Exam 10: Short-Term Operating Assets: Cash and Receivables

Exam 1: The Financial Reporting Environment63 Questions

Exam 2: Financial Reporting Theory178 Questions

Exam 3: Judgment and Applied Financial Accounting Research127 Questions

Exam 4: Review of the Accounting Cycle154 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income125 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report158 Questions

Exam 7: Accounting and the Time Value of Money120 Questions

Exam 8: Revenue Recognition159 Questions

Exam 9: OL: Revenue Recognition110 Questions

Exam 10: Short-Term Operating Assets: Cash and Receivables125 Questions

Exam 11: Short-Term Operating Assets: Inventory134 Questions

Exam 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition156 Questions

Exam 13: Long-Term Operating Assets: Departures From Historical Cost126 Questions

Exam 14: Operating Liabilities and Contingencies95 Questions

Exam 15: OL: Operating Liabilities and Contingencies12 Questions

Exam 16: Financing Liabilities167 Questions

Exam 17: Accounting for Stockholders Equity114 Questions

Exam 18: Investing Assets189 Questions

Exam 19: Accounting for Income Taxes121 Questions

Exam 20: Accounting for Employee Compensation and Benefits106 Questions

Exam 22: Accounting Corrections and Error Analysis394 Questions

Select questions type

Recording bad debt expense during the period when an account is determined to be uncollectible,which is generally not allowed under U.S.GAAP,is known as the ________.

(Multiple Choice)

5.0/5  (43)

(43)

Teeter Company began 2017 with accounts receivable of $400,000 and an allowance for uncollectible accounts of $20,000 (credit balance).Bad debt expense for the year was $33,000 and the ending balance in the allowance for uncollectible accounts account was $15,000.What was the amount of accounts receivable written off during the year?

(Multiple Choice)

4.8/5  (31)

(31)

Bad debt expense represents the amount of receivables written off during the period.

(True/False)

4.8/5  (32)

(32)

Which method of estimating bad debt expense focuses on faithful representation of the net realizable value of receivables?

(Multiple Choice)

4.8/5  (38)

(38)

Fraxon Inc.made a $10,000 sale on account with terms: of 1/15,n/30.If the company uses the gross method,which of the following will be included in the journal entry to record customer payment within the discount period?

(Multiple Choice)

4.9/5  (35)

(35)

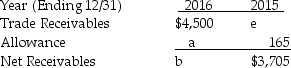

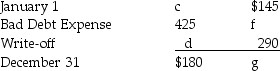

Complete the following disclosures of trade accounts receivables from Cheris Corp.'s notes to the financial statements.

Trade Receivables

Allowance for Uncollectible Accounts

Allowance for Uncollectible Accounts

(Essay)

4.9/5  (37)

(37)

The holder of a non-interest-bearing note does not recognize any interest revenue over the term of the note.

(True/False)

4.7/5  (32)

(32)

What factors are considered when determining either the percentage of sales or the percentage of aged receivables used in determining the adjustment for bad debt expense?

(Essay)

4.9/5  (38)

(38)

Darko Inc.made a $10,000 sale on account with terms: of 1/15,n/30.If the company uses the gross method,which of the following will be included in the journal entry to record the sale on account?

(Multiple Choice)

4.7/5  (42)

(42)

What is securitization of receivables? What are advantages and disadvantages of securitization?

(Essay)

4.8/5  (33)

(33)

The aging-of-receivable method determines current-period bad debt expense by focusing on balance sheet relationships.

(True/False)

4.9/5  (38)

(38)

If a company employs the net method of recording accounts receivable from customers,then sales discounts forfeited should be reported as ________.

(Multiple Choice)

4.9/5  (41)

(41)

How do accounting standards for bank overdrafts differ under U.S.GAAP and IFRS?

(Essay)

4.8/5  (37)

(37)

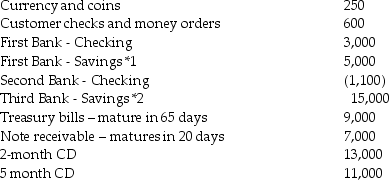

Grisson Enterprises provides the following data:

Notes related to these data include:

*1 A current loan obligation to First Bank requires Grisson to maintain a $1,200 compensating balance in the Savings account

*2 Grisson's board of directors have specified that these funds are restricted to provide for retirement of company bonds that mature in seven years.

Required:

a.Following U.S.GAAP,what is the dollar amount of Cash and Cash Equivalents reported on Grisson's balance sheet?

b.Describe appropriate accounting treatment for any given data that is excluded from Cash and Cash Equivalents.

Notes related to these data include:

*1 A current loan obligation to First Bank requires Grisson to maintain a $1,200 compensating balance in the Savings account

*2 Grisson's board of directors have specified that these funds are restricted to provide for retirement of company bonds that mature in seven years.

Required:

a.Following U.S.GAAP,what is the dollar amount of Cash and Cash Equivalents reported on Grisson's balance sheet?

b.Describe appropriate accounting treatment for any given data that is excluded from Cash and Cash Equivalents.

(Essay)

4.9/5  (46)

(46)

Popper Enterprises factors $800,000 of its accounts receivables to Third Bank with recourse for a finance charge of 5%.The finance company retains an amount equal to 7% of the accounts receivable for possible adjustments.Third Bank will return the hold back to Popper when it collects the receivables.In addition,the fair value of the recourse liability is estimated at $20,000.What amount of cash would Popper receive as a result of this transaction?

(Multiple Choice)

4.9/5  (35)

(35)

Marston Company has outstanding accounts receivable totaling €6.5 million as of December 31 and sales on credit during the year of €24 million.There is also a credit balance of €12,000 in the allowance for doubtful accounts.After aging its receivables,the company estimates that 8% of its total outstanding receivables will be uncollectible.What will be the amount of bad debt expense recognized for the year?

(Multiple Choice)

4.7/5  (37)

(37)

A compensating cash balance held as support of a credit agreement is not classified as cash on the balance sheet.

(True/False)

4.9/5  (33)

(33)

Showing 41 - 60 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)