Exam 2: Introduction to Financial Statement Analysis

Exam 1: The Corporation37 Questions

Exam 2: Introduction to Financial Statement Analysis93 Questions

Exam 3: Financial Decision Making and the Law of One Price89 Questions

Exam 4: The Time Value of Money89 Questions

Exam 5: Interest Rates68 Questions

Exam 6: Valuing Bonds110 Questions

Exam 7: Investment Decision Rules86 Questions

Exam 8: Fundamentals of Capital Budgeting93 Questions

Exam 9: Valuing Stocks96 Questions

Exam 10: Capital Markets and the Pricing of Risk101 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model133 Questions

Exam 12: Estimating the Cost of Capital104 Questions

Exam 13: Investor Behavior and Capital Market Efficiency75 Questions

Exam 14: Capital Structure in a Perfect Market98 Questions

Exam 15: Debt and Taxes95 Questions

Exam 16: Financial Distress, Managerial Incentives, and Information111 Questions

Exam 17: Payout Policy96 Questions

Exam 18: Capital Budgeting and Valuation With Leverage96 Questions

Exam 19: Valuation and Financial Modeling: a Case Study49 Questions

Exam 20: Financial Options55 Questions

Exam 21: Option Valuation41 Questions

Exam 22: Real Options58 Questions

Exam 23: Raising Equity Capital51 Questions

Exam 24: Debt Financing54 Questions

Exam 25: Leasing46 Questions

Exam 26: Working Capital Management48 Questions

Exam 27: Short-Term Financial Planning47 Questions

Exam 28: Mergers and Acquisitions56 Questions

Exam 29: Corporate Governance46 Questions

Exam 30: Risk Management49 Questions

Exam 31: International Corporate Finance45 Questions

Select questions type

Suppose Novak Company experienced a reduction in its ROE over the last year. This fall could be attributed to:

(Multiple Choice)

4.9/5  (34)

(34)

Use the information for the question(s) below.

In November 2009, Perrigo Co. (PRGO) had a share price of $39.20. They had 91.33 million shares outstanding, a market-to-book ratio of 3.76. In addition, PRGO had $845.01 million in outstanding debt, $163.82 million in net income, and cash of $257.09 million.

-Perrigo's enterprise value is closest to:

(Multiple Choice)

4.9/5  (44)

(44)

