Exam 6: Receivables and Inventories

Exam 1: The Role of Accounting in Business100 Questions

Exam 2: Basic Accounting Concepts91 Questions

Exam 3: Accrual Accounting Concepts115 Questions

Exam 4: Accounting for Merchandising Businesses145 Questions

Exam 5: Sarbanes-Oxley, internal Control, and Cash112 Questions

Exam 6: Receivables and Inventories105 Questions

Exam 7: Fixed Assets and Intangible Assets90 Questions

Exam 8: Liabilities and Stockholders Equity133 Questions

Exam 9: Financial Statement Analysis69 Questions

Exam 10: Accounting Systems for Manufacturing Businesses119 Questions

Exam 11: Cost Behavior and Cost-Volume-Profit Analysis140 Questions

Exam 12: Differential Analysis and Product Pricing102 Questions

Exam 13: Budgeting and Standard Cost Systems169 Questions

Exam 14: Performance Evaluation for Decentralized Operations137 Questions

Exam 15: Capital Investment Analysis103 Questions

Select questions type

Of the three widely used inventory costing methods (FIFO,LIFO,and average),the FIFO method of costing inventory is based on the assumption that costs are charged against revenues in the order in which they were incurred.

(True/False)

4.9/5  (37)

(37)

Prepare the Current Assets section of a balance sheet using some or all of the following accounts:

(Essay)

4.9/5  (32)

(32)

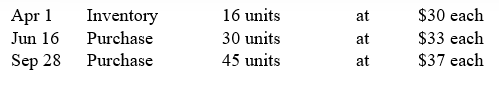

Use the following data to calculate the cost of ending inventory under the FIFO method.

(Multiple Choice)

4.8/5  (31)

(31)

During deflationary periods,the use of the LIFO method of costing inventory will result in a greater amount of net income than would result from the use of the FIFO method of inventory costing.

(True/False)

4.7/5  (37)

(37)

Allowance for Doubtful Accounts has an unadjusted balance of $1,100 at the end of the year,and an analysis of customers' accounts indicates doubtful accounts of $12,900.Which of the following records the proper provision for doubtful accounts?

(Multiple Choice)

4.9/5  (37)

(37)

All receivables that are expected to be realized in cash within a year are presented in the current assets section of the balance sheet.

(True/False)

4.7/5  (39)

(39)

In reference to a promissory note,the person who makes the promise to pay is called the:

(Multiple Choice)

4.7/5  (37)

(37)

Indicate the section of the balance sheet (current assets,fixed assets,investments,current liabilities,long-term liabilities,stockholders' equity)in which each of the following is reported:

(a) Note receivable due in 3 years

(b) Note receivable due in 90 days

(c) Allowance for doubtful accounts

(Essay)

4.9/5  (47)

(47)

Allowance for Doubtful Accounts is listed on the balance sheet under the caption:

(Multiple Choice)

4.9/5  (39)

(39)

The balance of the allowance for doubtful accounts is added to accounts receivable on the balance sheet.

(True/False)

4.7/5  (36)

(36)

The units of Product YY2 available for sale during the year were as follows:

There are 15 units of the product in the physical inventory at March 31. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

There are 15 units of the product in the physical inventory at March 31. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems.

(Essay)

4.8/5  (35)

(35)

A 90-day,10% note for $10,000 dated April 1 is received from a customer on account.The face value of the note is:

(Multiple Choice)

4.8/5  (41)

(41)

Inventories of merchandising and manufacturing businesses are reported as current assets on the balance sheet.

(True/False)

4.9/5  (31)

(31)

Both accounts receivable and notes receivable represent claims that are expected to be collected in cash.

(True/False)

4.9/5  (37)

(37)

At the end of a period before the accounts are adjusted,Allowance for Doubtful Accounts has a balance of $250,and net sales on account for the period total $500,000.If uncollectible accounts expense is estimated at 1% of net sales on account,the current provision to be made for uncollectible accounts expense is $4,997.50.

(True/False)

4.7/5  (41)

(41)

Showing 81 - 100 of 105

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)