Exam 7: Foreign Currency Derivatives: Futures and Options

Exam 1: Multinational Financial Management: Opportunities and Challenges66 Questions

Exam 2: The International Monetary System61 Questions

Exam 3: The Balance of Payments83 Questions

Exam 4: Financial Goals and Corporate Governance70 Questions

Exam 5: The Foreign Exchange Market69 Questions

Exam 6: International Parity Conditions61 Questions

Exam 7: Foreign Currency Derivatives: Futures and Options88 Questions

Exam 8: Interest Risk and Swaps49 Questions

Exam 9: Foreign Exchange Rate Determination63 Questions

Exam 10: Transaction Exposure64 Questions

Exam 11: Translation Exposure54 Questions

Exam 12: Operating Exposure58 Questions

Exam 13: The Global Cost and Availability of Capital83 Questions

Exam 14: Raising Equity and Debt Globally97 Questions

Exam 15: Multinational Tax Management58 Questions

Exam 16: International Trade Finance75 Questions

Exam 17: Foreign Direct Investment and Political Risk79 Questions

Exam 18: Multinational Capital Budgeting and Cross-Border Acquisitions61 Questions

Select questions type

If the exchange rate's volatility is rising,and therefore the risk of the option not being exercised is decreasing,the option premium would be increasing.

(True/False)

4.9/5  (44)

(44)

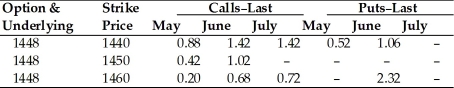

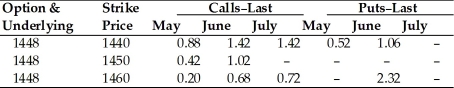

TABLE 7.1

Use the table to answer following question(s).

April 19, 2009, British Pound Option Prices (cents per pound, 62,500 pound contracts).  -Refer to Table 7.1.The May call option on pounds with a strike price of 1440 mean:

-Refer to Table 7.1.The May call option on pounds with a strike price of 1440 mean:

(Multiple Choice)

4.8/5  (46)

(46)

Traders by using the historical volatility assume that the immediate future will be the same as the recent past,and the historical volatility will equal the forward-looking volatility.

(True/False)

4.8/5  (39)

(39)

As long as the option has time remaining before expiration,the option will possess time the time value element.

(True/False)

4.8/5  (31)

(31)

Dash Brevenshure works for the currency trading unit of ING Bank in London.He speculates that in the coming months the dollar will rise sharply vs.the pound.What should Dash do to act on his speculation?

(Multiple Choice)

4.9/5  (28)

(28)

TABLE 7.1

Use the table to answer following question(s).

April 19, 2009, British Pound Option Prices (cents per pound, 62,500 pound contracts).  -Refer to Table 7.1.The exercise price of ________ giving the purchaser the right to sell pounds in June has a cost per pound of ________ for a total price of ________.

-Refer to Table 7.1.The exercise price of ________ giving the purchaser the right to sell pounds in June has a cost per pound of ________ for a total price of ________.

(Multiple Choice)

4.9/5  (41)

(41)

Peter Simpson thinks that the U.K.pound will cost $1.43/£ in six months.A 6-month currency futures contract is available today at a rate of $1.44/£.If Peter was to speculate in the currency futures market,and his expectations are correct,which of the following strategies would earn him a profit?

(Multiple Choice)

5.0/5  (35)

(35)

For a $1.50/£ call option with an initial premium of $0.033/£ and a phi value of -0.2,after an increase in the foreign interest (the pound sterling rate)rate from 8% to 9% - the new optiom premium would be:

(Multiple Choice)

4.7/5  (50)

(50)

The time value is asymmetric in value as you move away from the strike price (i.e.,the time value at two cents above the strike price is not necessarily the same as the time value two cents below the strike price).

(True/False)

4.8/5  (48)

(48)

As a general statement,it is safe to say that businesses generally use the ________ for foreign currency option contracts,and individuals and financial institutions typically use the ________.

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following statements is NOT true about currency option pricing sensitivities?

(Multiple Choice)

4.9/5  (45)

(45)

Jasper Pernik is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market.Currently the spot price for the Japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$.Jasper thinks the yen will move to ¥128.00/$ in the next six months.If Jasper's expectations are correct,then he could profit in the forward market by ________ and then ________.

(Multiple Choice)

4.8/5  (30)

(30)

Which of the following is NOT a contract specification for currency futures trading on an organized exchange?

(Multiple Choice)

4.9/5  (38)

(38)

Your U.S firm has an accounts payable denominated in UK pounds due in 6 months.To protect yourself against unexpected changes in the dollar/pound exchange rate you should:

(Multiple Choice)

4.9/5  (32)

(32)

Financial derivatives are powerful tools that can be used by management for purposes of:

(Multiple Choice)

4.9/5  (37)

(37)

The higher the delta the greater the probability of the option expiring in-the-money.

(True/False)

4.9/5  (40)

(40)

Compare and contrast foreign currency options and futures.Identify situations when you may prefer one vs.the other when speculating on foreign exchange.

(Essay)

4.9/5  (38)

(38)

The primary problem with volatility is that it is unobservable; it is the only input into the option pricing formula that is determined subjectively by the trader pricing the option.

(True/False)

5.0/5  (31)

(31)

A call option on UK pounds has a strike price of $2.05/£ and a cost of $0.02.What is the break-even price for the option?

(Multiple Choice)

4.9/5  (30)

(30)

Showing 21 - 40 of 88

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)