Exam 3: Time Value of Money: an Introduction

Exam 1: Corporate Finance and the Financial Manager80 Questions

Exam 2: Introduction to Financial Statement Analysis105 Questions

Exam 3: Time Value of Money: an Introduction107 Questions

Exam 4: Time Value of Money: Valuing Cash Flow Streams69 Questions

Exam 5: Interest Rates105 Questions

Exam 6: Bond Valuation100 Questions

Exam 8: Investment Decision Rules113 Questions

Exam 9: Fundamentals of Capital Budgeting96 Questions

Exam 11: Risk and Return in Capital Markets97 Questions

Exam 12: Systematic Risk and the Equity Risk Premium103 Questions

Exam 13: The Cost of Capital105 Questions

Exam 14: Raising Capital105 Questions

Exam 15: Debt Financing92 Questions

Exam 16: Capital Structure109 Questions

Exam 17: Payout Policy101 Questions

Exam 18: Financial Modelling and Pro-Forma Analysis102 Questions

Exam 19: Working Capital Management97 Questions

Exam 20: Option Applications and Corporate Finance95 Questions

Exam 21: Mergers and Acquisitions43 Questions

Exam 22: International Corporate Finance107 Questions

Exam 23: Insurance and Risk Management38 Questions

Select questions type

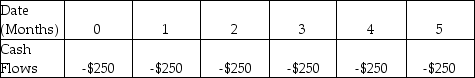

Consider the following timeline:  If the current market rate of interest is 8%, then the value as of year 1 is closest to:

If the current market rate of interest is 8%, then the value as of year 1 is closest to:

(Multiple Choice)

4.7/5  (36)

(36)

A firm has contracted to supply 500 000 gallons of propane fuel for $1.49 million to the local council. The council wants to break the contract. What does the minimum current market price of propane need to be in order for the firm to benefit from breaking the contract?

(Multiple Choice)

4.9/5  (37)

(37)

In a trade with the government of an oil-producing nation, a manufacturer will deliver 14 Caterpillar D9 tractors, with a value of $350 000 per tractor, and receive 45 000 barrels of oil, valued at $115 per barrel. What is the net benefit of this trade to the manufacturer?

(Multiple Choice)

4.8/5  (36)

(36)

To enable costs and benefits to be compared, they are typically converted into a common currency and common point of time, such as dollars today.

(True/False)

4.8/5  (37)

(37)

A company decides to close down its plastics division. It has on hand 20 tonnes of styrene monomer, a raw material that has a market price of $700 per tonne, which had been originally purchased at $650 per tonne. Given that the company has no use for the styrene monomer, and that it would cost the company $5 000 to store it, what is the value of the 20 tonnes of styrene monomer to the company?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following statements regarding the valuing of costs and benefits is NOT correct?

(Multiple Choice)

4.8/5  (38)

(38)

You have a used CD store. At an estate sale, you can purchase 250 compact discs for $500. You believe you could sell the CDs for an average of $2.50 each. What is the net benefit of buying the CDs at the estate sale and selling them in your store?

(Multiple Choice)

4.9/5  (40)

(40)

What is the present value (PV)of $280 000 received 25 years from now, assuming the interest rate is 4% per year?

(Multiple Choice)

4.8/5  (31)

(31)

What is the future value (FV)of $20 000 in four years, assuming the interest rate is 12% per year?

(Multiple Choice)

4.8/5  (40)

(40)

The State Bank offers an interest rate of 5.5% on savings and 6% on loans, while the Colonial Bank offers 6.5% on savings and 7% on loans. Which of the following is the LEAST likely outcome of such a situation?

(Multiple Choice)

4.9/5  (29)

(29)

Another oil refiner is offering to trade you 10 150 tonnes of TOC crude oil for 10 000 tonnes of WAI crude oil. Assuming you currently have 10 000 tonnes of WAI crude, what should you do?

(Multiple Choice)

4.8/5  (33)

(33)

A backhoe can dig 175 metre of trench per hour and costs $525 per hour to hire and operate. A ditch digger can dig 5 metre of trench per hour. Based on this information, what is the most a ditch digger can charge per hour when digging ditches?

(Multiple Choice)

4.9/5  (41)

(41)

Sara wants to have $500 000 in her savings account when she retires. How much must she put in the account now, if the account pays a fixed interest rate of 8%, to ensure that she has $500 000 in 20 years' time?

(Multiple Choice)

4.8/5  (29)

(29)

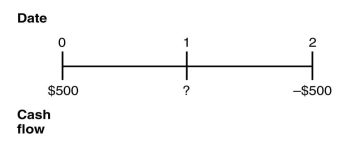

The timeline shown below best describes which of the following situations?

(Multiple Choice)

4.9/5  (36)

(36)

A vintner is deciding when to release a vintage of sauvignon blanc. If it is bottled and released now, the wine will be worth $2.2 million. If it is barrel-aged for a further year, it will be worth 20% more, though there will be additional costs of $500 000. If the interest rate is 7%, what is the difference in the benefit the vintner will realise if he releases the wine after barrel-aging it for one year or if he releases the wine now?

(Multiple Choice)

4.9/5  (40)

(40)

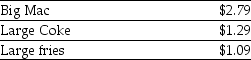

Use the table for the question(s)below.

Consider the following prices from a McDonald's Restaurant:

-A McDonald's Big Mac value meal consists of a Big Mac, a large Coke and a large fries. Assuming that there is a competitive market for McDonald's food items, at what price must a Big Mac value meal sell to insure the absence of an arbitrage opportunity and uphold the Law of One Price?

-A McDonald's Big Mac value meal consists of a Big Mac, a large Coke and a large fries. Assuming that there is a competitive market for McDonald's food items, at what price must a Big Mac value meal sell to insure the absence of an arbitrage opportunity and uphold the Law of One Price?

(Multiple Choice)

4.8/5  (40)

(40)

You are scheduled to receive $10 000 in one year. An increase in the interest rate will have what effect on the future value of this cash flow?

(Multiple Choice)

4.9/5  (41)

(41)

Showing 41 - 60 of 107

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)