Exam 5: Time Value of Money

Exam 1: The Role of Managerial Finance134 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis208 Questions

Exam 4: Cash Flow and Financial Planning185 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return188 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management336 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

Suzy wants to buy a house but does not want to get a loan. The average price of her dream house is $500,000 and its price is growing at 5 percent per year. How much should Suzy invest in a project at the end of each year for the next 5 years in order to accumulate enough money to buy her dream house with cash at the end of the fifth year? Assume the project pays 12 percent rate of return.

(Essay)

4.8/5  (31)

(31)

The future value of $200 received today and deposited at 8 percent for three years is ________.

(Multiple Choice)

4.8/5  (36)

(36)

Aunt Tillie has deposited $33,000 today in an account which will earn 10 percent annually. She plans to leave the funds in this account for seven years earning interest. If the goal of this deposit is to cover a future obligation of $65,000, what recommendation would you make to Aunt Tillie?

(Essay)

4.8/5  (38)

(38)

The greater the interest rate and the longer the period of time, the higher the present value.

(True/False)

4.8/5  (30)

(30)

When computing the number of deposits needed to accumulate a future sum, it will take longer if the interest rates are higher, holding the future value and deposit size constant.

(True/False)

4.8/5  (34)

(34)

How many years would it take for Jughead to save an adequate amount for retirement if he deposits $2,000 per month into an account beginning today that pays 12 percent per year if he wishes to have a total of $1,000,000 at retirement?

(Multiple Choice)

4.7/5  (42)

(42)

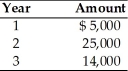

Find the present value of the following stream of a firm's cash flows, assuming that the firm's opportunity cost is 25 percent.

(Multiple Choice)

4.9/5  (37)

(37)

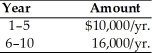

Find the present value of the following stream of a firm's cash flows, assuming that the firm's opportunity cost is 9 percent.

(Multiple Choice)

4.8/5  (29)

(29)

The present value of a $25,000 perpetuity at a 14 percent discount rate is ________.

(Multiple Choice)

4.9/5  (34)

(34)

A wealthy art collector has decided to endow her favorite art museum by establishing funds for an endowment which would provide the museum with $1,000,000 per year for acquisitions into perpetuity. The art collector will give the endowment upon her fiftieth birthday 10 years from today. She plans to accumulate the endowment by making annual end-of-year deposits into an account. The rate of interest is expected to be 6 percent in all future periods. How much must the art collector deposit each year to accumulate to the required amount?

(Multiple Choice)

4.7/5  (37)

(37)

The present value of $100 to be received 10 years from today, assuming an opportunity cost of 9 percent, is ________.

(Multiple Choice)

4.7/5  (33)

(33)

Since individuals are always confronted with opportunities to earn positive rates of return on their funds, the timing of cash flows does not have any significant economic consequences.

(True/False)

4.9/5  (33)

(33)

Time value of money is based on the belief that a dollar that will be received at some future date is worth more than a dollar today.

(True/False)

4.8/5  (30)

(30)

In general, with an amortized loan, the payment amount remains constant over the life of the loan, both the principal portion of and the interest portion declines over the life of the loan.

(True/False)

4.9/5  (34)

(34)

The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity for interest rates greater than zero.

(True/False)

5.0/5  (37)

(37)

The present value of $200 to be received 10 years from today, assuming an opportunity cost of 10 percent, is ________.

(Multiple Choice)

4.9/5  (32)

(32)

Rita borrows $4,500 from the bank at 9 percent annually compounded interest to be repaid in three equal annual installments. The interest paid in the third year is ________.

(Multiple Choice)

4.8/5  (32)

(32)

In comparing an ordinary annuity and an annuity due, which of the following is true?

(Multiple Choice)

4.9/5  (37)

(37)

Showing 101 - 120 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)