Exam 4: The Accounting Cycle Continued

Exam 1: Accounting Concepts and Procedures125 Questions

Exam 2: Debits and Credits: Analyzing and Recording Business Transactions134 Questions

Exam 3: Beginning the Accounting Cycle125 Questions

Exam 4: The Accounting Cycle Continued125 Questions

Exam 5: The Accounting Cycle Completed119 Questions

Exam 6: Banking Procedure and Control of Cash125 Questions

Exam 7: Calculating Pay and Payroll Taxes: The Beginning of the Payroll Process127 Questions

Exam 8: Paying,recording,and Reporting Payroll and Payroll Taxes: The Conclusion of the Payroll Process120 Questions

Exam 9: Sales and Cash Receipts125 Questions

Exam 10: Purchases and Cash Payments122 Questions

Exam 11: Preparing a Worksheet for a Merchandise Company125 Questions

Exam 12: Completion of the Accounting Cycle for a Merchandise Company125 Questions

Exam 13: Accounting for Bad Debts121 Questions

Exam 14: Notes Receivable and Notes Payable132 Questions

Exam 15: Accounting for Merchandise Inventory125 Questions

Exam 16: Accounting for Property, plant, equipment, and Intangible Assets147 Questions

Exam 17: Partnership130 Questions

Exam 18: Corporations: Organizations and Stock124 Questions

Exam 19: Corporations: Stock Values, dividends, treasury Stocks, and Retained Earnings123 Questions

Exam 20: Corporations and Bonds Payable138 Questions

Exam 21: Statement of Cash Flows123 Questions

Exam 22: Analyzing Financial Statements124 Questions

Exam 23: The Voucher System133 Questions

Exam 24: Departmental Accounting120 Questions

Exam 25: Manufacturing Accounting126 Questions

Select questions type

Depreciation Expense is debited when recording the depreciation for the period.

(True/False)

4.8/5  (38)

(38)

Withdrawals would most likely be found in which column of the worksheet?

(Multiple Choice)

4.7/5  (43)

(43)

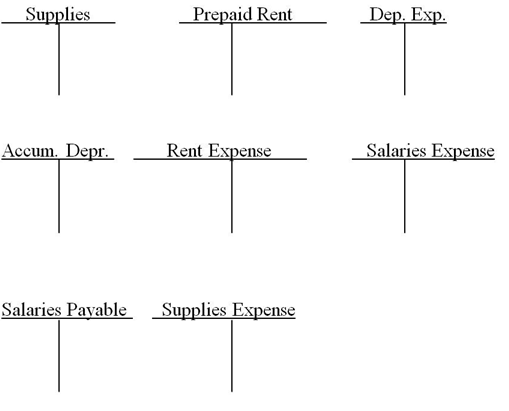

Provide the adjusting entries to account for the differences between the trial balance amounts and the adjusted trial balance amounts for the accounts shown.Only a partial trial balance is provided.Use T accounts to show the adjustments.

Supplies Prepaid Rent Equipment Accum. Depr. - Equip Service Fees Depreciation Expense Telephone Expense Salaries Expense Rent Expense Supplies Expense 500 1,100 10,000 150 500 3,000 1,200 500 300 10,000 400 150 600 800 250 3,000 1,200

(Essay)

4.8/5  (39)

(39)

Depreciation of equipment was recorded twice this period.This would:

(Multiple Choice)

4.8/5  (39)

(39)

The adjustment for accrued wages included the entire pay period,some of which occurs next month.This would:

(Multiple Choice)

4.8/5  (38)

(38)

The accounts added below the trial balance,on the worksheet,are always decreasing.

(True/False)

4.7/5  (40)

(40)

The amount of supplies used during the period would be shown in the adjustment columns of the worksheet.

(True/False)

4.8/5  (39)

(39)

The accumulated depreciation will appear in which of the following worksheet statement columns?

(Multiple Choice)

4.9/5  (43)

(43)

Equipment was purchased for $20,000,residual value is $2,000 and it is expected that the useful life is 10 years.What is the amount in the Accumulated Depreciation account after 3 years assuming straight-line depreciation?

$ ________

(Short Answer)

4.9/5  (40)

(40)

Equipment was purchased for $20,000,residual value is $2,000 and it is expected that the useful life is 10 years.What is the depreciation adjustment amount after the first year assuming straight-line depreciation?

$ ________

(Essay)

4.7/5  (30)

(30)

Bailey's received its electric bill for December on December 31 but did not pay nor record it in the general journal.This resulted in:

(Multiple Choice)

4.9/5  (45)

(45)

Which of the following is most likely to result in an adjusting entry at the end of the period?

(Multiple Choice)

4.9/5  (43)

(43)

Great Lakes Modeling Agency purchased $900 of office furniture at the beginning of the month.Depreciation Expense at the end of the month is $200.What is the balance of the Office Furniture account at the end of the month?

(Multiple Choice)

4.8/5  (37)

(37)

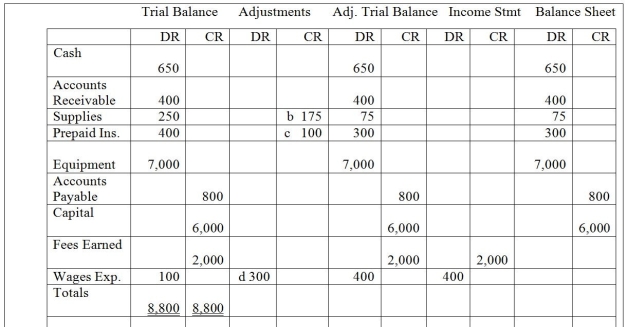

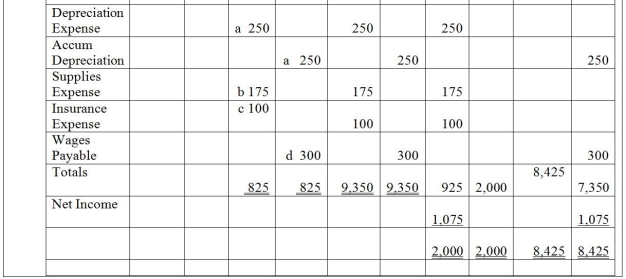

Given the income statement columns and the balance sheet columns of the worksheet,prepare a balance sheet dated December 31,200x,for Baur Company.

(Essay)

4.8/5  (33)

(33)

An important function of the worksheet is for the accountant to find and correct errors before the financial statements are prepared.

(True/False)

4.7/5  (36)

(36)

On a worksheet,the balance sheet debit column total is $1,000 and the credit column total is $2,000.Which of the following statements is correct?

(Multiple Choice)

4.8/5  (32)

(32)

For each account listed identify the category it belongs to,the normal balance (debit or credit),and the financial statement the account appears.

Account Category Normal Balance Financial Statement 0. Cash Asset Debit Balance Sheet 1. Depreciation Expense 2. Accumulated Depreciation 3 Wages Expense 4. Office Supplies 5. Office Supplies Expense 6. Wages Payable 7. Prepaid Rent

(Essay)

4.8/5  (38)

(38)

Unlimited Doors showed supplies available during the year of $1,900.A count of the supplies on hand as of October 31 is $800.The adjusting entry for Store Supplies would include:

(Multiple Choice)

4.9/5  (34)

(34)

Showing 21 - 40 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)