Exam 20: Accounting for State and Local Governmental Units - Governmental Funds

Exam 1: Business Combinations36 Questions

Exam 2: Stock Investments Investor Accounting and Reporting41 Questions

Exam 3: An Introduction to Consolidated Financial Statements39 Questions

Exam 4: Consolidated Techniques and Procedures38 Questions

Exam 5: Intercompany Profit Transactions - Inventories39 Questions

Exam 6: Intercompany Profit Transactions - Plant Assets39 Questions

Exam 7: Intercompany Profit Transactions - Bonds40 Questions

Exam 8: Consolidations - Changes in Ownership Interests38 Questions

Exam 9: Indirect and Mutual Holdings37 Questions

Exam 11: Consolidation Theories,push-Down Accounting,and Corporate Joint Ventures39 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions40 Questions

Exam 13: Accounting for Derivatives and Hedging Activities40 Questions

Exam 14: Foreign Currency Financial Statements39 Questions

Exam 15: Segment and Interim Financial Reporting38 Questions

Exam 16: Partnerships - Formation,operations,and Changes in Ownership Interests38 Questions

Exam 17: Partnership Liquidation40 Questions

Exam 18: Corporate Liquidations and Reorganizations38 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units38 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds34 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds39 Questions

Exam 22: Accounting for Not-For-Profit Organizations39 Questions

Exam 23: Estates and Trusts36 Questions

Select questions type

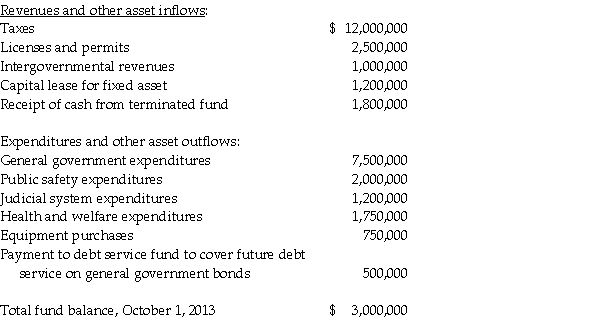

The following information regarding the fiscal year ended September 30,2014,was drawn from the accounts and records of the Mayberry County general fund:  Required:

Prepare a statement of revenues,expenditures,and changes in fund balance for the Mayberry County general fund for the year ended September 30,2014.

Required:

Prepare a statement of revenues,expenditures,and changes in fund balance for the Mayberry County general fund for the year ended September 30,2014.

Free

(Essay)

4.7/5  (35)

(35)

Correct Answer:

When a city enters into a capital lease for a fixed asset for the general government,

Free

(Multiple Choice)

5.0/5  (41)

(41)

Correct Answer:

A

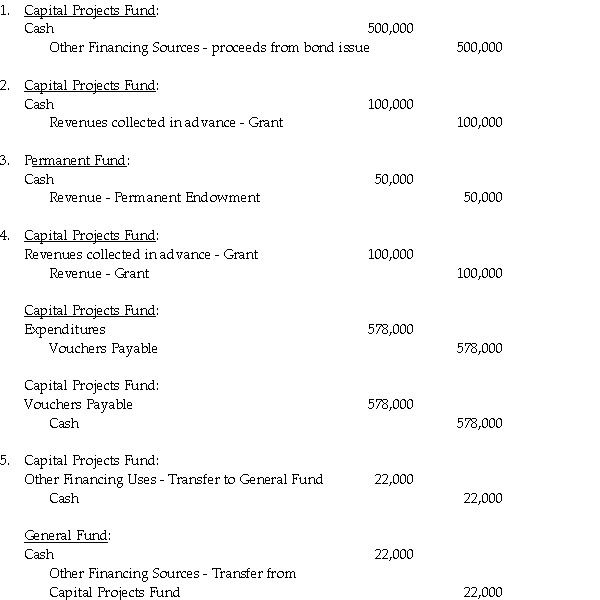

For each of the following transactions relating to the startup of a community pool,determine the fund(s)being affected and prepare the appropriate journal entry for each.Be sure to note the fund type with each journal entry prepared.

1.General obligation bonds are issued at face value of $500,000 to construct a new community pool.

2.Cash of $100,000 is received from a state grant.Grant is set up to support the construction of the community pool.

3.A community fund-raiser by a citizens' group raises $50,000 which is donated to the pool fund,with the restriction placed on it that only earnings are to be used for lifeguard wages,and the principal may not be used until such time as the pool ceases to operate,at which time the principal will revert to the general fund.

4.Construction is completed and the contractors invoices received,totaling $578,000.The invoices are paid within 60 days.

5.The balance of funds from the general obligation bonds and state grant that was not used is transferred to the General Fund.

Free

(Essay)

4.8/5  (43)

(43)

Correct Answer:

Which of the following funds has similar accounting and reporting to the special revenue fund?

