Exam 3: Time Value of Money - Introduction

Exam 1: Overview of Finance47 Questions

Exam 2: Financial Statements and Ratio Analysis69 Questions

Exam 3: Time Value of Money - Introduction105 Questions

Exam 4: Time Value of Money - Streams and Valuations103 Questions

Exam 5: Risk and Return - Introduction46 Questions

Exam 6: Portfolio Theory136 Questions

Exam 7: Interest Rates and Bond Valuation84 Questions

Exam 8: Stock Valuation and Market Efficiency111 Questions

Exam 9: Capital Budgeting Techniques86 Questions

Exam 10: Capital Budgeting - Cash Flows84 Questions

Exam 11: Cost of Capital95 Questions

Exam 12: Capital Structure111 Questions

Exam 13: Dividends, repurchases, and Splits57 Questions

Exam 14: Financial Planning77 Questions

Exam 15: The Management of Working Capital80 Questions

Exam 16: International Finance80 Questions

Select questions type

In 1958 the average tuition for one year at an Ivy League school was $1,800.Thirty years later,in 1988,the average cost was $13,700.What was the growth rate in tuition over the 30-year period?

(Multiple Choice)

4.7/5  (40)

(40)

You deposit $100 in a bank for a fixed 7 year term.Interest on the deposit is calculated every half-year (m = 2)at the rate of 5% per half-year (i/m = 5%).Because the term is fixed,you are not allowed to withdraw interest at any point.You earn interest in the final compounding period of the term.How much of that interest is earned off of earlier interest (as opposed to earned off of the principal)?

(Multiple Choice)

4.8/5  (32)

(32)

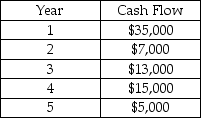

The table shows a series of deposits at different dates into a savings account.If the account pays 10.5% interest (compounded annually),what is their future value at year 6?

(Multiple Choice)

4.9/5  (38)

(38)

Henry purchased stock in Nortel Networks for $120 per share.Unfortunately the stock did not perform very well in the 3 years that Henry has owned it as it is now trading at $3.93 per share.Feeling that the value of the stock will only continue to drop,Henry sold his shares today.What annual rate of return did Henry make on his investment?

(Multiple Choice)

4.9/5  (42)

(42)

At 15% interest compounded annually,approximately how long will it take Walter to double his money?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 101 - 105 of 105

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)