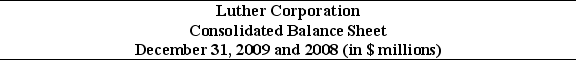

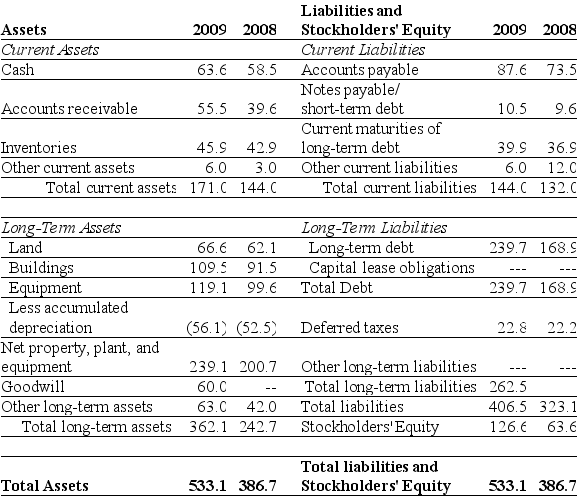

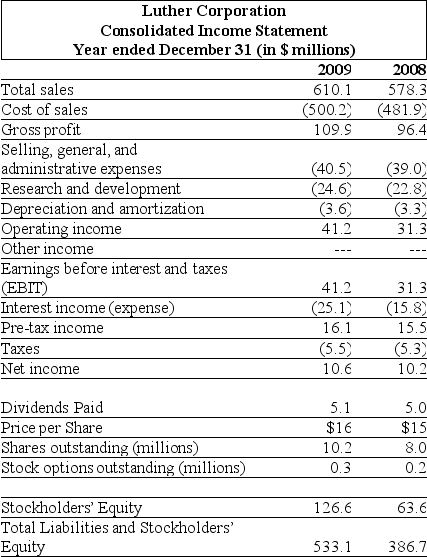

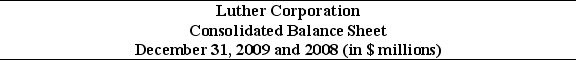

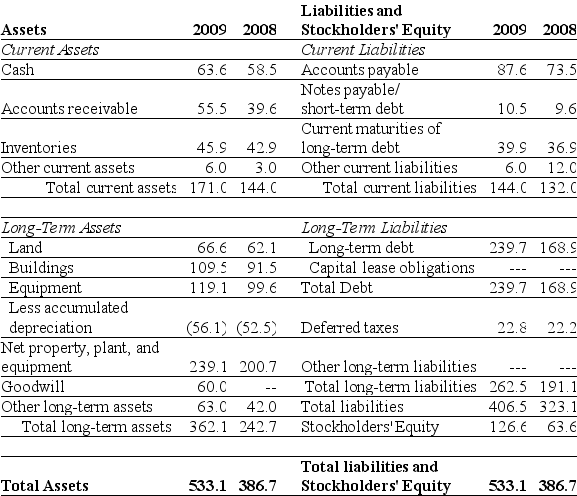

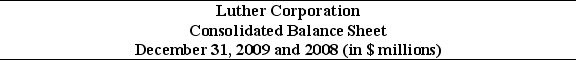

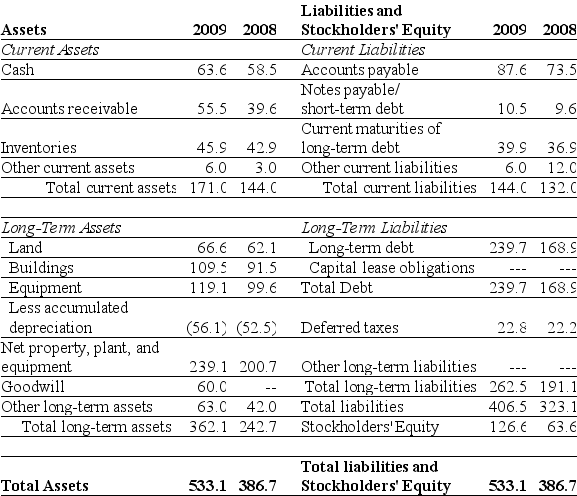

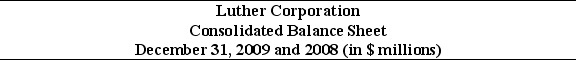

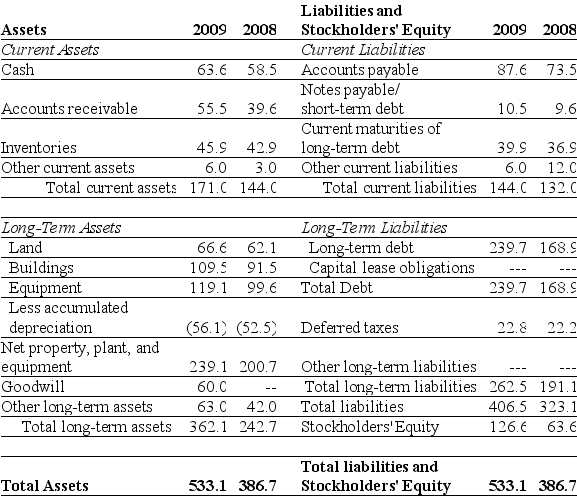

Use the tables for the question(s) below.

Consider the following financial information:

-For the year ending December 31, 2009 Luther's cash flow from financing activities is:

-For the year ending December 31, 2009 Luther's cash flow from financing activities is:

(Essay)

4.8/5  (36)

(36)

Use the information for the question(s) below.