(Multiple Choice)

4.9/5  (37)

(37)

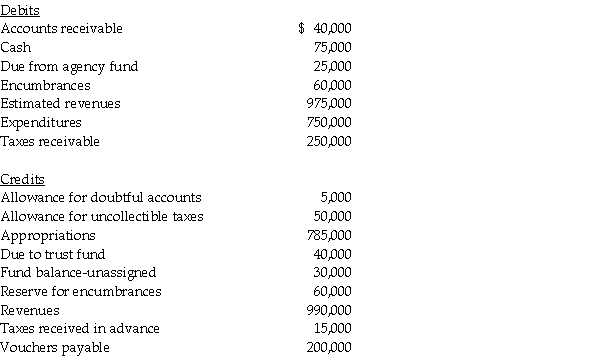

The unadjusted trial balance for the general fund of the City of Nineva at June 30,2014 is as follows:  Supplies on hand at June 30,2014 totaled $8,000.The $60,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Required:

Prepare a balance sheet for the general fund of the City of Nineva at June 30,2014.

Supplies on hand at June 30,2014 totaled $8,000.The $60,000 encumbrance relates to equipment ordered but not received by fiscal year-end.

Required:

Prepare a balance sheet for the general fund of the City of Nineva at June 30,2014.

(Essay)

4.7/5  (45)

(45)

Bounty County had the following transactions in 2014.

1.The budget for the county was approved,showing estimated revenues of $320,000 from local income taxes,and total estimated expenditures of $316,000.

2.Tax bills were mailed amounting to $326,000,which are due in 60 days.All but 2% was expected to be collectible.

3.Taxes collected prior to the due date amounted to $260,800.The balance was delinquent.

4.$4,200 of taxes due were determined to be uncollectible and written off.

5.The year-end books were closed,with the expectation that the remaining taxes due would be collected evenly over the first two months after the fiscal year end.

Required:

Prepare the journal entries for the General Fund for the transactions.

(Essay)

4.9/5  (32)

(32)

Goodwill County had the following transactions for their General Fund in the first month of their fiscal 2014 year,which ends June 30,2014.

1.The budget was approved,with $1,200,000 expected from property taxes,and another $5,000,000 expected from sales taxes.The budget showed these funds were expected to be spent on Salaries and Wages,$3,100,000;Utilities,$1,800,000;Rent,$900,000;and Supplies,$200,000.

2.Supplies were ordered in the amount of $33,000.

3.The electric bill was paid upon receipt in the amount of $75,000.

4.Property taxes were billed in the amount of $1,200,000,due on December 31.Bad debts are estimated at 1% of receivables.

5.Supplies were received,but the invoice amount was $35,000 and will be paid in 35 days.Supplies are used quickly and are not inventoried.

6.Property tax payments were received amounting to $100,000.

7.Payment was received from merchants for sales tax collections amounting to $400,000.

Required:

Prepare the journal entries for the General Fund that would be required for these transactions.

(Essay)

4.8/5  (32)

(32)

A Capital Projects Fund awards the construction of a building to a construction contractor at a contract cost of $1,000,000.What entry is prepared by the Capital Projects Fund?

(Multiple Choice)

4.8/5  (39)

(39)

Prepare journal entries to record the following grant-related transactions for a municipality special revenue fund.

1.Special Revenue Fund awarded an operating grant from the state,$2,500,000 (cash will be received after qualified expenditures are made).

2.Special Revenue Fund received funds of $1,600,000,temporarily transferred from the General Fund.

3.Incurred qualifying expenditures on the state grant program of $1,600,000 and paid them with funds temporarily transferred from the General Fund.

4.Received a federal grant to finance planting of trees in city,$4,500,000 (cash received in advance).

5.Incurred and paid cost of $3,000,000 for planting 10,000 trees in city.

(Essay)

4.9/5  (35)

(35)

When recording an approved budget into the accounts of the general fund,which of the following accounts would be credited?

(Multiple Choice)

4.9/5  (39)

(39)

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

-The proper sequence of events is

(Multiple Choice)

4.9/5  (41)

(41)

The City of Electri entered the following transactions during 2014:

1.Borrowed $120,000 for a six-month term,to be paid upon receipt of property tax payments which were previously billed.

2.Used the funds borrowed to purchase a new fire truck.The truck is expected to have a 15-year useful life,and a $5,000 residual value.

3.Received $90,000 cash from a state grant.Funds are restricted for the purchase of a second fire truck.

4.Used the grant funds received to purchase a second fire truck.The truck is expected to have a 15-year useful life,and a $5,000 residual value.

5.Nonreciprocal transfer of $50,000 to the Debt Service Fund to be used toward repayment of the note.

Required:

Prepare the journal entries in the General Fund for the transactions.

(Essay)

4.9/5  (40)

(40)

The proceeds from a bond issuance for the construction of a new public school should be recorded in the ________ fund at the time the bonds are sold.At the time of the bond issue,the debit is to cash and the credit is to ________.

(Multiple Choice)

4.8/5  (44)

(44)

Match the following fund balance descriptions for a General Fund with the proper classification for a fund balance.Each classification may be used more than once.

A.Nonspendable Fund Balance

B.Restricted Fund Balance

C.Committed Fund Balance

D.Assigned Fund Balance

E.Unassigned Fund Balance

________ 1.Amounts can only be spent for the specific purposes determined by a formal action of the government's highest level of decision-making authority.

