Exam 12: Leverage and Capital Structure

Exam 1: The Role of Managerial Finance134 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis208 Questions

Exam 4: Cash Flow and Financial Planning185 Questions

Exam 5: Time Value of Money172 Questions

Exam 6: Interest Rates and Bond Valuation223 Questions

Exam 7: Stock Valuation187 Questions

Exam 8: Risk and Return188 Questions

Exam 9: The Cost of Capital135 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows and Risk Refinements208 Questions

Exam 12: Leverage and Capital Structure217 Questions

Exam 13: Payout Policy130 Questions

Exam 14: Working Capital and Current Assets Management333 Questions

Exam 15: Current Liabilities Management170 Questions

Select questions type

The total leverage measures the combined effect of operating and financial leverage on a firm's risk.

(True/False)

4.9/5  (40)

(40)

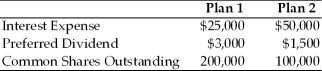

Table 12.1  -At about what EBIT level should the financial manager be indifferent to either plan? (See Table 12.1)

-At about what EBIT level should the financial manager be indifferent to either plan? (See Table 12.1)

(Essay)

4.8/5  (36)

(36)

The cost of equity is greater than the cost of debt and increases with increasing financial leverage,but generally less rapidly than the cost of debt.

(True/False)

4.8/5  (31)

(31)

The pecking order explanation of capital structure states that a hierarchy of financing exists for firms,in which new external debt financing is employed first,followed by retained earnings and finally by external equity financing.

(True/False)

4.9/5  (41)

(41)

Because the degree of total leverage is multiplicative and not additive,when a firm has very high operating leverage it can moderate its total risk by ________.

(Multiple Choice)

4.8/5  (22)

(22)

An increase in fixed operating costs will result in ________.

(Multiple Choice)

4.7/5  (36)

(36)

Tangshan Mining Company must choose its optimal capital structure.Currently,the firm has a 40 percent debt ratio and the firm expects to generate a dividend next year of $4.89 per share and dividends are expected to grow at a constant rate of 5 percent for the foreseeable future.Stockholders currently require a 10.89 percent return on their investment.Tangshan Mining is considering changing its capital structure if it would benefit shareholders.The firm estimates that if it increases the debt ratio to 50 percent,it will increase its expected dividend to $5.24 per share.Because of the additional leverage,dividend growth is expected to increase to 6 percent and this growth will be sustained indefinitely.However,because of the added risk,the required return demanded by stockholders will increase to 11.34 percent.

(a)What is the value per share for Tangshan Mining under the current capital structure?

(b)What is the value per share for Tangshan Mining under the proposed capital structure?

(c)Should Tangshan Mining make the capital structure change? Explain.

(Essay)

4.9/5  (31)

(31)

The optimal capital structure is the one that balances ________.

(Multiple Choice)

4.8/5  (31)

(31)

The breakeven point in dollars can be computed by dividing the contribution margin into the variable operating costs.

(True/False)

4.9/5  (28)

(28)

In theory,a firm should maintain financial leverage consistent with a capital structure that ________.

(Multiple Choice)

4.9/5  (33)

(33)

A firm has interest expense of $145,000,preferred dividends of $25,000,and a tax rate of 40 percent.The firm's financial breakeven point is ________.

(Multiple Choice)

4.9/5  (24)

(24)

A major assumption of breakeven analysis and one which causes severe limitations in its use is that ________.

(Multiple Choice)

4.8/5  (40)

(40)

After satisfying obligations to creditors,the government,and preferred stockholders,any remaining earnings will most likely be allocated to ________.

(Multiple Choice)

4.8/5  (30)

(30)

A firm is analyzing two possible capital structures-30 and 50 percent debt ratios.The firm has total assets of $5,000,000 and common stock valued at $50 per share.The firm has a marginal tax rate of 40 percent on ordinary income.The number of common shares outstanding for each of the capital structures would be ________.

(Multiple Choice)

4.8/5  (37)

(37)

The degree of operating leverage depends on the base level of sales used as a point of reference.The closer the base sales level used is to the operating breakeven point,the greater the operating leverage.

(True/False)

4.9/5  (44)

(44)

The use of a dollar breakeven point is important when a firm has more than one product,especially when each product is selling at a different price.

(True/False)

4.7/5  (34)

(34)

Showing 201 - 217 of 217

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)