Exam 2: The Financial Market Environment

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

The ordinary income of a corporation is income earned through the sale of a firm's goods and services and is currently taxed subject to the individual income tax rates.

Free

(True/False)

4.8/5  (33)

(33)

Correct Answer:

False

The Glass-Steagall Act was imposed to allow commercial and investment banks to combine and work together.

Free

(True/False)

4.7/5  (27)

(27)

Correct Answer:

False

An efficient market is a market that allocates funds to their most productive use as a result of competition among wealth-maximizing investors.

Free

(True/False)

4.8/5  (29)

(29)

Correct Answer:

True

Long-term debt instruments used by both government and business are known as

(Multiple Choice)

4.9/5  (25)

(25)

The money market is a financial relationship created by a number of institutions and arrangements that allows suppliers and demanders of long-term funds to make transactions.

(True/False)

4.8/5  (30)

(30)

Corporation X needs $1,000,000 and can raise this through debt at an annual rate of 10 percent, or preferred stock at an annual cost of 7 percent. If the corporation has a 40 percent tax rate, the after-tax cost of each is

(Multiple Choice)

4.9/5  (45)

(45)

All of the following are examples of organized stock exchanges EXCEPT

(Multiple Choice)

4.9/5  (40)

(40)

Consider two firms, Go Debt corporation and No Debt corporation. Both firms are expected to have earnings before interest and taxes of $100,000 during the coming year. In addition, Go Debt is expected to incur $40,000 in interest expenses as a result of its borrowings whereas No Debt will incur no interest expense because it does not use debt financing. However, No Debt will have to pay stockholders $40,000 in dividend income. Both firms are in the 40 percent tax bracket. Calculate the Earnings after tax for both firms. Which firm has the higher after-tax earnings? Which firm appears to have the higher cash flow? How do you account for the difference?

(Essay)

4.8/5  (36)

(36)

Eurocurrency deposits arise when a corporation or individual makes a deposit in a bank in a currency other than the local currency of the country where the bank is located.

(True/False)

4.8/5  (39)

(39)

The tax liability of a corporation with ordinary income of $1,500,000 is

(Multiple Choice)

4.8/5  (33)

(33)

Mortgage default rates were low from the mid 1990's through 2006 because home prices were rising and lenders allowed borrowers who were having difficulty making payments to refinance on the built up home equity.

(True/False)

4.8/5  (31)

(31)

Securities exchanges create efficient markets that do all of the following EXCEPT

(Multiple Choice)

4.9/5  (40)

(40)

In the OTC market, the prices at which securities are traded result from both competitive bids and negotiation.

(True/False)

4.7/5  (37)

(37)

All of the following are functions of security exchanges EXCEPT

(Multiple Choice)

4.8/5  (34)

(34)

A financial institution is an intermediary that channels the savings of individuals, businesses, and governments into loans or investments.

(True/False)

4.9/5  (29)

(29)

Firms that require funds from external sources can obtain them from

(Multiple Choice)

4.8/5  (33)

(33)

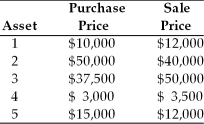

During 2002, a firm has sold 5 assets described below. Calculate the tax liability on the assets. The firm pays a 40 percent tax rate on ordinary income.

(Essay)

4.9/5  (33)

(33)

The tax deductibility of various expenses such as general and administrative expenses ________ their after-tax cost.

(Multiple Choice)

4.9/5  (24)

(24)

The tax liability of a corporation with ordinary income of $105,000 is

(Multiple Choice)

4.7/5  (34)

(34)

The ________ stock exchange is a primary market where new public issues are sold.

(Multiple Choice)

4.9/5  (26)

(26)

Showing 1 - 20 of 91

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)