Exam 4: Activity-Based Costing, lean Operations, and the Costs of Quality

Exam 1: Introduction to Managerial Accounting205 Questions

Exam 2: Building Blocks of Managerial Accounting284 Questions

Exam 3: Job Costing334 Questions

Exam 4: Activity-Based Costing, lean Operations, and the Costs of Quality251 Questions

Exam 5: Process Costing259 Questions

Exam 6: Cost Behavior294 Questions

Exam 7: Cost-Volume-Profit Analysis261 Questions

Exam 8: Relevant Costs for Short-Term Decisions253 Questions

Exam 9: The Master Budget200 Questions

Exam 10: Performance Evaluation212 Questions

Exam 11: Standard Costs and Variances241 Questions

Exam 12: Capital Investment Decisions and the Time Value of Money195 Questions

Exam 13: Statement of Cash Flows183 Questions

Exam 14: Financial Statement Analysis177 Questions

Exam 15: Sustainability107 Questions

Select questions type

The cost allocation rate for each activity is equal to the total estimated activity cost pool divided by the total estimated activity allocation base.

(True/False)

4.8/5  (32)

(32)

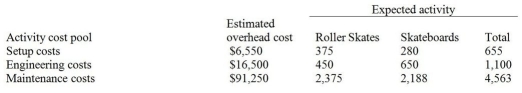

Vintage Fun reproduces old-fashioned style roller skates and skateboards.The annual production and sales of roller skates is 950 units,while 1,750 skateboards are produced and sold.The company has traditionally used direct labor hours to allocate its overhead to products.Roller skates require 2.5 direct labor hours per unit,while skateboards require 1.25 direct labor hours per unit.The total estimated overhead for the period is $114,300.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:  The overhead cost per skateboard using an activity-based costing system would be closest to

The overhead cost per skateboard using an activity-based costing system would be closest to

(Multiple Choice)

4.7/5  (29)

(29)

Lean companies typically cross-train employees to perform more than one task.

(True/False)

4.9/5  (32)

(32)

When a company has established separate manufacturing overhead rates for each department,it is using

(Multiple Choice)

4.9/5  (46)

(46)

Quality-related costs generally fall into four different categories,which include all of the following except

(Multiple Choice)

4.9/5  (43)

(43)

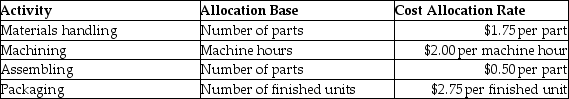

The Cosmo Corporation manufactures and assembles office chairs.Cosmo uses an activity-based costing system to allocate all manufacturing conversion costs.Each chair consists of 15 separate parts totaling $125 in direct materials,and requires 2.0 hours of machine time to produce.Additional information follows:

What is the number of finished office chairs?

What is the number of finished office chairs?

(Multiple Choice)

4.9/5  (42)

(42)

The costs of adopting ABC may be lower for some companies than for others.This situation may occur

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following is an example of a cost item that should be classified as an internal failure cost?

(Multiple Choice)

4.8/5  (42)

(42)

The goal of total quality management (TQM)is to provide customers with inferior products and services.

(True/False)

4.8/5  (50)

(50)

Research and development would most likely be classified as a ________ cost.

(Multiple Choice)

4.9/5  (40)

(40)

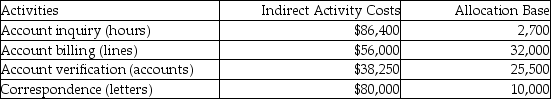

Potter & Weasley Company had the following activities,estimated indirect activity costs,and allocation bases:

Potter & Weasley uses activity based costing.

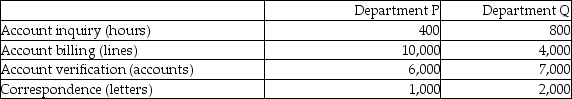

The above activities are used by Departments P and Q as follows:

Potter & Weasley uses activity based costing.

The above activities are used by Departments P and Q as follows:

What is the cost per driver unit for the account inquiry activity?

What is the cost per driver unit for the account inquiry activity?

(Multiple Choice)

4.8/5  (40)

(40)

The cost of downtime caused by quality problems with the raw materials would be classified as what type of cost?

(Multiple Choice)

4.9/5  (38)

(38)

The cost of inspection at various stages of production is an example of a(n)

(Multiple Choice)

4.8/5  (32)

(32)

As a result of cost distortion,some products will be overcosted while other products will be undercosted.

(True/False)

4.7/5  (42)

(42)

Facility-level activities and costs are incurred no matter how many units,batches,or products are produced in the plant.

(True/False)

4.9/5  (27)

(27)

The lost profits from lost customers are an example of what type of cost?

(Multiple Choice)

4.9/5  (39)

(39)

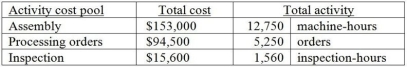

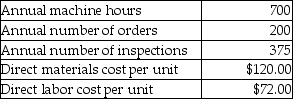

Bohemian Manufacturing manufactures several different products and uses an activity-based costing system.Information from its system for the year for all products follows:  The annual production and sales of one of its products,the Sizzler,are 1,500 units.The following data relate to the production and sales of Sizzlers in the most recent year:

The annual production and sales of one of its products,the Sizzler,are 1,500 units.The following data relate to the production and sales of Sizzlers in the most recent year:

Required:

1.Calculate the activity cost pool rates for each of the three activity cost pools listed.

2.Calculate the average cost of one Sizzler.

Required:

1.Calculate the activity cost pool rates for each of the three activity cost pools listed.

2.Calculate the average cost of one Sizzler.

(Essay)

4.8/5  (41)

(41)

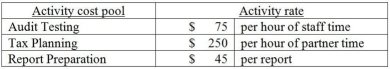

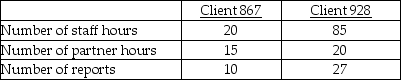

Augustine Associates is a CPA firm that offers assurance and consulting services.The firm uses an activity-based costing system and has developed the following activity pool cost rates:  Cost and activity data related to two clients is as follows:

Cost and activity data related to two clients is as follows:

How much overhead cost would be allocated to Client 867 using the activity-based costing system?

How much overhead cost would be allocated to Client 867 using the activity-based costing system?

(Multiple Choice)

5.0/5  (44)

(44)

An example of an appraisal cost is the cost of automating the production process.

(True/False)

4.8/5  (35)

(35)

Showing 161 - 180 of 251

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)