Exam 13: Weighing Net Present Value and Other Capital Budgeting Criteria

Exam 1: Introduction to Financial Management71 Questions

Exam 2: Reviewing Financial Statements125 Questions

Exam 3: Analyzing Financial Statements134 Questions

Exam 4: Time Value of Money 1: Analyzing Single Cash Flows153 Questions

Exam 5: Time Value of Money 2: Analyzing Annuity Cash Flows156 Questions

Exam 6: Understanding Financial Markets and Institutions114 Questions

Exam 7: Valuing Bonds131 Questions

Exam 8: Valuing Stocks119 Questions

Exam 9: Characterizing Risk and Return110 Questions

Exam 10: Estimating Risk and Return110 Questions

Exam 11: Calculating the Cost of Capital127 Questions

Exam 12: Estimating Cash Flows on Capital Budgeting Projects121 Questions

Exam 13: Weighing Net Present Value and Other Capital Budgeting Criteria119 Questions

Exam 14: Working Capital Management and Policies137 Questions

Select questions type

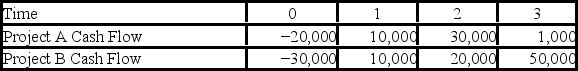

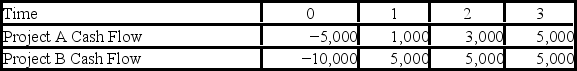

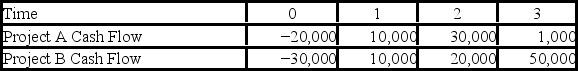

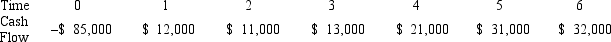

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

Use the payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

A

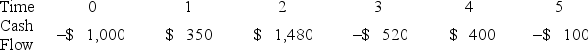

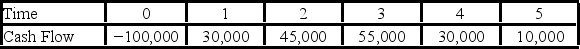

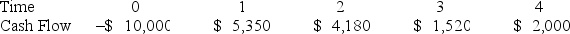

Compute the NPV statistic for Project U given the following cash flows if the appropriate cost of capital is 9 percent. Project U

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

C

Compute the MIRR for Project Y and accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 12 percent.

Free

(Multiple Choice)

4.7/5  (35)

(35)

Correct Answer:

B

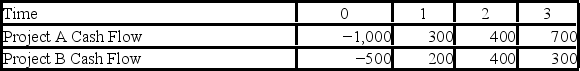

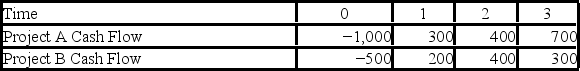

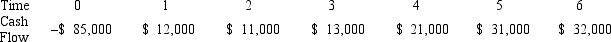

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.  Use the MIRR decision rule to evaluate these projects; which one(s)should be accepted or rejected?

Use the MIRR decision rule to evaluate these projects; which one(s)should be accepted or rejected?

(Multiple Choice)

4.8/5  (38)

(38)

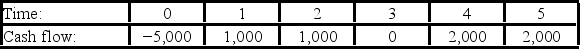

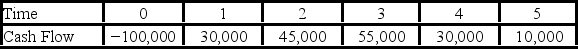

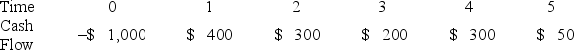

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the PI decision rule to evaluate this project; should it be accepted or rejected?

Use the PI decision rule to evaluate this project; should it be accepted or rejected?

(Multiple Choice)

4.9/5  (39)

(39)

Compute the NPV statistic for Project X given the following cash flows if the appropriate cost of capital is 12 percent. Project X

(Multiple Choice)

4.8/5  (38)

(38)

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

(Multiple Choice)

4.8/5  (43)

(43)

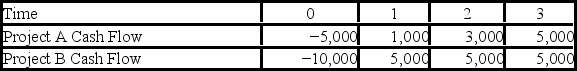

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the discounted payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

Use the discounted payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

(Multiple Choice)

4.8/5  (44)

(44)

Which of these are sets of cash flows where all the initial cash flows are negative and all the subsequent ones are either zero or positive?

(Multiple Choice)

4.8/5  (32)

(32)

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the discounted payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

Use the discounted payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

(Multiple Choice)

4.8/5  (31)

(31)

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.  Use the PI decision rule to evaluate these projects; which one(s)should be accepted or rejected?

Use the PI decision rule to evaluate these projects; which one(s)should be accepted or rejected?

(Multiple Choice)

4.8/5  (47)

(47)

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.  Use the discounted payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

Use the discounted payback decision rule to evaluate these projects; which one(s)should be accepted or rejected?

(Multiple Choice)

4.9/5  (36)

(36)

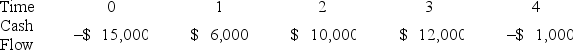

Compute the MIRR statistic for Project I and note whether to accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 15 percent. Project I

(Short Answer)

5.0/5  (37)

(37)

Projects A and B are mutually exclusive.Project A costs $20,000 and is expected to generate cash inflows of $7,500 for 4 years.Project B costs $10,000 and is expected to generate a single cash flow in year 4 of $20,000.The cost of capital is 12%.Which project would you accept and why?

(Multiple Choice)

4.9/5  (36)

(36)

How many possible IRRs could you find for the following set of cash flows?

(Multiple Choice)

4.9/5  (42)

(42)

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

(Multiple Choice)

4.8/5  (36)

(36)

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

(Multiple Choice)

4.9/5  (28)

(28)

Showing 1 - 20 of 119

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)