Exam 13: Short-Run Decision Making: Relevant Costing

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts247 Questions

Exam 3: Cost Behavior237 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool179 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management124 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis172 Questions

Exam 12: Performance Evaluation and Decentralization166 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis191 Questions

Select questions type

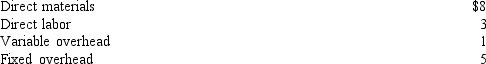

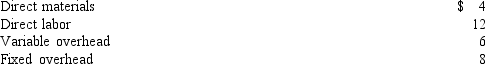

Piersall Company makes a variety of paper products. One product is 20 lb copier paper, packaged 5,000 sheets to a box. One box normally sells for $18. A large bank offered to purchase 3,000 boxes at $14 per box. Costs per box are as follows:  No variable marketing costs would be incurred on the order. The company is operating significantly below the maximum productive capacity. No fixed costs are avoidable.

Should Piersall accept the order?

No variable marketing costs would be incurred on the order. The company is operating significantly below the maximum productive capacity. No fixed costs are avoidable.

Should Piersall accept the order?

(Multiple Choice)

4.7/5  (30)

(30)

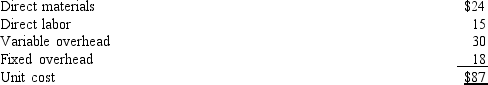

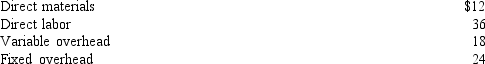

The following information relates to a product produced by Creamer Company:  Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold. Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year. The product normally sells for $120 each. A customer has offered to buy 60,000 units for $90 each.

The incremental cost per unit associated with the special order is

Fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold. Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year. The product normally sells for $120 each. A customer has offered to buy 60,000 units for $90 each.

The incremental cost per unit associated with the special order is

(Multiple Choice)

4.8/5  (40)

(40)

Brorsen, Inc., has just designed a new product with a target cost of $64. Brorsen requires new product to have a profit of 20%. What is the target price for the new product?

(Multiple Choice)

4.9/5  (39)

(39)

A decision that focuses on whether a specially priced order should be accepted or rejected is what kind of decision?

(Multiple Choice)

4.8/5  (40)

(40)

Refer to Figure 13-9. What is the contribution margin per hour of machine time for Test C?

(Multiple Choice)

4.8/5  (41)

(41)

Boone Products had the following unit costs:  A one-time customer has offered to buy 2,000 units at a special price of $48 per unit. Because of capacity constraints, 1,000 units will need to be produced during overtime. Overtime premium is $8 per unit. How much additional profit or loss will be generated by accepting the special order?

A one-time customer has offered to buy 2,000 units at a special price of $48 per unit. Because of capacity constraints, 1,000 units will need to be produced during overtime. Overtime premium is $8 per unit. How much additional profit or loss will be generated by accepting the special order?

(Multiple Choice)

4.8/5  (35)

(35)

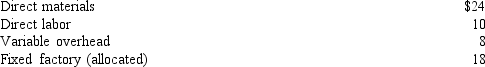

Figure 13-7.Ring Company makes telephones. Currently, Ring makes all components of the telephones in-house. An outside company has offered to supply one component, part number X76, for $12 each. Ring uses 22,000 of these components per year. Costs of X76 are as follows:

-Refer to Figure 13-7. Suppose that 30% of the fixed overhead is avoidable if part X76 is not made by Ring. Should Ring purchase the part from the outside supplier?

-Refer to Figure 13-7. Suppose that 30% of the fixed overhead is avoidable if part X76 is not made by Ring. Should Ring purchase the part from the outside supplier?

(Multiple Choice)

4.8/5  (37)

(37)

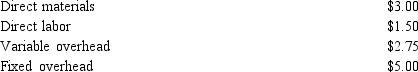

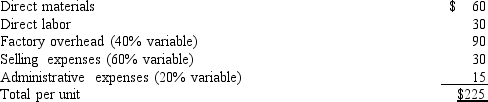

Gundy Company manufactures a product with the following costs per unit at the expected production of 30,000 units:  The company has the capacity to produce 30,000 units. The product regularly sells for $40. A wholesaler has offered to pay $32 per unit for 2,000 units.

If the firm chooses to accept the special order and reject some regular sales, the effect on operating income would be

The company has the capacity to produce 30,000 units. The product regularly sells for $40. A wholesaler has offered to pay $32 per unit for 2,000 units.

If the firm chooses to accept the special order and reject some regular sales, the effect on operating income would be

(Multiple Choice)

4.9/5  (33)

(33)

Resources that are acquired in advance of usage are flexible resources.

(True/False)

5.0/5  (49)

(49)

Match each statement with the correct item below.

-Keep-or-drop decisions

(Multiple Choice)

4.8/5  (33)

(33)

Walton Company manufactures a product with the following costs per unit at the expected production level of 84,000 units:  The company has the capacity to produce 90,000 units. The product regularly sells for $120. A wholesaler has offered to pay $110 per unit for 7,500 units. If the special order is accepted, the effect on operating income would be a

The company has the capacity to produce 90,000 units. The product regularly sells for $120. A wholesaler has offered to pay $110 per unit for 7,500 units. If the special order is accepted, the effect on operating income would be a

(Multiple Choice)

4.7/5  (36)

(36)

Match each statement with the correct item below.

-Joint products

(Multiple Choice)

5.0/5  (41)

(41)

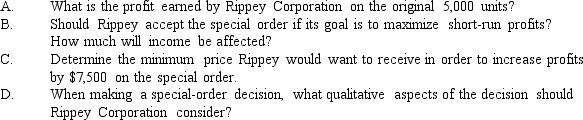

Rippey Corporation manufactures a single product with the following unit costs for 5,000 units:

Recently, a company approached Rippey Corporation about buying 1,000 units for $225. Currently, the models are sold to dealers for $412.50. Rippey's capacity is sufficient to produce the extra 1,000 units. No additional selling expenses would be incurred on the special order.

Required:

Recently, a company approached Rippey Corporation about buying 1,000 units for $225. Currently, the models are sold to dealers for $412.50. Rippey's capacity is sufficient to produce the extra 1,000 units. No additional selling expenses would be incurred on the special order.

Required:

(Essay)

4.9/5  (43)

(43)

Super Pet Supplies sets prices at cost plus 70% of cost. The cost of an aquarium start-up kit is $110. What price does Super Pet Supplies charge for the aquarium start-up kit?

(Multiple Choice)

4.7/5  (38)

(38)

_____________________ are simply those factors that are hard to put a number on, including things like political pressure and product safety.

(Short Answer)

4.8/5  (36)

(36)

Match each statement with the correct item below.

-Constraints

(Multiple Choice)

4.8/5  (32)

(32)

A cost that cannot be affected by any future action is called a(n) _______________.

(Short Answer)

4.9/5  (32)

(32)

Showing 141 - 160 of 170

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)