Exam 4: Why Do Interest Rates Change

Exam 1: Why Study Financial Markets and Institutions63 Questions

Exam 2: Overview of the Financial System80 Questions

Exam 3: What Do Interest Rates Mean and What Is Their Role in Valuation95 Questions

Exam 4: Why Do Interest Rates Change106 Questions

Exam 5: How Do Risk and Term Structure Affect Interest Rates98 Questions

Exam 6: Are Financial Markets Efficient58 Questions

Exam 7: Why Do Financial Institutions Exist119 Questions

Exam 8: Why Do Financial Crises Occur and Why Are They so Damaging to the Economy55 Questions

Exam 9: Central Banks and the Federal Reserve System98 Questions

Exam 10: Conduct of Monetary Policy: Tools, Goals, Strategy, and Tactics95 Questions

Exam 11: The Money Markets76 Questions

Exam 12: The Bond Market88 Questions

Exam 13: The Stock Market68 Questions

Exam 14: The Mortgage Markets75 Questions

Exam 15: The Foreign Exchange Market85 Questions

Exam 16: The International Financial System88 Questions

Exam 17: Banking and the Management of Financial Institutions104 Questions

Exam 18: Financial Regulation73 Questions

Exam 19: Banking Industry: Structure and Competition134 Questions

Exam 20: The Mutual Fund Industry57 Questions

Exam 21: Insurance Companies and Pension Funds79 Questions

Exam 22: Investment Banks, Security Brokers and Dealers, and Venture Capital Firms84 Questions

Exam 23: Risk Management in Financial Institutions63 Questions

Exam 24: Hedging With Financial Derivatives114 Questions

Exam 25: Savings Associations and Credit Unions87 Questions

Exam 26: Finance Companies41 Questions

Select questions type

When the inflation rate is expected to increase, the real cost of borrowing declines at any given interest rate; as a result, the ________ bonds increases and the ________ curve shifts to the right.

(Multiple Choice)

4.8/5  (30)

(30)

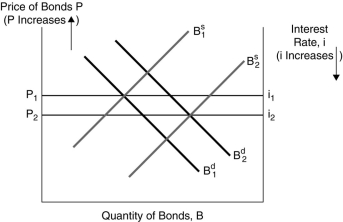

Use the following figure to answer the questions : Figure 4.1:  -In Figure 4.1, the most likely cause of a decrease in the equilibrium interest rate from i2 to i1 is

-In Figure 4.1, the most likely cause of a decrease in the equilibrium interest rate from i2 to i1 is

(Multiple Choice)

4.7/5  (35)

(35)

When bond prices become more volatile, the demand for bonds ________ and the interest rate ________.

(Multiple Choice)

4.9/5  (33)

(33)

A person who is risk averse prefers to hold assets that are more, not less, risky.

(True/False)

4.8/5  (39)

(39)

The more liquid an asset is relative to alternative assets, holding everything else unchanged, the more desirable it is, and the greater the quantity demanded.

(True/False)

4.7/5  (36)

(36)

Factors that can cause the supply curve for bonds to shift to the right include

(Multiple Choice)

4.9/5  (37)

(37)

In Keynes's liquidity preference framework, individuals are assumed to hold their wealth in two forms:

(Multiple Choice)

4.7/5  (34)

(34)

When the growth rate of the money supply increases, interest rates end up being permanently lower if

(Multiple Choice)

4.9/5  (43)

(43)

During an economic expansion, the supply of bonds ________ and the supply curve shifts to the ________.

(Multiple Choice)

4.8/5  (46)

(46)

Holding everything else constant, an increase in wealth lowers the quantity demanded of an asset.

(True/False)

4.9/5  (39)

(39)

When comparing the loanable funds and liquidity preference frameworks of interest rate determination, which of the following is true?

(Multiple Choice)

4.9/5  (45)

(45)

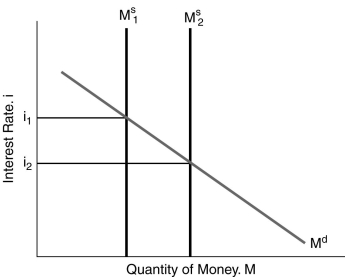

Use the following figure to answer the questions : Figure 4.3:

-In Figure 4.3, the decrease in the interest rate from i1 to i2 can be explained by

-In Figure 4.3, the decrease in the interest rate from i1 to i2 can be explained by

(Multiple Choice)

4.7/5  (29)

(29)

How is the equilibrium interest rate determined in the bond market? Explain why the interest rate will move toward equilibrium if it is temporarily above or below the equilibrium rate.

(Not Answered)

This question doesn't have any answer yet

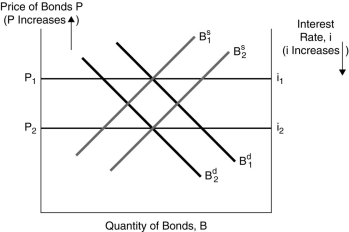

Use the following figure to answer the questions : Figure 4.2:

-In Figure 4.2, one possible explanation for the increase in the interest rate from i1 to i2 is

-In Figure 4.2, one possible explanation for the increase in the interest rate from i1 to i2 is

(Multiple Choice)

4.9/5  (25)

(25)

When the price of a bond is ________ the equilibrium price, there is an excess supply of bonds and the price will ________.

(Multiple Choice)

4.7/5  (33)

(33)

A decline in the expected inflation rate causes the demand for money to ________ and the demand curve to shift to the ________

(Multiple Choice)

4.9/5  (46)

(46)

When the growth rate of the money supply is increased, interest rates will rise immediately if the liquidity effect is ________ than the other effects and if there is ________ adjustment of expected inflation.

(Multiple Choice)

4.8/5  (46)

(46)

When an economy grows out of a recession, normally the demand for bonds increases and the supply of bonds increases.

(True/False)

4.9/5  (30)

(30)

When the growth rate of the money supply is decreased, interest rates will rise immediately if the liquidity effect is ________ than the other effects and if there is ________ adjustment of expected inflation.

(Multiple Choice)

5.0/5  (40)

(40)

Showing 21 - 40 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)