Exam 14: Financial Statement Analysis

Exam 1: Investments: Background and Issues75 Questions

Exam 2: Asset Classes and Financial Instruments85 Questions

Exam 3: Securities Markets90 Questions

Exam 4: Mutual Funds and Other Investment Companies85 Questions

Exam 5: Risk and Return: Past and Prologue83 Questions

Exam 6: Efficient Diversification84 Questions

Exam 7: Capital Asset Pricing and Arbitrage Pricing Theory85 Questions

Exam 8: The Efficient Market Hypothesis86 Questions

Exam 9: Behavioral Finance and Technical Analysis87 Questions

Exam 10: Bond Prices and Yields93 Questions

Exam 11: Managing Bond Portfolios85 Questions

Exam 12: Macroeconomic and Industry Analysis89 Questions

Exam 13: Equity Valuation88 Questions

Exam 14: Financial Statement Analysis84 Questions

Exam 15: Options Markets88 Questions

Exam 16: Option Valuation85 Questions

Exam 17: Futures Markets and Risk Management87 Questions

Exam 18: Portfolio Performance Evaluation87 Questions

Exam 19: Globalization and International Investing70 Questions

Exam 20: Hedge Funds60 Questions

Exam 21: Taxes,inflation,and Investment Strategy73 Questions

Exam 22: Investors and the Investment Process81 Questions

Select questions type

The tax burden of the firm is 0.5,the interest burden is 0.55,the profit margin is 0.25,the asset turnover is 1.5,and the leverage ratio is 1.65.What is the ROE of the firm?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following transactions will result in a decrease in cash flow from operations?

(Multiple Choice)

4.8/5  (40)

(40)

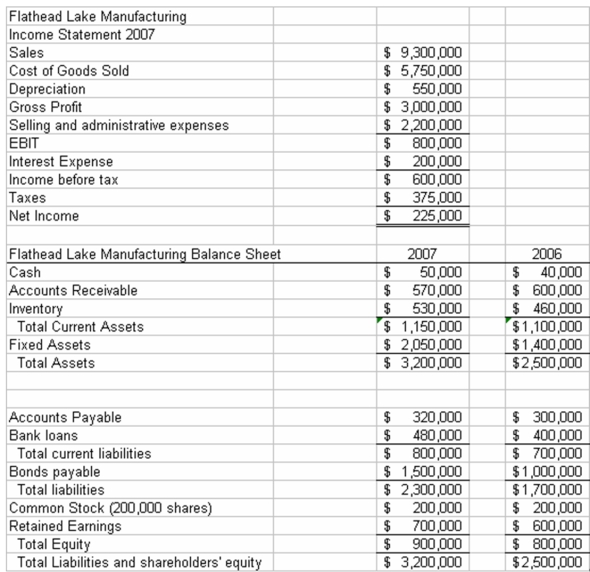

The financial statements of Flathead Lake Manufacturing Company are given below:  Note: The common shares are trading in the stock market for $15 per share

-Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's ATO for 2007 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

Note: The common shares are trading in the stock market for $15 per share

-Refer to the financial statements of Flathead Lake Manufacturing Company.The firm's ATO for 2007 is _________.Please keep in mind that when a ratio involves both income statement and balance sheet numbers,the balance sheet numbers for the beginning and end of the year must be averaged.

(Multiple Choice)

4.7/5  (44)

(44)

The level of real income of a firm can be distorted by the reporting of depreciation and interest expense.During periods of low inflation,the level of reported depreciation tends to __________ income,and the level of interest expense reported tends to __________ income.

(Multiple Choice)

4.8/5  (42)

(42)

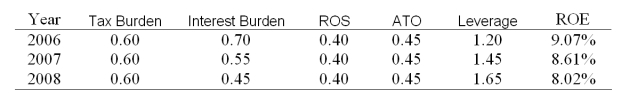

Look at the following table of data for Key Biscuit Company:  What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?

(Multiple Choice)

4.7/5  (32)

(32)

A firm purchases goods on credit worth $100.The same firm pays off $80 in old credit purchases.An investment is made via the purchase of a new facility and equity is issued in the amount of $200 to pay for the purchase.What is the change in net cash provided by financing?

(Multiple Choice)

4.9/5  (41)

(41)

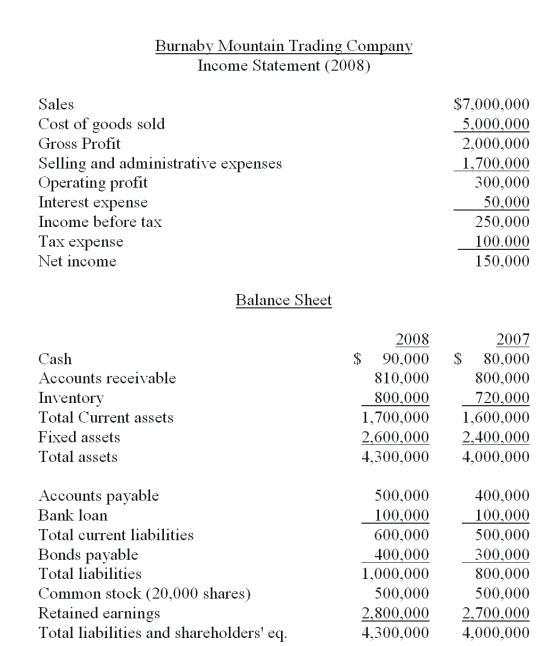

The financial statements of Burnaby Mountain Trading Company are given below.  Note: The common shares are trading in the stock market for $27 each.

-Refer to the financial statements of Burnaby Mountain Trading Company.The firm's P/E ratio for 2008 is _________.

Note: The common shares are trading in the stock market for $27 each.

-Refer to the financial statements of Burnaby Mountain Trading Company.The firm's P/E ratio for 2008 is _________.

(Multiple Choice)

4.9/5  (42)

(42)

If the interest rate on debt is higher than the ROA,then a firm's ROE will _________.

(Multiple Choice)

4.8/5  (36)

(36)

By 2008,over 100 countries have adopted financial reporting standards which are in conformance with ________.

(Multiple Choice)

4.9/5  (29)

(29)

A firm has an ROA of 8%,a debt/equity ratio of 0.5,its ROE is _________.

(Multiple Choice)

4.9/5  (43)

(43)

A firm has a tax burden of 0.7,a leverage ratio of 1.3,an interest burden of 0.8,and a return on sales ratio of 10%.The firm generates $2.28 in sales per dollar of assets.What is the firm's ROE?

(Multiple Choice)

4.9/5  (46)

(46)

In 2006 Hewlett Packard repurchased shares of common stock worth $5,241 million and made dividend payments of $894 million.Other financing activities raised $196 million and Hewlett-Packard's total cash flow from financing was -$6,077 million.How much did the long term debt accounts of Hewlett Packard change?

(Multiple Choice)

4.9/5  (33)

(33)

The firms leverage ratio is 1.2,interest burden ratio is .81,profit margin is .25,and its asset turnover is 1.10.What is the firm's compound leverage factor?

(Multiple Choice)

4.8/5  (40)

(40)

What ratio will definitely increase when a firm increases its annual sales with no corresponding increase in assets?

(Multiple Choice)

4.7/5  (32)

(32)

The major difference between IFRS and GAAP is that U.S.standards are ___________ and IFRS standards are _________.

(Multiple Choice)

4.9/5  (38)

(38)

A firm has a ROE of 20% and a market-to-book ratio of 2.38.Its P/E ratio is _________.

(Multiple Choice)

4.9/5  (46)

(46)

Showing 41 - 60 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)