Exam 12: Property Transactions: Nontaxable Exchanges

Exam 1: An Introduction to Taxation100 Questions

Exam 2: Determination of Tax132 Questions

Exam 3: Gross Income: Inclusions130 Questions

Exam 4: Gross Income: Exclusions105 Questions

Exam 5: Property Transactions: Capital Gains and Losses128 Questions

Exam 6: Deductions and Losses125 Questions

Exam 7: Itemized Deductions107 Questions

Exam 8: Losses and Bad Debts111 Questions

Exam 9: Employee Expenses and Deferred Compensation129 Questions

Exam 10: Depreciation, cost Recovery, amortization, and Depletion96 Questions

Exam 11: Accounting Periods and Methods103 Questions

Exam 12: Property Transactions: Nontaxable Exchanges109 Questions

Exam 13: Property Transactions: Section 1231 and Recapture99 Questions

Exam 14: Special Tax Computation Methods, tax Credits, and Payment of Tax110 Questions

Exam 15: Tax Research112 Questions

Exam 16: Corporations128 Questions

Exam 17: Partnerships and S Corporations124 Questions

Exam 18: Taxes and Investment Planning79 Questions

Select questions type

If each party in a like-kind exchange assumes a liability of the other party,only the net liability given or received is boot.

(True/False)

4.9/5  (36)

(36)

Glen owns a building that is used in business.The building is worth $200,000,but is subject to a mortgage of $40,000.Glen's basis in the building is $120,000.Glen exchanges the building for investment land worth $150,000 plus $10,000 cash.In addition,the other party assumes the mortgage which will be held for investment.Glen must recognize a gain of

(Multiple Choice)

5.0/5  (28)

(28)

Laurie owns land held for investment.The land's FMV is $150,000.Laurie's basis in the land is $130,000.Laurie exchanges the land,plus $20,000 of cash,for a warehouse owned by Trey.The warehouse is worth $210,000,but is subject to a mortgage of $40,000 which Laurie will assume.Trey's basis in the warehouse is $120,000.Laurie's basis in the warehouse received will be

(Multiple Choice)

4.7/5  (39)

(39)

Discuss the rules regarding the holding period for like-kind property received in a nontaxable exchange.

(Essay)

4.9/5  (40)

(40)

William and Kate married in 2013 and purchased a new home together.Each had owned and lived in separate residences for the past 5 years.William's adjusted basis in his old residence was $200,000; Kate's adjusted basis in her old residence was $120,000.In late 2013,William sells his residence for $500,000 while Kate sells her residence for $190,000.What is the total gain to be excluded from these transactions in 2013?

(Multiple Choice)

4.8/5  (37)

(37)

Cassie owns a Rembrandt painting she acquired on June 1,2008 as an investment.She exchanges the painting on September 5,2013,for a Picasso sculpture and marketable securities to be held as an investment.On what date does the sculpture's holding period begin?

(Multiple Choice)

4.8/5  (35)

(35)

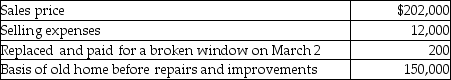

Frank,a single person age 52,sold his home this year.He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3.

Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

(Multiple Choice)

4.8/5  (23)

(23)

Dean exchanges business equipment with a $120,000 adjusted basis for $40,000 cash and business equipment with a $140,000 FMV.What is the amount of gain which Dean recognizes on the exchange?

(Multiple Choice)

4.9/5  (36)

(36)

Kevin exchanges an office building used in his business for another office building worth $200,000 plus $30,000 cash.The FMV of Kevin's old building is $280,000 (basis $150,000)and it is subject to a mortgage of $50,000.The mortgage is assumed by the other party.

a.What is the amount of gain realized by Kevin?

b.What is the amount of gain recognized by Kevin?

c.What is the basis of the new building to Kevin?

(Essay)

4.9/5  (44)

(44)

Showing 101 - 109 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)