Exam 14: Capital Structure in a Perfect Market

Exam 1: The Corporation37 Questions

Exam 2: Introduction to Financial Statement Analysis93 Questions

Exam 3: Financial Decision Making and the Law of One Price89 Questions

Exam 4: The Time Value of Money89 Questions

Exam 5: Interest Rates68 Questions

Exam 6: Valuing Bonds110 Questions

Exam 7: Investment Decision Rules86 Questions

Exam 8: Fundamentals of Capital Budgeting93 Questions

Exam 9: Valuing Stocks96 Questions

Exam 10: Capital Markets and the Pricing of Risk101 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model133 Questions

Exam 12: Estimating the Cost of Capital104 Questions

Exam 13: Investor Behavior and Capital Market Efficiency75 Questions

Exam 14: Capital Structure in a Perfect Market98 Questions

Exam 15: Debt and Taxes95 Questions

Exam 16: Financial Distress, Managerial Incentives, and Information111 Questions

Exam 17: Payout Policy96 Questions

Exam 18: Capital Budgeting and Valuation With Leverage96 Questions

Exam 19: Valuation and Financial Modeling: a Case Study49 Questions

Exam 20: Financial Options55 Questions

Exam 21: Option Valuation41 Questions

Exam 22: Real Options59 Questions

Exam 23: Raising Equity Capital51 Questions

Exam 24: Debt Financing54 Questions

Exam 25: Leasing46 Questions

Exam 26: Working Capital Management48 Questions

Exam 27: Short-Term Financial Planning47 Questions

Exam 28: Mergers and Acquisitions56 Questions

Exam 29: Corporate Governance46 Questions

Exam 30: Risk Management49 Questions

Exam 31: International Corporate Finance45 Questions

Select questions type

Use the following information to answer the question(s)below.

d'Anconia Copper is an all-equity firm with 60 million shares outstanding, which are currently trading at $20 per share. Last month, d'Anconia announced that it will change its capital structure by issuing $300 million in debt. The $200 million raised by this issue, plus another $200 million in cash that d'Anconia already has, will be used to repurchase existing shares of stock. Assume that capital markets are perfect.

-At the conclusion of this transaction, the number of shares that d'Anconia Copper will repurchase is closest to:

(Multiple Choice)

4.7/5  (39)

(39)

Use the information for the question(s)below.

Assume that Rose Corporation's (RC)EBIT is not expected to grow in the future and that all earnings are paid out as dividends. RC is currently an all equity firm. It expects to generate earnings before interest and taxes (EBIT)of $6 million over the next year. Currently RC has 5 million shares outstanding and its stock is trading for a price of $12.00 per share. RC is considering borrowing $12 million at a rate of 6% and using the proceeds to repurchase shares at the current price of $12.00.

-What is the conservation of value principle?

(Essay)

4.8/5  (35)

(35)

Consider the following equation: βU =  βE +

βE +  βD

The term

βD

The term  in the equation is:

in the equation is:

(Multiple Choice)

4.8/5  (42)

(42)

Use the information for the question(s)below.

Rockwood Enterprises is currently an all equity firm and has just announced plans to expand their current business. In order to fund this expansion, Rockwood will need to raise $100 million in new capital. After the expansion, Rockwood is expected to produce earnings before interest and taxes of $50 million per year in perpetuity. Rockwood has already announced the planned expansion, but has not yet determined how best to fund the expansion. Rockwood currently has 16 million shares outstanding and following the expansion announcement these shares are trading at $25 per share. Rockwood has the ability to borrow at a rate of 5% or to issue new equity at $25 per share.

-Show mathematically that the stock price of Rockwood does not depend on whether they issue new stock or borrow to fund their expansion.

(Essay)

4.7/5  (36)

(36)

Suppose you are a shareholder in d'Anconia Copper holding 500 shares, and you disagree with the decision to lever the firm. You can undo the effect of this decision by:

(Multiple Choice)

4.9/5  (35)

(35)

Use the information for the question(s)below.

Consider a project with free cash flows in one year of $90,000 in a weak economy or $117,000 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%.

-Suppose that to raise the funds for the initial investment the firm borrows $40,000 at the risk free rate and issues new equity to cover the remainder. In this situation, the value of the firm's levered equity from the project is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

Use the following information to answer the question(s)below.

Galt Industries has 50 million shares outstanding and a market capitalization of $1.25 billion. It also has $750 million in debt outstanding. Galt Industries has decided to delever the firm by issuing new equity and completely repaying all the outstanding debt. Assume perfect capital markets.

