Exam 8: Reporting and Analyzing Long-Term Assets

Exam 1: Introducing Financial Accounting260 Questions

Exam 2: Accounting System and Financial Statements228 Questions

Exam 3: Adjusting Accounts for Financial Statements244 Questions

Exam 4: Reporting and Analyzing Merchandising Operations213 Questions

Exam 5: Reporting and Analyzing Inventories211 Questions

Exam 6: Reporting and Analyzing Cash and Internal Controls202 Questions

Exam 7: Reporting and Analyzing Receivables176 Questions

Exam 8: Reporting and Analyzing Long-Term Assets209 Questions

Exam 9: Reporting and Analyzing Current Liabilities193 Questions

Exam 10: Reporting and Analyzing Long-Term Liabilities194 Questions

Exam 11: Reporting and Analyzing Equity208 Questions

Exam 12: Reporting and Analyzing Cash Flows172 Questions

Exam 13: Analyzing and Interpreting Financial Statements185 Questions

Exam 14: Applying Present and Future Values52 Questions

Exam 15: Investments and International Operations186 Questions

Exam 16: Accounting for Partnerships134 Questions

Exam 17: Accounting With Special Journals159 Questions

Select questions type

___________________ are additional costs of plant assets that do not materially increase the asset's life or productive capabilities.

(Short Answer)

4.8/5  (25)

(25)

A company purchased equipment valued at $200,000 on January 1.The equipment has an estimated useful life of six years or 5 million units.The equipment is estimated to have a salvage value of $13,400.

-Assuming the double declining balance method of depreciation,what is the book value at the end of the second year?

(Multiple Choice)

4.8/5  (43)

(43)

Match each of the following terms with the appropriate definitions.

Correct Answer:

Premises:

Responses:

(Matching)

4.8/5  (39)

(39)

A company bought a new display case for $42,000 and was given a trade-in of $2,000 on an old display case,so the company paid $40,000 cash with the trade-in.The old case had an original cost of $37,000 and accumulated depreciation of $34,000.The company should record the value of new display case at:

(Multiple Choice)

4.7/5  (30)

(30)

A company purchased a POS cash register on January 1 for $5,400.This register has a useful life of 10 years and a salvage value of $400.What would be the depreciation expense for the second-year of its useful life using the double-declining-balance method?

(Multiple Choice)

4.9/5  (33)

(33)

When an asset is purchased (or disposed of) at any time other than the beginning or the end of an accounting period,depreciation is recorded for part of a year so that the year of purchase or the year of disposal is charged with its share of the asset's depreciation.

(True/False)

4.7/5  (42)

(42)

A company purchased equipment valued at $200,000 on January 1.The equipment has an estimated useful life of six years or 5 million units.The equipment is estimated to have a salvage value of $13,400.

-Assuming the double declining balance method of depreciation,what is the depreciation for the second year?

(Multiple Choice)

4.8/5  (32)

(32)

Revenue expenditures are additional costs of plant assets that materially increase the assets' life or productive capabilities.

(True/False)

4.7/5  (31)

(31)

A company purchased equipment valued at $825,000 on January 1.The equipment has an estimated useful life of seven years or 6 million units.The equipment is estimated to have a salvage value of $35,000.Assuming the straight-line method of depreciation,what is depreciation for the second year?

(Short Answer)

4.8/5  (30)

(30)

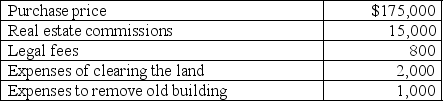

A company purchased property for a building site.The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

(Multiple Choice)

4.8/5  (43)

(43)

Treating capital expenditures of a small dollar amount as revenue expenditures is likely to mislead the users of financial statements.

(True/False)

4.9/5  (37)

(37)

A company exchanged an old truck for a newer model.The old truck account had a cost of $76,000 and accumulated depreciation of $65,000 as of the exchange date.The new truck had a cash price of $84,000,but the company was given a $15,000 trade-in allowance and the balance of $69,000 was paid in cash.Prepare the journal entry to record the exchange.

(Essay)

4.8/5  (29)

(29)

A depreciation method in which a plant asset's depreciation expense for a period is determined by applying a constant depreciation rate each period to the asset's beginning book value is called:

(Multiple Choice)

4.9/5  (43)

(43)

On December 31,2013,Stable Company sold a piece of equipment that was purchased on January 1,2009.The equipment originally cost $820,000 and has an estimated useful life of eight years.Stable uses the double-declining-balance method of depreciation.What is the gain/loss on the sale of equipment that Stable will recognize if the equipment was sold for $230,000?

(Multiple Choice)

4.8/5  (38)

(38)

A company purchased mining property containing 7,350,000 tons of ore for $1,837,500.In 2012 it mined and sold 857,000 tons of ore and in 2013 it mined and sold 943,000 tons of ore.Calculate the depletion expense for 2012 and 2013.What was the book value of the property at the end of 2013?

(Essay)

4.8/5  (36)

(36)

A company had net sales of $541,500 in 2013 and $475,300 in 2014.Its average assets were $410,000 for 2013 and $400,000 for 2014.(1) Calculate the total asset turnover for each year.(2) Interpret and comment on the company's efficiency in the use of its assets.

(Essay)

4.7/5  (34)

(34)

A company purchased equipment for $50,000 on January 1,2012.The equipment was sold for $10,000 on December 31,2015.Accumulated Depreciation in the amount of $40,000 had been recorded through that date.How would the company record this transaction?

(Multiple Choice)

4.8/5  (45)

(45)

Ace Company purchased a machine valued at $320,000 on August 1.The equipment has an estimated useful life of five years or 2.5 million units.The equipment is estimated to have a salvage value of $8,200.Assuming the double-declining-balance method of depreciation,what is the amount of depreciation expense that needs to be recorded at the end of the second year?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 41 - 60 of 209

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)