Exam 17: Accounting for State and Local Governments, Part II

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 1: A: the Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information116 Questions

Exam 2: A: Consolidation of Financial Information116 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 3: A: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 4: A: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 5: A: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 6: A: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 8: Segment and Interim Reporting105 Questions

Exam 8: A: Segment and Interim Reporting115 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 10: Translation of Foreign Currency Financial Statements96 Questions

Exam 10: A: Translation of Foreign Currency Financial Statements96 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 11: A: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 12: A: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations75 Questions

Exam 13: A: Accounting for Legal Reorganizations and Liquidations78 Questions

Exam 14: Partnerships: Formation and Operation89 Questions

Exam 14: A: Partnerships: Formation and Operation89 Questions

Exam 15: Partnerships: Termination and Liquidation69 Questions

Exam 15: A: Partnerships: Termination and Liquidation69 Questions

Exam 16: Accounting for State and Local Governments, Part I83 Questions

Exam 16: A: Accounting for State and Local Governments, Part I83 Questions

Exam 17: Accounting for State and Local Governments, Part II42 Questions

Exam 17: A: Accounting for State and Local Governments, Part II47 Questions

Exam 18: Accounting for Not-For-Profit Entities72 Questions

Exam 18: A: Accounting for Not-For-Profit Entities72 Questions

Exam 19: Accounting for Estates and Trusts81 Questions

Exam 19: A: Accounting for Estates and Trusts81 Questions

Select questions type

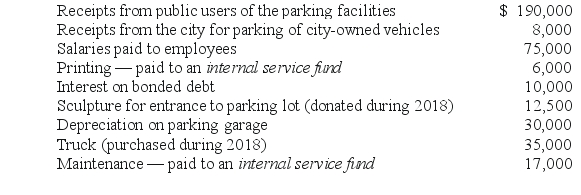

The parking garage and parking lots owned by the City of Danton reported the following balances for 2018:

Required:

Prepare the appropriate financial statement for the fund that was used to account for parking operations.

Required:

Prepare the appropriate financial statement for the fund that was used to account for parking operations.

(Essay)

4.8/5  (35)

(35)

Which of the following is a section of the financial section of the comprehensive annual financial report (CAFR) of a state or local government? (1) Management's discussion and analysis (MD&A).

(2) Required supplementary information (other than MD&A).

(3)) Basic financial statements and notes to financial statements.

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following is not a step in reporting a pension liability?

(Multiple Choice)

4.9/5  (34)

(34)

Which statement is false regarding the Statement of Revenues, Expenditures, and Other Changes in Fund Balance when it is included with government-wide financial statements?

(Multiple Choice)

4.9/5  (39)

(39)

What are the three broad sections of a state or local government's CAFR?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following statements regarding Management's Discussion and Analysis is true?

(Multiple Choice)

4.8/5  (46)

(46)

Jones College, a public institution of higher education, must prepare financial statements

(Multiple Choice)

4.8/5  (36)

(36)

For the purpose of government-wide financial statements, the cost of cleaning up a government-owned landfill and closing the landfill

(Multiple Choice)

4.8/5  (29)

(29)

Over the years, four alternatives have been suggested for constructing the financial statements for public colleges and universities.These alternatives include all of the following except:

(Multiple Choice)

4.8/5  (30)

(30)

The City of Kamen maintains a collection of paintings of a former citizen in its City Hall building. During the year, one painting was purchased by the city for $2,000 at an auction using appropriated funds in the General Fund. Also during the year, a donation of a painting valued at $3,000 was made to the city.

-Prepare the journal entry/entries for the two transactions for the purposes of preparing the government-wide financial statements.

(Essay)

4.9/5  (34)

(34)

Which information must be disclosed regarding tax abatement agreements? i) The purpose of the tax abatement program.

ii. The dollar amount of abatement and the names of recipients.

iii. The type of tax being abated.

(Multiple Choice)

4.9/5  (31)

(31)

What is the highest level of authoritative rules for state and local government accounting?

(Multiple Choice)

4.8/5  (34)

(34)

What are the three broad sections of a state or local government's CAFR?

(Essay)

4.9/5  (43)

(43)

What three criteria must be met before a governmental unit can elect to not capitalize and therefore report a work of art or historical treasure as an asset?

(Essay)

4.7/5  (36)

(36)

According to the GASB (Governmental Accounting Standards Board), which one of the following is not a criterion for determining whether a government is legally separate?

(Multiple Choice)

4.9/5  (34)

(34)

Which criteria must be met to be considered a special purpose government? (1.) Have a separately elected governing body

(2)) Be legally independent

(3)) Be fiscally independent

(Multiple Choice)

4.9/5  (38)

(38)

All of the following about tax abatement agreements must be disclosed by state and local governments except:

(Multiple Choice)

4.8/5  (38)

(38)

What information is required in the introductory section of a state or local government's CAFR?

(Essay)

4.8/5  (38)

(38)

All of the following are true about the modified approach to infrastructure depreciation except:

(Multiple Choice)

4.9/5  (33)

(33)

Drye Township has received a donation of a rare painting worth $1,000,000.For Drye's government-wide financial statements, three criteria must be met before Drye can opt not to recognize the painting as an asset.Which of the following is not one of the three criteria? (1.) The painting is held for public exhibition, education, or research in furtherance of public service, rather than financial gain.

(2)) The painting is scheduled to be sold immediately at auction.

(3)) The painting is protected, kept unencumbered, cared for, and preserved.

(Multiple Choice)

4.9/5  (39)

(39)

Showing 21 - 40 of 42

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)