Exam 4: Corporate Nonliquidating Distributions

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

A corporation distributes land and the related liability to Meg,its sole shareholder.The land has an FMV of $60,000 and is subject to a liability of $70,000.The corporation has current and accumulated E&P of $80,000.The corporation's adjusted basis for the property is $70,000.What effect does the transaction have on the corporation?

(Multiple Choice)

4.9/5  (38)

(38)

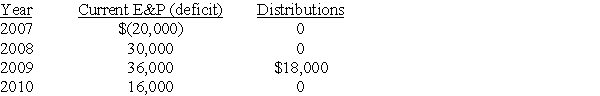

Omega Corporation is formed in 2006.Its current E&P and distributions for each year through 2010 are as follows:

Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

Is the distribution made from current or accumulated E&P? At the beginning of 2011,what is accumulated E&P?

(Essay)

4.7/5  (39)

(39)

White Corporation is a calendar-year taxpayer.Wilhelmina owns all of its stock.Her basis for the stock is $25,000.On March 1 of the current year (not a leap year),White Corporation distributes $60,000 to Wilhelmina.Determine the tax consequences of the cash distribution to Wilhelmina in each of the following independent situations:

a)Current E&P $15,000,accumulated E&P $50,000.

b)Current E&P $25,000,accumulated E&P $(25,000).

c)Current E&P ($36,500),accumulated E&P $65,000.

d)Current E&P ($10,000),accumulated E&P $(25,000).

(Essay)

4.8/5  (27)

(27)

The gross estate of a decedent contains $2,000,000 cash and 100% of Davis Corporation stock worth $600,000.Funeral and administrative expenses and state death taxes allowable as estate tax deductions amount to $400,000.The estate owes no other liabilities.The decedent's Davis stock can be

(Multiple Choice)

4.9/5  (42)

(42)

River Corporation's taxable income is $25,000,after deducting a $5,000 NOL carryover from last year and after claiming a $10,000 dividends-received deduction.What is the current E&P?

(Essay)

4.8/5  (37)

(37)

Which of the following is not a reason for a stock redemption?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following is not a condition that permits a stock redemption to be treated as a sale?

(Multiple Choice)

4.9/5  (35)

(35)

What is a stock redemption? What are some of the reasons for making a stock redemption? Why are some redemptions treated as sales and others as dividends?

(Essay)

4.9/5  (36)

(36)

In the current year,Ho Corporation sells land that has a $6,000 basis and a $10,000 FMV to Henry,an unrelated individual.Henry makes a $2,500 down payment this year and will pay Ho $2,500 per year for the next three years,plus interest on the unpaid balance at a rate acceptable to the IRS.Ho's realized gain is $4,000.Since Ho is not in the business of selling land,it will use the installment method of accounting.How does this transaction affect Ho's E&P in the current year and the three subsequent years?

(Essay)

4.9/5  (39)

(39)

Checkers Corporation has a single class of common stock outstanding.Bert owns 100 shares,which he purchased five years ago for $200,000.In the current year,when the stock is worth $2,500 per share,Checkers Corporation declares a 10% stock dividend payable in common stock.Bert receives ten additional shares on December 10 of the current year.On January 25 of next year he sells all ten shares for $30,000.

a)How much income must Bert recognize when he receives the stock dividend?

b)How much gain or loss must Bert recognize when he sells the ten shares he received as a stock dividend?

(Essay)

4.9/5  (34)

(34)

In 2010,Tru Corporation deducted $5,000 of bad debts.It received no tax benefit from the deduction because it had an NOL in 2010 that it was unable to carry back or forward.In 2011,Tru recovered $4,000 of the amount due.

a)What amount must Tru include in income in 2011?

b)What effect does the $4,000 have on E&P in 2011,if any?

(Essay)

4.9/5  (35)

(35)

Showing 101 - 113 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)