Exam 22: Valuation and Financial Modelling: a Case Study

Exam 1: The Corporation42 Questions

Exam 2: Introduction to Financial Statement Analysis74 Questions

Exam 3: Arbitrage and Financial Decision Making79 Questions

Exam 4: The Time Value of Money84 Questions

Exam 5: Interest Rates69 Questions

Exam 6: Valuing Bonds104 Questions

Exam 7: Valuing Stocks88 Questions

Exam 8: Investment Decision Rules83 Questions

Exam 9: Fundamentals of Capital Budgeting94 Questions

Exam 10: Capital Markets and the Pricing of Risk98 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model108 Questions

Exam 12: Estimating the Cost of Capital108 Questions

Exam 13: Investor Behaviour and Capital Market Efficiency74 Questions

Exam 14: Financial Options56 Questions

Exam 15: Option Valuation42 Questions

Exam 16: Real Options57 Questions

Exam 17: Capital Structure in a Perfect Market86 Questions

Exam 18: Debt and Taxes84 Questions

Exam 19: Financial Distress, managerial Incentives, and Information99 Questions

Exam 20: Payout Policy92 Questions

Exam 21: Capital Budgeting and Valuation With Leverage94 Questions

Exam 22: Valuation and Financial Modelling: a Case Study47 Questions

Exam 23: The Mechanics of Raising Equity Capital49 Questions

Exam 24: Debt Financing49 Questions

Exam 25: Leasing58 Questions

Exam 26: Working Capital Management45 Questions

Exam 27: Short-Term Financial Planning49 Questions

Exam 28: Mergers and Acquisitions52 Questions

Exam 29: Corporate Governance49 Questions

Exam 30: Risk Management52 Questions

Exam 31: International Corporate Finance45 Questions

Select questions type

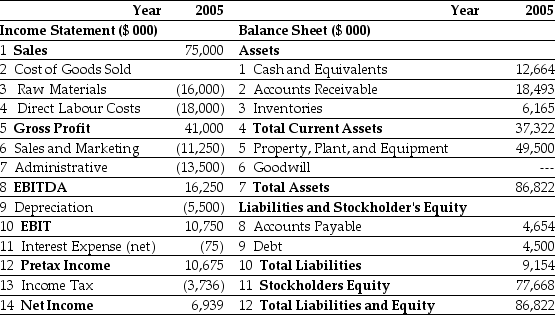

Use the tables for the question(s) below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

-Ideko's Accounts Receivable Days is closest to:

-Ideko's Accounts Receivable Days is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

The cash multiple does not depend on the amount of time it takes to receive the cash,nor does it account for the risk of the investment.It is therefore useful only for comparing deals

(Multiple Choice)

4.9/5  (32)

(32)

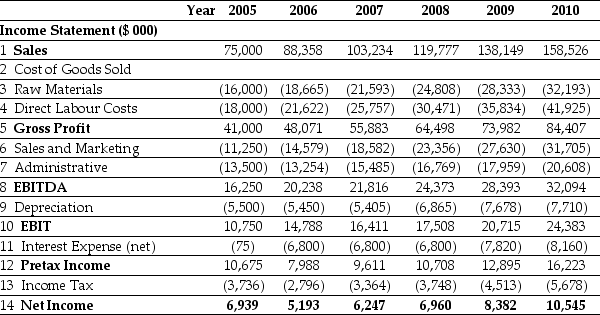

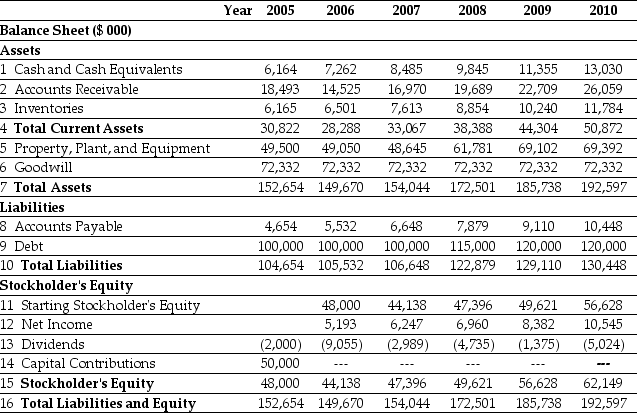

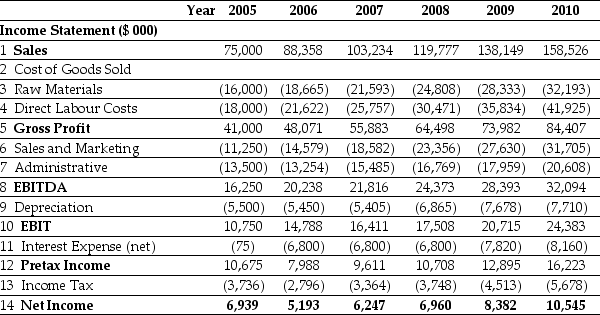

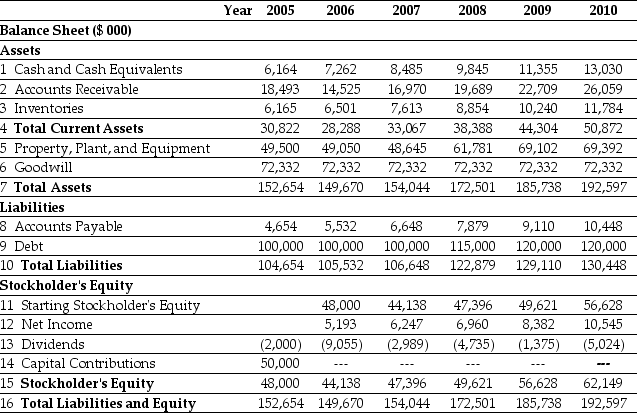

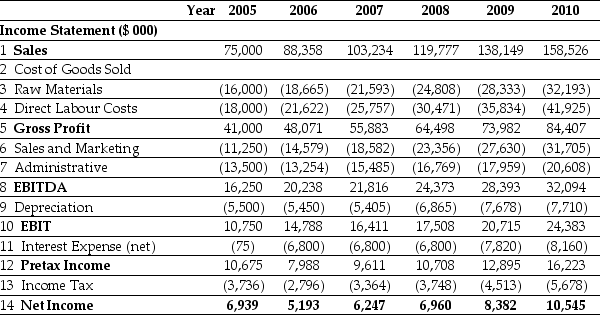

Use the tables for the question(s) below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation unlevered P/E ratio of Ideko in 2010 is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

Use the tables for the question(s) below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

-Assuming that Ideko has a EBITDA multiple of 9.4,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

-Assuming that Ideko has a EBITDA multiple of 9.4,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

(Multiple Choice)

4.9/5  (35)

(35)

According to the Canadian Institute of Chartered Accountants (CICA)handbook,a firm's goodwill is not necessarily amortized but it is subject to ________ at least once a year.

(Multiple Choice)

4.8/5  (32)

(32)

What range for the market value of equity for Ideko is implied by the range of EV/Sales multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

(Essay)

4.7/5  (35)

(35)

Use the table for the question(s) below.

Pro Forma Income Statement for Ideko, 2005-2010

-With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60.The forecasted accounts receivable for Ideko in 2006 is closest to:

-With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60.The forecasted accounts receivable for Ideko in 2006 is closest to:

(Multiple Choice)

4.8/5  (29)

(29)

Showing 41 - 47 of 47

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)