Exam 9: Characterizing Risk and Return

Exam 1: Introduction to Financial Management71 Questions

Exam 2: Reviewing Financial Statements121 Questions

Exam 3: Analyzing Financial Statements135 Questions

Exam 4: Time Value of Money153 Questions

Exam 5: Time Value of Money159 Questions

Exam 7: Valuing Bonds138 Questions

Exam 8: Valuing Stockspart123 Questions

Exam 9: Characterizing Risk and Return119 Questions

Exam 10: Estimating Risk and Return113 Questions

Exam 11: Calculating the Cost of Capital130 Questions

Exam 12: Estimating Cash Flows on Capital Budgeting Projects124 Questions

Exam 13: Weighing Net Present Value and Other Capital Budgeting Criteria127 Questions

Exam 14: Working Capital and Policies137 Questions

Exam 15: Financial Planning and Forecasting92 Questions

Exam 16: Assessing Long-Term Debt, equity, and Capital Structure120 Questions

Exam 18: Issuing Capital and the Investment Banking Process123 Questions

Exam 19: International Corporate Finance128 Questions

Exam 20: Mergers and Acquisitions and Financial Distress116 Questions

Select questions type

Average Return The past five monthly returns for K and Company are 2.28 percent,2.64 percent,-1.05 percent,4.25 percent,and 9.25 percent.What is the average monthly return?

(Multiple Choice)

4.8/5  (41)

(41)

We commonly measure the risk-return relationship using which of the following?

(Multiple Choice)

4.8/5  (43)

(43)

Portfolio Return At the beginning of the month,you owned $8,000 of Company G,$8,000 of Company S,and $3,000 of Company N.The monthly returns for Company G,Company S,and Company N were 7.80 percent,1.50 percent,and -0.75 percent.What is your portfolio return?

(Multiple Choice)

4.8/5  (23)

(23)

Which of the following is a measurement of the co-movement between two variables that ranges between -1 and +1?

(Multiple Choice)

5.0/5  (35)

(35)

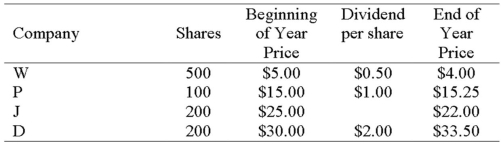

Portfolio Return The following table shows your stock positions at the beginning of the year,the dividends that each stock paid during the year,and the stock prices at the end of the year.What is your portfolio percentage return?

(Multiple Choice)

4.7/5  (34)

(34)

Risk versus Return Rank the following three stocks by their risk-return relationship,best to worst.Rail Haul has an average return of 10 percent and standard deviation of 15 percent.The average return and standard deviation of Idol Staff are 15 percent and 25 percent; and of Poker-R-Us are 12 percent and 35 percent.

(Multiple Choice)

4.8/5  (41)

(41)

Sharif's portfolio generated returns of 12 percent,15 percent,-15 percent,19 percent,and -12 percent over five years.What was his average return over this period?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following makes this a true statement: The shape of the efficient frontier implies that:

(Multiple Choice)

4.9/5  (32)

(32)

Rank the following three stocks by their risk-return relationship,best to worst.Rail Haul has an average return of 10 percent and standard deviation of 19 percent.The average return and standard deviation of Idol Staff are 12 percent and 22 percent; and of Poker-R-Us are 11 percent and 25 percent.

(Multiple Choice)

4.8/5  (40)

(40)

Dominant Portfolios Determine which one of these three portfolios dominates another.Name the dominated portfolio and the portfolio that dominates it.Portfolio Blue has an expected return of 7 percent and risk of 10 percent.The expected return and risk of portfolio Yellow are 13 percent and 10 percent,and for the Purple portfolio are 9 percent and 14 percent.

(Multiple Choice)

4.7/5  (38)

(38)

Which of these is a measure summarizing the overall past performance of an investment?

(Multiple Choice)

4.9/5  (36)

(36)

Portfolio Weights If you own 100 shares of Air Line Inc.at $42.50,250 shares of BuyRite at $53.25,and 350 shares of MotorCity at $7.75,what are the portfolio weights of each stock?

(Multiple Choice)

4.8/5  (37)

(37)

Which of these is the dollar return characterized as a percentage of money invested?

(Multiple Choice)

4.7/5  (46)

(46)

Risk versus Return Rank the following three stocks by their risk-return relationship,best to worst.Rail Haul has an average return of 8 percent and standard deviation of 10 percent.The average return and standard deviation of Idol Staff are 10 percent and 20 percent; and of Poker-R-Us are 6 percent and 15 percent.

(Multiple Choice)

4.8/5  (39)

(39)

Why is the percentage return a more useful measure than the dollar return?

(Essay)

4.9/5  (42)

(42)

Which of the following statements is correct regarding total risk?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following describes what will occur as you randomly add stocks to your portfolio?

(Multiple Choice)

4.8/5  (37)

(37)

Showing 101 - 119 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)