-Suppose you are a shareholder in Galt industries holding 600 shares, and you disagree with this decision to delever the firm. You can undo the effect of this decision by:

(Multiple Choice)

5.0/5  (40)

(40)

Use the following information to answer the question(s)below.

Galt Industries has no debt, total equity capitalization of $600 million, and an equity beta of 1.2. Included in Galt's assets is $90 million in cash and risk-free securities. Assume the risk-free rate is 4% and the market risk premium is 6%.

-Which of the following statements is FALSE?

(Multiple Choice)

4.8/5  (38)

(38)

Use the information for the question(s)below.

Luther is a successful logistical services firm that currently has $5 billion in cash. Luther has decided to use this cash to repurchase shares from its investors, and has already announced the stock repurchase plan. Currently Luther is an all equity firm with 1.25 billion shares outstanding. Luther's shares are currently trading at $20 per share.

-The market value of Luther's non-cash assets is closest to:

(Multiple Choice)

4.8/5  (32)

(32)

Use the following information to answer the question(s)below.

Nielson Motors (NM)has no debt. Its assets will be worth $600 million in one year if the economy is strong, but only $300 million if the economy is weak. Both events are equally likely. The market value today of Nielson's assets is $400 million.

-The expected return for Nielson Motors stock without leverage is closest to:

(Multiple Choice)

4.9/5  (33)

(33)

Use the information for the question(s)below.

Consider a project with free cash flows in one year of $90,000 in a weak economy or $117,000 in a strong economy, with each outcome being equally likely. The initial investment required for the project is $80,000, and the project's cost of capital is 15%. The risk-free interest rate is 5%.

-Suppose that to raise the funds for the initial investment the firm borrows $80,000 at the risk free rate, then the cash flow that equity holders will receive in one year in a strong economy is closest to:

(Multiple Choice)

4.9/5  (29)

(29)

Use the information for the question(s)below.

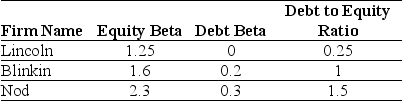

You are evaluating a new project and need an estimate for your project's beta. You have identified the following information about three firms with comparable projects:

-The unlevered beta for Nod is closest to:

-The unlevered beta for Nod is closest to:

(Multiple Choice)

4.7/5  (35)

(35)

Use the information for the question(s)below.

Consider two firms, With and Without, that have identical assets that generate identical cash flows. Without is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. With has 2 million shares outstanding and $12 million dollars in debt at an interest rate of 5%.

-According to MM Proposition 1, the stock price for With is closest to:

(Multiple Choice)

5.0/5  (38)

(38)

Use the information for the question(s)below.

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Suppose that Taggart Transcontinental currently has no debt and has an equity cost of capital of 10%. Taggart is considering borrowing funds at a cost of 6% and using these funds to repurchase existing shares of stock. Assume perfect capital markets. If Taggart borrows until they achieved a debt -to-value ratio of 20%, then Taggart's levered cost of equity would be closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Use the information for the question(s)below.

Assume that Rose Corporation's (RC)EBIT is not expected to grow in the future and that all earnings are paid out as dividends. RC is currently an all equity firm. It expects to generate earnings before interest and taxes (EBIT)of $6 million over the next year. Currently RC has 5 million shares outstanding and its stock is trading for a price of $12.00 per share. RC is considering borrowing $12 million at a rate of 6% and using the proceeds to repurchase shares at the current price of $12.00.

-Following the borrowing of $12 and subsequent share repurchase, the value of a share for RC is closest to:

(Multiple Choice)

4.8/5  (26)

(26)

Use the following information to answer the question(s)below.

d'Anconia Copper is an all-equity firm with 60 million shares outstanding, which are currently trading at $20 per share. Last month, d'Anconia announced that it will change its capital structure by issuing $300 million in debt. The $200 million raised by this issue, plus another $200 million in cash that d'Anconia already has, will be used to repurchase existing shares of stock. Assume that capital markets are perfect.

-At the conclusion of this transaction, the value of a share of d'Anconia Copper will be closest to:

(Multiple Choice)

4.9/5  (36)

(36)

Use the following information to answer the question(s)below.

Galt Industries has no debt, total equity capitalization of $600 million, and an equity beta of 1.2. Included in Galt's assets is $90 million in cash and risk-free securities. Assume the risk-free rate is 4% and the market risk premium is 6%.

-Galt's asset beta (ie the beta of its operating assets)is closest to:

(Multiple Choice)

4.9/5  (29)

(29)

Showing 81 - 98 of 98

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)