taxes levied are expected to be uncollectible.When recording the levies in an agency fund,what amount would Ford County record as Taxes Receivable for Other Governments - Current and Due to Other Governments?

(Multiple Choice)

4.8/5  (36)

(36)

A statewide pension plan exists for all local governments in a certain state.The provisions of the plan indicate that each qualifying retiree receive 2% multiplied by the number of years active employment multiplied by the average salary for the past four years of service.The government calculates the actuarial liability on a statewide basis,not by individual government.The plan would be known as a:

(Multiple Choice)

4.8/5  (36)

(36)

Investment Trust Funds account for the external portion of investment pools.

(True/False)

4.9/5  (32)

(32)

Churchville County is trustee for a multi-government investment pool and has established an investment trust fund.Included in the investment trust fund,for management purposes,are investments in the amount of $15 million from the County's General Fund,$3 million from the County's special revenue funds,and $112 million from other governments.Which of the following would be true?

(Multiple Choice)

4.9/5  (35)

(35)

A county treasurer maintains an investment pool in which several different towns in the county hold investments.Where should the towns' investments be recorded?

(Multiple Choice)

4.8/5  (34)

(34)

Showing 101 - 120 of 162

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)