Exam 2: Understanding the Accounting Cycle

Exam 1: An Introduction to Accounting148 Questions

Exam 2: Understanding the Accounting Cycle149 Questions

Exam 3: The Double-Entry Accounting System157 Questions

Exam 4: Accounting for Merchandising Businesses153 Questions

Exam 5: Accounting for Inventories134 Questions

Exam 6: Internal Control and Accounting for Cash141 Questions

Exam 7: Accounting for Receivables144 Questions

Exam 8: Accounting for Long-Term Operational Assets157 Questions

Exam 9: Accounting for Current Liabilities and Payroll122 Questions

Exam 10: Accounting for Long-Term Debt157 Questions

Exam 11: Proprietorships,partnerships,and Corporations154 Questions

Exam 12: Statement of Cash Flows129 Questions

Exam 13: Financial Statement Analysis129 Questions

Select questions type

The Sarbanes-Oxley Act includes several significant reforms that affect the auditing profession,but it did not reduce an audit firm's ability to provide non-audit services to its audit clients.

(True/False)

4.9/5  (30)

(30)

Alabama Company purchased a machine on January 1,2016 for $26,000 cash.The machine has an estimated useful life of 4 years and a $6,000 salvage value.What would be the book (carrying)value of the machine reported on Alabama's December 31,2016 balance sheet?

(Multiple Choice)

4.9/5  (37)

(37)

The year-end adjustment to recognize one month's work on the three-month contract results in a $2,000 decrease in liabilities (unearned revenue)and an increase in equity (retained earnings due to recognizing revenue).

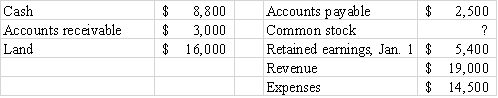

The following account balances were drawn from the 2016 financial statements of Grayson Company:

-Sheldon Company began 2016 with $1,200 in its supplies account.During the year,the company purchased $3,400 of supplies on account.The company paid $3,000 on accounts payable by year end.On December 31,2016,Sheldon counted $1,400 of supplies on hand.Sheldon's financial statements for 2016 would show:

-Sheldon Company began 2016 with $1,200 in its supplies account.During the year,the company purchased $3,400 of supplies on account.The company paid $3,000 on accounts payable by year end.On December 31,2016,Sheldon counted $1,400 of supplies on hand.Sheldon's financial statements for 2016 would show:

(Multiple Choice)

4.9/5  (30)

(30)

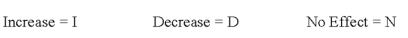

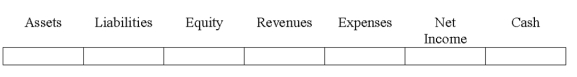

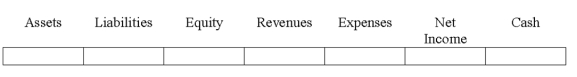

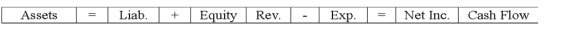

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.

-Carson Company accrued $100 of interest expense.

-Carson Company accrued $100 of interest expense.

(Essay)

4.8/5  (41)

(41)

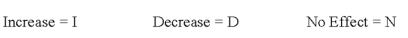

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.

-Cason Company recorded $2,000 of depreciation expense on a delivery van.

-Cason Company recorded $2,000 of depreciation expense on a delivery van.

(Essay)

4.9/5  (43)

(43)

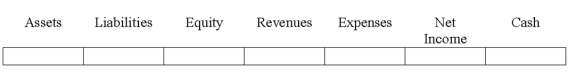

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.

-Venture Company paid $50 of accrued interest expense.

-Venture Company paid $50 of accrued interest expense.

(Essay)

4.7/5  (28)

(28)

Classify each of the following transactions for the purpose of the statement of cash flows as operating activities (OA),investing activities (IA),financing activities (FA),or not reported on the statement of cash flows (NA).

1)_____Collected accounts receivable

2)_____Made adjusting entry to accrue salary expense at the end of the year

3)_____Borrowed funds from the bank

4)_____Paid rent for the month

5)_____Paid cash to settle accounts payable

6)_____Issued common stock for $30,000 cash

7)_____Paid cash to acquire land

(Essay)

4.9/5  (30)

(30)

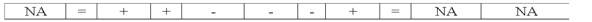

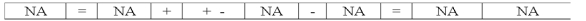

The collection of an account receivable is a claims exchange transaction.

(True/False)

4.8/5  (39)

(39)

The ethical standards for certified public accountants only require that such accountants comply with applicable laws and regulations.

(True/False)

4.7/5  (37)

(37)

Policies and procedures designed to reduce the opportunities for fraud are often called:

(Multiple Choice)

4.7/5  (38)

(38)

The matching concept leads accountants to select the recognition alternative that produces the lowest amount of net income.

(True/False)

4.7/5  (45)

(45)

Which of the following events would not require an end-of-year adjusting entry?

(Multiple Choice)

4.9/5  (36)

(36)

In the closing process,the amounts in temporary accounts are moved to net income,a permanent account.

(True/False)

4.9/5  (38)

(38)

Expenses that are matched with the period in which they are incurred are frequently called:

(Multiple Choice)

4.9/5  (38)

(38)

For each of the following transactions,indicate the type by entering AS for asset source transactions,AU for asset use transactions,AE for asset exchange transactions,and CE for claims exchange transactions.

1)____Paid $2,000 in dividends to its stockholders.

2)____Recorded the accrual of $1,000 in salaries to be paid later.

3)____Issued common stock for $20,000 in cash.

4)____Earned revenue to be collected next year.

5)____Paid the salaries accrued in #2 above.

6)____Received cash from customers in #4 above.

7)____Purchased supplies on account.

8)____Received $500 from a customer for services to be provided later.

(Essay)

4.7/5  (40)

(40)

Recognition of revenue may be accompanied by which of the following?

(Multiple Choice)

4.9/5  (29)

(29)

The Maryland Corporation was started on January 1,2016,with the issuance of $50,000 of stock.During 2016,the company provided $75,000 of services on account and collected $68,000 of that amount.Maryland incurred $63,000 of expenses,and paid $50,000 of that amount during 2016.On December 31,2016,Maryland paid investors a $2,000 cash dividend and accrued $4,000 of salary expense.

Required:

1)What is the net income for year ended December 31,2016?

2)Prepare Maryland Corporation's Statement of Cash Flows for the year ended December 31,2016.Precede a cash outflow amount with a minus sign.

3)What is the balance in Maryland's retained earnings account after closing entries are made on December 31,2016?

(Essay)

4.8/5  (34)

(34)

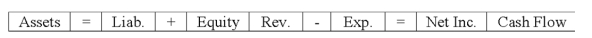

Which of the following describes the effects of a claims exchange transaction on a company's financial statements?

(Short Answer)

4.9/5  (41)

(41)

Which of the following financial statement elements is closed at the end of an accounting cycle?

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following choices accurately reflects how the recording of accrued salary expense affects the financial statements of a business?

(Short Answer)

4.9/5  (46)

(46)

Showing 121 - 140 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)