Exam 3: Accruals and Deferrals: Timing Is Everything in Accounting

Exam 1: Business: Whats It All About226 Questions

Exam 2: Qualities of Accounting Information180 Questions

Exam 3: Accruals and Deferrals: Timing Is Everything in Accounting260 Questions

Exam 4: Payment for Goods and Services: Cash and Accounts Receivable195 Questions

Exam 5: The Purchase and Sale of Inventory249 Questions

Exam 6: Acquisition and Use of Long-Term Assets217 Questions

Exam 7: Accounting for Liabilities308 Questions

Exam 9: Preparing and Analyzing the Statement of Cash Flows277 Questions

Exam 10: Using Financial Statement Analysis to Evaluate Firm Performance273 Questions

Exam 11: Quality of Earnings, corporate Governance, and Ifrs159 Questions

Select questions type

Sure Enuf,Inc.paid $4,800 on May 1,2012 for 12 months' insurance coverage starting May 1.How much insurance expense should appear on the company's balance sheet at December 31,2012?

(Multiple Choice)

4.8/5  (35)

(35)

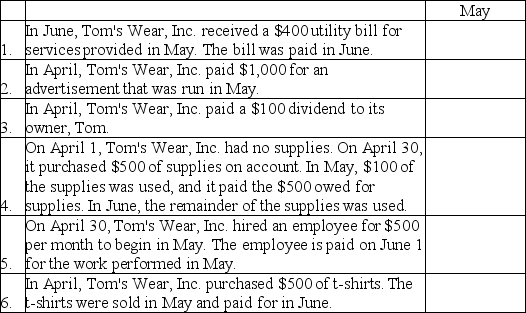

For each event,determine the amount of expense to be recorded,even if $0,in May.

(Essay)

4.7/5  (38)

(38)

Ima Hogg wants to borrow money to expand her business.Her plan is to open a new store on each of the major islands in the Caribbean.She knows that her bank will want to see a full set of this year's financial statements before agreeing to lend the company money.Ima tells the company accountant,Tom Trueheart,not to pay December rent or utilities.That way there will be less rent expense and utility expense on this year's income statement.

1.What effect will failing to pay these bills have on this year's income statement? How will the balance sheet be affected? Why would Ima Hogg ask Tom Trueheart to do this?

2.Would it be ethical for Tom to do as Ima asks? Why?

(Essay)

4.8/5  (27)

(27)

Match the following terms with the appropriate definitions.Definitions have not been provided for all of these terms.

Correct Answer:

Premises:

Responses:

(Matching)

5.0/5  (41)

(41)

The employees of Dew Drop Inn get paid every Friday for a 5-day workweek (Monday through Friday).The total payroll is $5,000 per day of work.If the accounting period ends on Friday of a given week,what effect will this have on the company's accounting system?

(Multiple Choice)

4.7/5  (31)

(31)

Avatar,Inc.bought a machine on January 1,2011 for $96,000.The machine is expected to last for 8 years,after which it will be worthless.How much depreciation expense will Avatar show on its income statement for the year ended December 31,2012?

(Multiple Choice)

4.9/5  (39)

(39)

On January 1,2011,Beyers Company pays $205,000 cash for factory equipment that has an estimated useful life of 10 years and an expected residual value of $5,000.What will Beyers report on its income statement for the year ended December 31,2011?

(Multiple Choice)

4.9/5  (42)

(42)

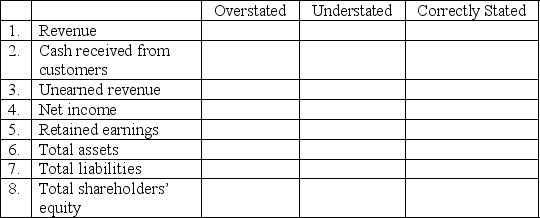

Stimpy,Inc.collected $3,600 on December 20,2011 from a customer for services to be performed next year in 2012.In Stimpy's information system,the entire cash receipt of $3,600 was recorded as revenue earned.Stimpy forgot to make the necessary adjusting entry before preparing financial statements on December 31,2011.Put an X in the appropriate box to show how each of these line items will be reported on Stimpy's December 31,2011 financial statements.Dollar amounts are not required.

(Essay)

4.7/5  (40)

(40)

Use the following code to classify the accounts listed below by the appropriate balance sheet category:

a.Asset

b.Liability

c.Shareholders' equity

______ 1.Cash

______ 2.Accounts receivable

______ 3.Common stock

______ 4.Office computers

______ 5.Office supplies

______ 6.Accounts payable

______ 7.Factory equipment

______ 8.Salaries payable

______ 9.Accumulated depreciation

______ 10.Interest receivable

(Short Answer)

4.9/5  (39)

(39)

Fair Play,Inc.paid $3,600 on September 1,2011 for an 18-month insurance policy beginning on that day.The company recorded the entire amount as prepaid insurance.How much insurance expense should the company show on its income statement for the year ended December 31,2011?

(Multiple Choice)

4.9/5  (37)

(37)

Assume XYZ Co.used cash to purchase $500 of supplies during the current year and had $200 of the supplies left over unused at the end of the accounting period.In the space provided below,describe how this information would be reported on the financial statements of XYZ Co:

The statement of cash flows:

The income statement:

The balance sheet:

(Essay)

4.7/5  (41)

(41)

The cost of borrowing money from a creditor is called the principal of the loan.

(True/False)

5.0/5  (38)

(38)

Computerized accounting systems make sure that the accounting equation is in balance.

(True/False)

4.9/5  (41)

(41)

The employees of Dew Drop Inn get paid every Friday for a 5-day workweek (Monday through Friday).The total payroll is $5,000 per day of work.If the accounting period ends on Wednesday of a given week and the proper adjustment is made on Wednesday,what will be the effect of the adjustment on the company's financial statements?

(Multiple Choice)

4.9/5  (35)

(35)

Maxine,Inc.bought a machine on January 1,2012 for $48,000.The machine is expected to last for 8 years,after which it will be worthless.What is the book value of the machine on Maxine's balance sheet at December 31,2013?

(Multiple Choice)

4.9/5  (39)

(39)

If a one-year insurance policy is purchased,an asset should be recorded.

(True/False)

4.8/5  (45)

(45)

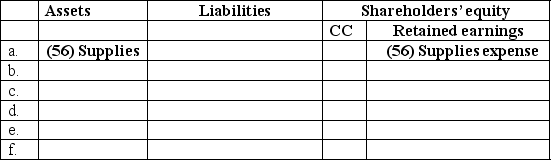

Identify the effects of each of the following items of information on the accounting equation.Show the correct dollar amount and name the accounts involved.The first transaction has been done for you.

a.Supplies used up during the period,$56

b.Prepaid rent used up during the period,$120

c.Interest accrued on a note payable but unpaid,$203

d.Depreciation on long-term assets,$4,000

e.The portion of unearned revenue that has been earned,$1,000

f.A $12,000,12-month insurance policy was purchased 7 months ago

(Essay)

4.8/5  (29)

(29)

Making an adjustment for a transaction in which the action has occurred but the cash has not yet changed hands is called "accruing" the revenue or expense.

(True/False)

4.8/5  (40)

(40)

Showing 61 - 80 of 260

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)