In November 2009, Perrigo Co. (PRGO) had a share price of $39.20. They had 91.33 million shares outstanding, a market-to-book ratio of 3.76. In addition, PRGO had $845.01 million in outstanding debt, $163.82 million in net income, and cash of $257.09 million.

-The statement of financial performance is also known as the:

(Multiple Choice)

4.8/5  (45)

(45)

Which of the following is NOT a reason why cash flow may not equal net income?

(Multiple Choice)

4.9/5  (36)

(36)

If Moon Corporation has depreciation or amortization expense, which of the following is TRUE?

(Multiple Choice)

4.9/5  (40)

(40)

Use the table for the question(s) below.

Consider the following income statement and other information:

-If Luther's accounts receivable were $55.5 million in 2009, then calculate Luther's accounts receivable days for 2009.

-If Luther's accounts receivable were $55.5 million in 2009, then calculate Luther's accounts receivable days for 2009.

(Essay)

4.8/5  (29)

(29)

Use the following information for ECE incorporated:

Assets $200 million

Shareholder Equity $100 million

Sales $300 million

Net Income $15 million

Interest Expense $2 million

-IECE's Return on Assets (ROA) is:

(Multiple Choice)

4.9/5  (33)

(33)

Use the table for the question(s) below.

Consider the following balance sheet:

-Luther's quick ratio for 2008 is closest to:

-Luther's quick ratio for 2008 is closest to:

(Multiple Choice)

4.9/5  (32)

(32)

Use the information for the question(s) below.

In November 2009, Perrigo Co. (PRGO) had a share price of $39.20. They had 91.33 million shares outstanding, a market-to-book ratio of 3.76. In addition, PRGO had $845.01 million in outstanding debt, $163.82 million in net income, and cash of $257.09 million.

-Perrigo's price-earnings ratio (P/E) is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

Use the table for the question(s) below.

Consider the following income statement and other information:

-Luther's EBIT coverage ratio for the year ending December 31, 2008 is closest to:

-Luther's EBIT coverage ratio for the year ending December 31, 2008 is closest to:

(Multiple Choice)

4.8/5  (43)

(43)

Use the table for the question(s) below.

Consider the following income statement and other information:

-Wyatt Oil has a net profit margin of 4.0%, a total asset turnover of 2.2, total assets of $525 million, and a book value of equity of $220 million. Wyatt Oil's current return-on-assets (ROA) is closest to:

-Wyatt Oil has a net profit margin of 4.0%, a total asset turnover of 2.2, total assets of $525 million, and a book value of equity of $220 million. Wyatt Oil's current return-on-assets (ROA) is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Use the table for the question(s) below.

Consider the following balance sheet:

-When using the book value of equity, the debt to equity ratio for Luther in 2009 is closest to:

-When using the book value of equity, the debt to equity ratio for Luther in 2009 is closest to:

(Multiple Choice)

4.9/5  (35)

(35)

In addition to the balance sheet, income statement, and the statement of cash flows, a firm's complete financial statements will include all of the following EXCEPT:

(Multiple Choice)

4.8/5  (37)

(37)

U.S. public companies are required to file their annual financial statements with the U.S. Securities and Exchange Commission on which form?

(Multiple Choice)

4.8/5  (32)

(32)

Use the table for the question(s) below.

Consider the following balance sheet:

-If in 2009 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then what is Luther's Enterprise Value?

-If in 2009 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then what is Luther's Enterprise Value?

(Multiple Choice)

4.9/5  (36)

(36)

Use the following information for ECE incorporated:

Assets $200 million

Shareholder Equity $100 million

Sales $300 million

Net Income $15 million

Interest Expense $2 million

-If ECE's stock is currently trading at $24.00 and ECE has 25 million shares outstanding, then ECE's market-to-book ratio is closest to:

(Multiple Choice)

5.0/5  (40)

(40)

Which of the following is an example of an intangible asset?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 61 - 80 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)