Exam 12: Long-Term Liabilities: Bonds and Notes

Exam 1: Introduction to Accounting and Business179 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process174 Questions

Exam 4: Completing the Accounting Cycle178 Questions

Exam 5: Accounting for Merchandising Businesses204 Questions

Exam 6: Inventories156 Questions

Exam 7: Sarbanes-Oxley,internal Control,and Cash160 Questions

Exam 8: Receivables167 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll178 Questions

Exam 11: Corporations: Organization,stock Transactions,and Dividends165 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes156 Questions

Exam 13: Investments and Fair Value Accounting147 Questions

Exam 14: Statement of Cash Flows156 Questions

Exam 15: Financial Statement Analysis179 Questions

Select questions type

When the market rate of interest was 12%,Halprin Corporation issued $1,000,000,11%,10-year bonds that pay interest annually.The selling price of this bond issue was

(Multiple Choice)

4.8/5  (40)

(40)

There is a loss on redemption of bonds when bonds are redeemed above carrying value.

(True/False)

4.9/5  (40)

(40)

A corporation often issues callable bonds to protect itself against significant declines in future interest rates.

(True/False)

4.8/5  (28)

(28)

The Designer Company issued 10-year bonds on January 1.The 6% bonds have a face value of $800,000 and pay interest every January 1 and July 1.The bonds were sold for $690,960 based on the market interest rate of 8%.Designer uses the effective interest method to amortize bond discounts and premiums.On July 1,of the first year,Designer should record interest expense round to the nearest dollar of

(Multiple Choice)

4.9/5  (41)

(41)

The balance in a bond discount account should be reported on the balance sheet as a deduction from the related bonds payable.

(True/False)

4.7/5  (37)

(37)

The entry to record the amortization of a premium on bonds payable on an interest payment date would

(Multiple Choice)

4.7/5  (33)

(33)

Only callable bonds can be purchased by the issuing corporation before maturity.

(True/False)

4.8/5  (31)

(31)

The total interest expense over the entire life of a bond is equal to the sum of the interest payments plus the total discount or minus the total premium related to the bond.

(True/False)

4.8/5  (35)

(35)

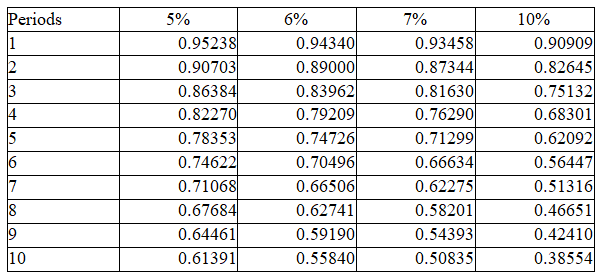

Using the following table,what is the present value of $15,000 to be received in 10 years,if the market rate is 5% compounded annually?

(Short Answer)

4.7/5  (29)

(29)

To determine the six-month interest payment amount on a bond,you would take one-half of the market rate times the face value of the bond.

(True/False)

4.8/5  (43)

(43)

A company issued $1,000,000 of 30-year, 8% callable bonds on April 1, with interest payable on April 1 and October 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions:

Year 1

Apr. 1 Issued the bonds for cash at their face amount. Oct. 1 Paid the interest on the bonds.

Year 3

Oct. 1 Called the bond issue at 104, the rate provided in the bond indenture. Omit entry for payment of interest.

(Essay)

4.9/5  (35)

(35)

Given the following data, prepare the journal entry to record interest expense and any related amortization on December 31 of the first year using the effective interest rate method. Assume interest is paid annually on January 1. The bonds were issued on January 1 for $7,411,233.

Bonds payable, maturing in 10 years = $8,000,000 Contract interest rate = 5%

Market effective interest rate = 6%

Round answers to nearest dollar.

(Essay)

4.7/5  (31)

(31)

Amortization is the allocation process of writing off bond premiums and discounts to interest expense over the life of the bond issue.

(True/False)

4.9/5  (45)

(45)

On January 1,Gemstone Company obtained a $165,000,10-year,7% installment note from Guarantee Bank.The note requires annual payments of $23,492,with the first payment occurring on the last day of the fiscal year.The first payment consists of interest of $11,550 and principal repayment of $11,942.The journal entry to record the issuance of the installment note for cash on January 1 would include a

(Multiple Choice)

4.9/5  (36)

(36)

On the first day of the fiscal year,Lisbon Co.issued $1,000,000 of 10-year,7% bonds for $1,050,000,with interest payable semiannually.Orange Inc.purchased the bonds on the issue date for the issue price.The journal entry to record the amortization of the premium by the straight-line method for the year by Lisbon Co.includes a debit to

(Multiple Choice)

5.0/5  (37)

(37)

The journal entry a company records for the payment of interest,interest expense,and amortization of bond discount is

(Multiple Choice)

4.8/5  (29)

(29)

On January 1,the Elias Corporation issued 10% bonds with a face value of $50,000.The bonds are sold for $46,000.The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31,ten years from now.Elias records straight-line amortization of the bond discount.The bond interest expense for the year ended December 31 of the first year is

(Multiple Choice)

4.9/5  (36)

(36)

If the straight-line method of amortization is used,the amount of unamortized premium on bonds payable will decrease as the bonds approach maturity.

(True/False)

4.9/5  (41)

(41)

A corporation issues for cash $1,000,000 of 10%,20-year bonds,interest payable annually,at a time when the market rate of interest is 12%.The straight-line method is adopted for the amortization of bond discount or premium.Which of the following statements is true?

(Multiple Choice)

4.9/5  (35)

(35)

The amount of interest expense reported on the income statement will be more than the interest paid to bondholders if the bonds were originally sold at a discount.

(True/False)

4.9/5  (46)

(46)

Showing 21 - 40 of 156

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)