________ 2.Amounts can only be spent for the specific purposes stipulated by constitution,external resource provider or enabling legislation.

________ 3.Residual classification of funds for the General Fund.

________ 4.Dollar amount of Ending Inventory.

________ 5.Amounts intended to be used by the government for specific purposes but do not meet the criteria of restricted or committed.

________ 6.Dollar amount of endowment principal.

(Essay)

4.7/5  (46)

(46)

Carson County had the following transactions for their General Fund relating to the levy and collection of property taxes.

1.Property tax bills for $1,000,000 are sent to property tax owners.Taxes are due in 45 days.History shows that Carson County should expect 1.5% of the property taxes to be uncollectible.

2.$850,000 in property taxes is collected.The remaining receivables are past due.

3.An additional $80,000 of the delinquent taxes is collected.

4.Wrote off $10,000 of delinquent taxes determined to be uncollectible.

Required:

Prepare the journal entries in the General Fund for the transactions.

(Essay)

4.7/5  (30)

(30)

The City of Attross entered the following transactions during 2014:

1.The city authorized a bond issue of $2,500,000 par to finance construction of a fountain and pavilion in the city square.The bonds were issued for $2,560,000.The premium was transferred to the fund for which the debt will be serviced.(This was a nonreciprocal transfer . )

2.The city entered into a contract for construction of the fountain at an estimated cost of $2,425,000.

3.The city received and paid a bill for $2,445,000 from the contractor upon completion of and approval of the fountain.

4.The unused bond proceeds were set aside for debt service on the bonds.Accordingly,those resources were paid to the appropriate fund(nonreciprocal).

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Attross.

(Essay)

4.7/5  (41)

(41)

Peking County incurred the following transactions during 2014:

1.Marketable securities were donated to support the county's bike and nature trails.The donor acquired the securities for $35,000 ten years earlier;however,their current market value was $200,000.The donor specified that all income from the securities be used for the trails.The principal is to be held intact for an indefinite period of time.

2.Computer equipment was ordered for general fund departments.The estimated cost was $48,000.

3.The county received the computer equipment.The actual cost was $47,750,of which $42,000 was paid to the vendor before year-end.

4.The county sold a (general government)dump truck that originally cost $55,000.The county sold the truck at auction for $3,300.The book value of the truck at the time of sale was $0.

5.The government leased equipment for the general government under a capital lease agreement.The present value of the minimum lease payments was $120,000.The county made an initial down payment of $10,000.

Required:

Prepare journal entries for each of the above transactions.Identify the appropriate fund or funds used by Peking County.

(Essay)

4.9/5  (27)

(27)

Address the following situations separately.

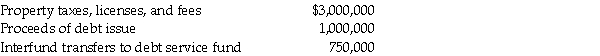

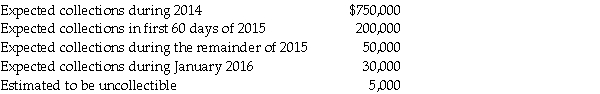

1.For the budgetary year beginning July 1,2014,Coastal City expected the following cash flow resources:  In the budgetary entry,what amount did Coastal City record for estimated revenues?

2.During the fiscal year ended June 30,2014,Western County issued purchase orders totaling $7,000,000.Western County received $6,500,000 of invoiced goods at the encumbered amounts and paid $6,100,000 toward them before year-end.

How much were Western County's encumbrances on July 1,2014?

3.The following information pertains to property taxes levied ($1,035,000 total)by Southern Township for the calendar year 2014:

In the budgetary entry,what amount did Coastal City record for estimated revenues?

2.During the fiscal year ended June 30,2014,Western County issued purchase orders totaling $7,000,000.Western County received $6,500,000 of invoiced goods at the encumbered amounts and paid $6,100,000 toward them before year-end.

How much were Western County's encumbrances on July 1,2014?

3.The following information pertains to property taxes levied ($1,035,000 total)by Southern Township for the calendar year 2014:  What amount did Southern Township report for property tax revenues in 2014?

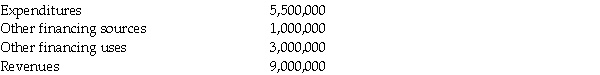

4.The following information pertains to Northern City's general fund for 2014:

What amount did Southern Township report for property tax revenues in 2014?

4.The following information pertains to Northern City's general fund for 2014:  At what amount will Northern City's total fund balance increase (decrease)in 2014?

At what amount will Northern City's total fund balance increase (decrease)in 2014?

(Essay)

4.7/5  (36)

(36)

Use the following information to answer the question(s)below.

The town of Mayberry receives a gift of $500,000 in bonds.The contributor instructs that the principal should remain intact,but the annual interest income of $50,000 can be used for the maintenance of the zoo animals.

-Governments must record a liability for uncollected taxes instead of revenues for uncollected taxes if the taxes are going to be collected

(Multiple Choice)

4.8/5  (41)

(41)

At any point in time,a government will be able to spend an amount equal to

(Multiple Choice)

4.8/5  (37)

(37)

Showing 1 - 20 of 34

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)