Exam 3: A: Consolidations - Subsequent to the Date of Acquisition

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 1: A: the Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information116 Questions

Exam 2: A: Consolidation of Financial Information116 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 3: A: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 4: A: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 5: A: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 6: A: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 8: Segment and Interim Reporting105 Questions

Exam 8: A: Segment and Interim Reporting115 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 10: Translation of Foreign Currency Financial Statements96 Questions

Exam 10: A: Translation of Foreign Currency Financial Statements96 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 11: A: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 12: A: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations75 Questions

Exam 13: A: Accounting for Legal Reorganizations and Liquidations78 Questions

Exam 14: Partnerships: Formation and Operation89 Questions

Exam 14: A: Partnerships: Formation and Operation89 Questions

Exam 15: Partnerships: Termination and Liquidation69 Questions

Exam 15: A: Partnerships: Termination and Liquidation69 Questions

Exam 16: Accounting for State and Local Governments, Part I83 Questions

Exam 16: A: Accounting for State and Local Governments, Part I83 Questions

Exam 17: Accounting for State and Local Governments, Part II42 Questions

Exam 17: A: Accounting for State and Local Governments, Part II47 Questions

Exam 18: Accounting for Not-For-Profit Entities72 Questions

Exam 18: A: Accounting for Not-For-Profit Entities72 Questions

Exam 19: Accounting for Estates and Trusts81 Questions

Exam 19: A: Accounting for Estates and Trusts81 Questions

Select questions type

If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2017, what amount representing Glen would be reflected in consolidated net income for the year ended December 31, 2017?

(Multiple Choice)

4.9/5  (34)

(34)

If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2019?

(Multiple Choice)

4.9/5  (27)

(27)

Which of the following internal record-keeping methods can a parent choose to account for a subsidiary acquired in a business combination?

(Multiple Choice)

4.9/5  (43)

(43)

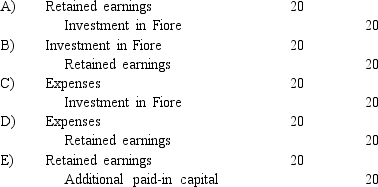

Assume the partial equity method is used.In the years following acquisition, what additional worksheet entry must be made for consolidation purposes, but is not required for the equity method?

(Multiple Choice)

4.7/5  (35)

(35)

With respect to the recognition of goodwill in a business combination, which of the following statements is true?

(Multiple Choice)

4.7/5  (34)

(34)

Compute the amount of Hurley's inventory that would be reported in a January 1, 2017, consolidated balance sheet.

(Multiple Choice)

4.9/5  (33)

(33)

Under the partial equity method, the parent recognizes income when

(Multiple Choice)

4.7/5  (28)

(28)

What should an entity evaluate when making an initial impairment assessment of an intangible asset (other than goodwill)?

(Essay)

4.9/5  (38)

(38)

What is the amount of consolidated net income for the year 2017?

(Multiple Choice)

4.8/5  (35)

(35)

On April 1, 2018, Beatty stock closes with a market value of $8.98 per share.How many shares of stock, rounded to the next whole number, must it issue to the former owners of Gateax?

(Multiple Choice)

5.0/5  (37)

(37)

If the equity method had been applied, what would be the Investment in Tysk Corp.account balance within the records of Jans at the end of 2018?

(Multiple Choice)

4.9/5  (36)

(36)

What is the partial equity method? How does it differ from the equity method? What are its advantages and disadvantages compared to the equity method?

(Essay)

4.8/5  (35)

(35)

If Goehler applies the initial value method in accounting for Kenneth, what is the consolidated balance for the Equipment account as of December 31, 2018?

(Multiple Choice)

4.9/5  (38)

(38)

Assume the partial equity method is applied.How much equity income will Kaye report on its internal accounting records as a result of Fiore's operations?

(Multiple Choice)

4.9/5  (32)

(32)

Determine the amortization expense related to the combination at the year-end date of 12/31/16.

(Essay)

4.7/5  (25)

(25)

Compute the amount of Hurley's buildings that would be reported in a December 31, 2017, consolidated balance sheet.

(Multiple Choice)

4.9/5  (38)

(38)

Showing 101 - 120 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)