Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business179 Questions

Exam 2: Analyzing Transactions210 Questions

Exam 3: The Adjusting Process174 Questions

Exam 4: Completing the Accounting Cycle178 Questions

Exam 5: Accounting for Merchandising Businesses204 Questions

Exam 6: Inventories156 Questions

Exam 7: Sarbanes-Oxley,internal Control,and Cash160 Questions

Exam 8: Receivables167 Questions

Exam 9: Fixed Assets and Intangible Assets177 Questions

Exam 10: Current Liabilities and Payroll178 Questions

Exam 11: Corporations: Organization,stock Transactions,and Dividends165 Questions

Exam 12: Long-Term Liabilities: Bonds and Notes156 Questions

Exam 13: Investments and Fair Value Accounting147 Questions

Exam 14: Statement of Cash Flows156 Questions

Exam 15: Financial Statement Analysis179 Questions

Select questions type

Complete the missing items in the Summary of Adjustments chart:

11ea83a5_c2bd_4dbc_908c_3b738474d684

(Essay)

4.8/5  (38)

(38)

For the year ending June 30,Island Clinical Services mistakenly omitted adjusting entries for 1 $1,500 of supplies that were used,2 unearned revenue of $4,200 that was earned,and 3 insurance of $5,000 that expired.What is the combined effect of these errors on a revenues,b expenses,and c net income for the year ending June 30?

(Essay)

4.8/5  (30)

(30)

At the end of the fiscal year,the usual adjusting entry for depreciation on equipment was omitted.Which of the following is true?

(Multiple Choice)

4.8/5  (45)

(45)

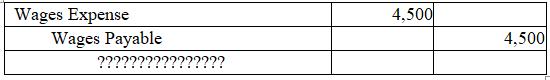

The following adjusting journal entry found in the journal is missing an explanation.Select the best explanation for the entry.

(Multiple Choice)

4.8/5  (32)

(32)

The adjusting entry to adjust supplies was omitted at the end of the year.This would affect the income statement by having

(Multiple Choice)

4.8/5  (37)

(37)

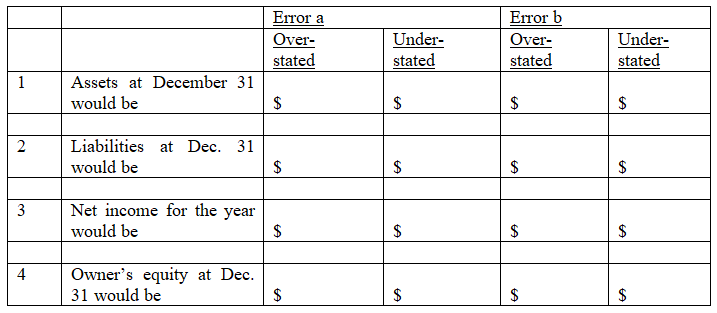

At the end of the fiscal year,the following adjusting entries were omitted:

a. No adjusting entry was made to transfer the $1,750 of prepaid insurance from the asset account to the expense account.

b. No adjusting entry was made to record accrued fees of $525 for services provided to customers.

Assuming that financial statements are prepared before the errors are discovered,indicate the effect of each error,considered individually,by inserting the dollar amount in the appropriate spaces.Insert "0" if the error does not affect the item.

(Essay)

4.8/5  (36)

(36)

A company pays an employee $3,000 for a five day work week,Monday-Friday.The adjusting entry on December 31,which is a Wednesday,is a debit to Wages Expense,$1,800,and a credit to Wages Payable,$1,800.

(True/False)

4.9/5  (25)

(25)

The difference between deferred revenue and accrued revenue is that accrued revenue has been recorded and needs adjusting and deferred revenue has never been recorded.

(True/False)

4.8/5  (35)

(35)

The adjusting entry to record the depreciation of a building for the fiscal period is

(Multiple Choice)

4.8/5  (45)

(45)

Which of the following is an example of a prepaid expense?

(Multiple Choice)

4.8/5  (37)

(37)

On December 31,a business estimates depreciation on equipment used during the first year of operations to be $2,900.a Journalize the adjusting entry required on December 31.b If the adjusting entry in a were omitted,which items would be erroneously stated on 1 the income statement for the year and 2 the balance sheet as of December 31?

(Essay)

4.7/5  (37)

(37)

On March 1,a business paid $3,600 for a twelve-month liability insurance policy.On April 1,the business entered into a two-year rental contract for equipment at a total cost of $18,000.Determine the following amounts:

a. insurance expense for the month of March

b. prepaid insurance as of March 31

c. equipment rent expense for the month of April

d. prepaid equipment rental as of April 30

(Essay)

4.9/5  (43)

(43)

Which one of the accounts below would likely be included in an accrual adjusting entry?

(Multiple Choice)

4.7/5  (33)

(33)

The adjusting entry for gym memberships earned that were previously recorded in the unearned gym memberships account is

(Multiple Choice)

4.9/5  (38)

(38)

Indicate whether the following error would cause the adjusted trial balance totals to be unequal.If the error would cause the adjusted trial balance totals to be unequal,indicate whether the debit or credit total is higher and by how much.

The adjustment for accrued fees of $1,170 was journalized as a debit to Accounts Receivable for $1,170 and a credit to Fees Earned for $1,107.

(Essay)

4.9/5  (34)

(34)

Accumulated Depreciation and Depreciation Expense are classified,respectively,as

(Multiple Choice)

4.9/5  (43)

(43)

Showing 141 - 160 of 174

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)