Exam 8: Variable Costing: a Tool for Management

Exam 1: Managerial Accounting and the Business Environment49 Questions

Exam 2: Cost Terms, Concepts, and Classifications103 Questions

Exam 3: Cost Behaviour: Analysis and Use106 Questions

Exam 4: Cost-Volume-Profit Relationships401 Questions

Exam 5: Systems Design: Job-Order Costing108 Questions

Exam 6: Systems Design: Process Costing130 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making120 Questions

Exam 8: Variable Costing: a Tool for Management135 Questions

Exam 9: Budgeting128 Questions

Exam 10: Standard Costs and Overhead Analysis223 Questions

Exam 11: Reporting for Control193 Questions

Exam 12: Relevant Costs for Decision Making88 Questions

Exam 13: Capital Budgeting Decisions180 Questions

Exam 14: Financial Statement Analysis Online200 Questions

Select questions type

What was the operating income (loss)for the month under absorption costing?

Free

(Multiple Choice)

5.0/5  (29)

(29)

Correct Answer:

D

For the month noted,what was the relationship between the operating income under variable costing as opposed to under absorption costing?

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

B

Last year,Silver Company's total variable production costs were $7,500,and its total fixed manufacturing overhead costs were $4,500.The company produced 3,000 units during the year and sold 2,400 units.There were no units in the beginning inventory.Which of the following statements is true?

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

C

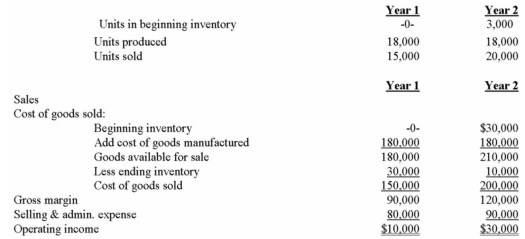

Operating data for Fowler Company and its absorption costing income statements for the last two years are presented below:  Variable manufacturing costs are $6 per unit.Fixed manufacturing overhead totals $72,000 in each year.This overhead is applied at the rate of $4 per unit.Variable selling and administrative expenses were $2 per unit sold.

Required:

a)What was the unit product cost in each year under variable costing?

b)Prepare new income statements for each year using variable costing.

c)Reconcile the absorption costing and variable costing operating income for each year.

Variable manufacturing costs are $6 per unit.Fixed manufacturing overhead totals $72,000 in each year.This overhead is applied at the rate of $4 per unit.Variable selling and administrative expenses were $2 per unit sold.

Required:

a)What was the unit product cost in each year under variable costing?

b)Prepare new income statements for each year using variable costing.

c)Reconcile the absorption costing and variable costing operating income for each year.

(Essay)

4.9/5  (31)

(31)

What was the total period cost for the month under variable costing?

(Multiple Choice)

4.8/5  (31)

(31)

At the end of last year,Lee Company had 30,000 units in its ending inventory.Every year,Lee Company's variable production costs are $10 per unit,and its fixed manufacturing overhead costs are $5 per unit.The company's operating income for the year was $12,000 higher under variable costing than under absorption costing.Given these facts,what must have been the number of units of product in inventory at the beginning of the year?

(Multiple Choice)

4.8/5  (34)

(34)

Under absorption costing,what was the total amount of fixed manufacturing cost in the ending inventory?

(Multiple Choice)

4.8/5  (46)

(46)

The term "gross margin" for a manufacturing company refers to the excess of sales over which of the following?

(Multiple Choice)

4.8/5  (37)

(37)

What was the amount of fixed manufacturing overhead deferred under absorption costing?

(Multiple Choice)

4.8/5  (43)

(43)

Under absorption costing,what was the carrying value on the balance sheet of the ending inventory for the year? Do not round intermediate calculations.

(Multiple Choice)

4.9/5  (33)

(33)

Variable costing is sometimes referred to as direct costing or marginal costing.

(True/False)

4.9/5  (39)

(39)

What was the contribution margin per unit? Do not round intermediate calculations.

(Multiple Choice)

4.8/5  (35)

(35)

What is the operating income (loss)for the month under variable costing?

(Multiple Choice)

4.8/5  (28)

(28)

Under absorption costing,what was the carrying value on the balance sheet of the ending finished goods inventory? Do not round intermediate calculations.

(Multiple Choice)

4.8/5  (29)

(29)

What was the total period cost for the month under the variable costing approach?

(Multiple Choice)

4.8/5  (43)

(43)

What was the operating income (loss)for the month under variable costing?

(Multiple Choice)

4.7/5  (31)

(31)

Operating income determined using absorption costing can be reconciled to operating income determined using variable costing by computing the difference between which of the following?

(Multiple Choice)

4.8/5  (37)

(37)

When lean production methods are introduced,the difference in operating income calculated using the absorption and variable costing methods is reduced.

(True/False)

4.9/5  (42)

(42)

Showing 1 - 20 of 135

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)