Exam 3: Financial Statements,tools,and Budgets

Exam 1: Understanding Personal Finance141 Questions

Exam 2: Career Planning76 Questions

Exam 3: Financial Statements,tools,and Budgets151 Questions

Exam 4: Managing Income Taxes196 Questions

Exam 5: Managing Checking and Savings Accounts181 Questions

Exam 6: Building and Maintaining Good Credit143 Questions

Exam 7: Credit Cards and Consumer Loans160 Questions

Exam 8: Vehicles and Other Major Purchases144 Questions

Exam 9: Obtaining Affordable Housing214 Questions

Exam 10: Managing Property and Liability Risk202 Questions

Exam 11: Managing Health Expenses126 Questions

Exam 12: Life Insurance Planning214 Questions

Exam 13: Investment Fundamentals173 Questions

Exam 14: Investing in Stocks and Bonds351 Questions

Exam 15: Investing Through Mutual Funds172 Questions

Exam 16: Real Estate and High-Risk Investments112 Questions

Exam 17: Retirement Planning257 Questions

Select questions type

Tran Zhao has monetary assets valued at $17,500 and monthly expenses of $2,525.Using the liquidity ratio,how long could Tran live on his monetary assets if he were to lose his job?

(Multiple Choice)

4.9/5  (36)

(36)

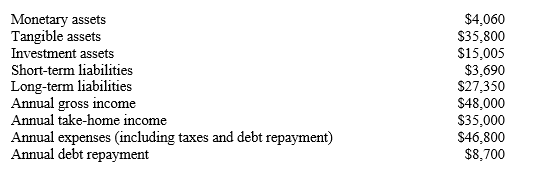

NARRBEGIN: Figure 3-1

Figure 3-1

Maria and John Sanchez have just completed their third annual set of financial statements.They met in a personal finance class while in college and still remember their instructor's advice regarding the importance of knowing their financial condition and progress.Even before they got married,they decided that each year on February 2 (Groundhog Day)they would update their cash-flow statement and their balance sheet.

The following information is taken from their latest financial statements:

-Refer to Figure 3-1.According to the liquidity ratio,how long could Maria and John continue to meet their expenses after a total loss of income?

-Refer to Figure 3-1.According to the liquidity ratio,how long could Maria and John continue to meet their expenses after a total loss of income?

(Multiple Choice)

4.7/5  (32)

(32)

The surplus section on an individual's cash-flow statement is similar to net profit for a business.

(True/False)

4.9/5  (33)

(33)

Pre-established plans of action to be implemented in specific circumstances are called

(Multiple Choice)

4.8/5  (36)

(36)

Reconciling budget estimates includes reconciling conflicting needs and wants.

(True/False)

5.0/5  (41)

(41)

Using a budget design that keeps a declining balance helps one

(Multiple Choice)

4.9/5  (30)

(30)

The balance sheet serves as an assessment of assets and liabilities at fair market value as of a specified date.

(True/False)

4.9/5  (34)

(34)

A budget variance is the difference between one's actual expenditure with budgeted amount for a specific category.

(True/False)

4.8/5  (41)

(41)

Many experts recommend that people should have assets equal to one year's expenses in emergency cash reserves.

(True/False)

4.9/5  (39)

(39)

Paying off debts is an example of a financial goal even though it does not involve a direct purchase.

(True/False)

4.9/5  (22)

(22)

Showing 141 - 151 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)