Exam 3: Measuring and Reporting Financial Performance

Exam 1: Introduction to Accounting71 Questions

Exam 2: Measuring and Reporting Financial Position72 Questions

Exam 3: Measuring and Reporting Financial Performance70 Questions

Exam 4: Introduction to Limited Companies61 Questions

Exam 5: Regulatory Framework for Companies56 Questions

Exam 6: Measuring and Reporting Cash Flows70 Questions

Exam 7: Corporate Social Responsibility and Sustainability Accounting58 Questions

Exam 8: Analysis and Interpretation of Financial Statements66 Questions

Exam 9: Cost-Volume-Profit Analysis and Relevant Costing66 Questions

Exam 10: Full Costing67 Questions

Exam 11: Budgeting76 Questions

Exam 12: Capital Investment Decisions68 Questions

Exam 13: The Management of Working Capital66 Questions

Exam 14: Financing the Business68 Questions

Select questions type

What type of account is accumulated depreciation?

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

C

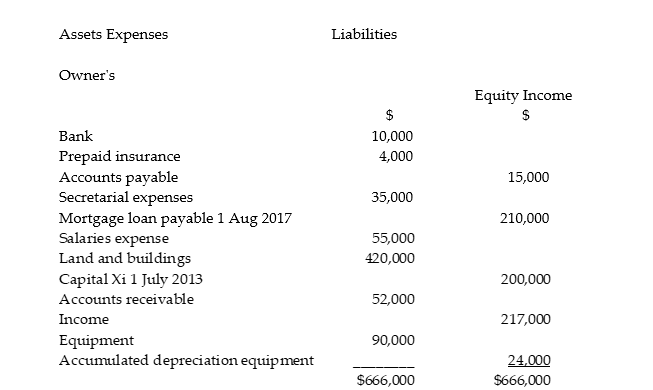

The following information was prepared for Xi Services as at 30 June 2018.

Additional information available at 30 June 2018:

1. Interest expense outstanding is $4,500.

2. An allowance for doubtful debts is to be created for $1,500.

3. Depreciation of equipment is at the rate of 15% p.a. using the reducing-balance method.

4. $2,500 of the prepaid insurance has been used-up during the year

REQUIRED:

Incorporating all the above information, prepare:

a)an Income Statement for the year ended 30 June 2018.

Additional information available at 30 June 2018:

1. Interest expense outstanding is $4,500.

2. An allowance for doubtful debts is to be created for $1,500.

3. Depreciation of equipment is at the rate of 15% p.a. using the reducing-balance method.

4. $2,500 of the prepaid insurance has been used-up during the year

REQUIRED:

Incorporating all the above information, prepare:

a)an Income Statement for the year ended 30 June 2018.

Free

(Essay)

4.7/5  (34)

(34)

Correct Answer:

a)

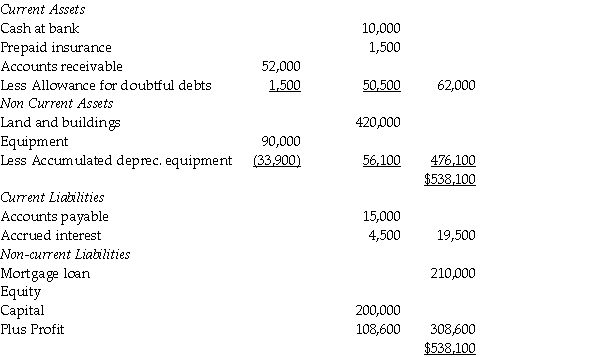

b)Statement of financial position at 30 June 2018

Choose the statement which is correct. Assume that inventory prices are rising.

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

B

Which of these is not an area where judgement must normally be applied in order to calculate depreciation expense?

(Multiple Choice)

4.8/5  (32)

(32)

The amount of interest paid in cash for the period May to August is $1,000. However, the financial reports show interest expense for the period as $750. The difference is recorded in the statement of financial position as:

(Multiple Choice)

4.8/5  (25)

(25)

An item of inventory costing $750 can now only be sold at auction for $200. Auction costs of $50 will be incurred to make the sale. The net realisable value of the inventory is:

(Multiple Choice)

4.9/5  (34)

(34)

The recognition criteria that must be satisfied under the Conceptual Framework for an expense to be included in the income statement is:

(Multiple Choice)

4.7/5  (32)

(32)

Cost of sales is a major expense for a retailer. Cost of sales is:

(Multiple Choice)

4.7/5  (31)

(31)

On 1 July 2017, LMZ Traders paid $12,000 in insurance premiums for coverage for the next three years. The insurance expense that will appear in the income statement and the amount of prepaid insurance in the statement of financial position for the year ended 30 June 2018, respectively, are:

(Multiple Choice)

4.8/5  (33)

(33)

Calculate cost of sales if stock at start is $2,450, purchases are $19,000 and stock at end is $1,000.

(Multiple Choice)

4.8/5  (32)

(32)

To allow for debts that might prove bad in the future, a business will recognise as an expense in the income statement:

(Multiple Choice)

4.9/5  (40)

(40)

Which accounting statement is specifically designed to measure and report on how much profit an entity has made?

(Multiple Choice)

4.7/5  (31)

(31)

Which of these are not alternative names for the same thing?

(Multiple Choice)

4.7/5  (35)

(35)

In relation to the recognition and realisation of income, which statement is correct?

(Multiple Choice)

4.8/5  (37)

(37)

If a business decided to classify its expenses under the headings 'Selling and Distribution,' 'General and Administrative' and 'Financial,' into which groupings would 1. depreciation of sales staff's motor vehicles and 2. bad debts written off, fall?

(Multiple Choice)

4.8/5  (35)

(35)

If equity at the beginning of the period is $45,000 and at the end of the period is $56,000 and $20,000 is withdrawn by the owner during the period, calculate profit. (Use the stock approach.)

(Multiple Choice)

4.9/5  (36)

(36)

LTT had stock on hand on the 1st January 2018 of 100 heaters valued at $50 each.

The following transactions occurred during January:

Jan 7 bought 110 heaters at $52 each

15 sold 60 heaters at $80 each (selling price)

30 sold 70 heaters at $80 each (selling price)

REQUIRED:

a)Calculate cost of sales and closing stock at the end of the month from the above information using:

i)the FIFO method of valuation,

ii)the LIFO method of valuation, and

iii)the average cost method of valuation.

b)Prepare a statement of comprehensive income for the month ended 31 January under each method assuming no stock loss (use a columnar approach).

c)i)Which method produces the most favourable profit result for LTT?

ii)Comment on why the differences in profit have occurred under the 3 methods.

(Essay)

4.9/5  (35)

(35)

Showing 1 - 20 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)