Exam 4: Consolidated Techniques and Procedures

Exam 1: Business Combinations46 Questions

Exam 2: Stock Investments - Investor Accounting and Reporting51 Questions

Exam 3: An Introduction to Consolidated Financial Statements50 Questions

Exam 4: Consolidated Techniques and Procedures50 Questions

Exam 5: Intercompany Profit Transactions - Inventories50 Questions

Exam 6: Intercompany Profit Transactions - Plant Assets50 Questions

Exam 7: Intercompany Profit Transactions - Bonds50 Questions

Exam 8: Consolidations - Changes in Ownership Interests50 Questions

Exam 9: Indirect and Mutual Holdings50 Questions

Exam 11: Consolidation Theories, push-Down Accounting, and Corporate Joint Ventures55 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions50 Questions

Exam 13: Accounting for Derivatives and Hedging Activities50 Questions

Exam 14: Foreign Currency Financial Statements50 Questions

Exam 15: Segment and Interim Financial Reporting50 Questions

Exam 16: Partnerships - Formation,operations,and Changes in Ownership Interests50 Questions

Exam 17: Partnership Liquidation50 Questions

Exam 18: Corporate Liquidations and Reorganizations50 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units50 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds48 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds50 Questions

Exam 22: Accounting for Not-For-Profit Organizations50 Questions

Exam 23: Estates and Trusts50 Questions

Select questions type

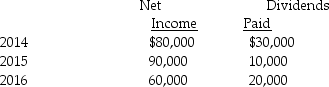

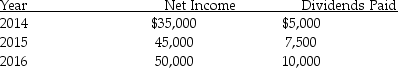

On January 1,2014,Paisley Incorporated paid $300,000 for 60% of Smarnia Company's outstanding capital stock.Smarnia reported common stock on that date of $250,000 and retained earnings of $100,000.Plant assets,which had a five-year remaining life,were undervalued in Smarnia's financial records by $10,000.Smarnia also had a patent that was not on the books,but had a market value of $60,000.The patent has a remaining useful life of 10 years.Any remaining fair value/book value differential is allocated to goodwill.Smarnia's net income and dividends paid the first three years that Paisley owned them are shown below.

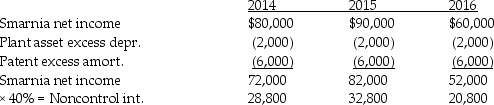

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia,calculate the ending balance in the Investment in Smarnia account for each of the three years.

Requirement 1: Calculate the noncontrolling interest share in Smarnia's income for each of the three years.

Requirement 2: Calculate the noncontrolling interest that should be reported on the consolidated balance sheet at the end of each of the three years.

Requirement 3: Assuming that Paisley uses the equity method to record their investment in Smarnia,calculate the ending balance in the Investment in Smarnia account for each of the three years.

Free

(Essay)

4.8/5  (33)

(33)

Correct Answer:

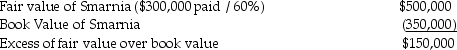

Preliminary calculations:

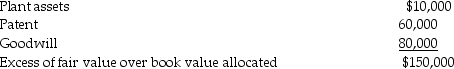

Excess of fair value over book value allocation:

Excess of fair value over book value allocation:

Requirement 1:

Requirement 1:

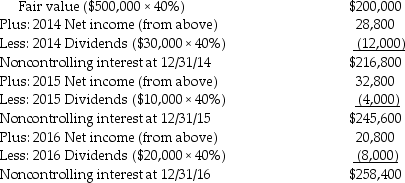

Requirement 2:

Requirement 2:

Beginning noncontrolling interest

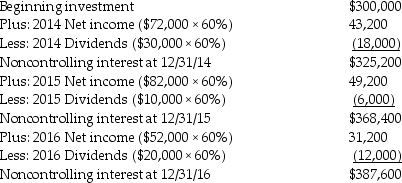

Requirement 3:

Requirement 3:

When performing a consolidation,if the balance sheet does not balance,

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

B

Pigeon Corporation acquired an 80% interest in Statue Company on January 1,2014,for $90,000 cash when Statue had Capital Stock of $60,000 and Retained Earnings of $40,000.The fair value/book value differential of $12,500 was attributable to equipment with a 10-year (straight-line)life.Statue suffered a $10,000 net loss in 2014 and paid no dividends.At year-end 2014,Statue owed Pigeon $18,000 on account.Pigeon's separate income for 2011 was $150,000.Controlling interest share of consolidated net income for 2014 was

Free

(Multiple Choice)

4.9/5  (25)

(25)

Correct Answer:

B

Which of the following statements is not true with respect to the statement of cash flows for a consolidated entity?

(Multiple Choice)

5.0/5  (39)

(39)

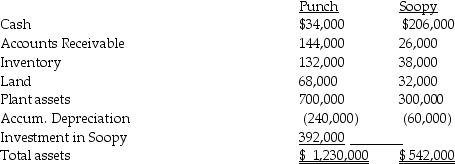

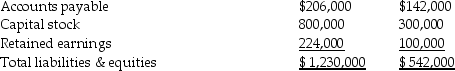

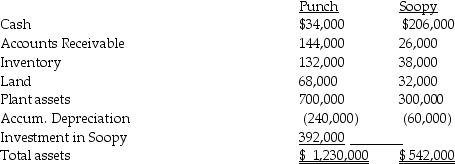

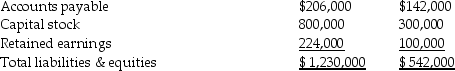

Use the following information to answer question(s) below.

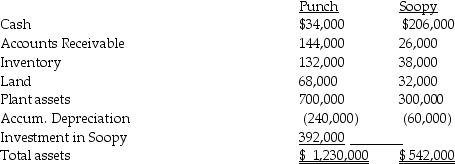

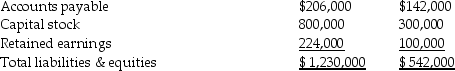

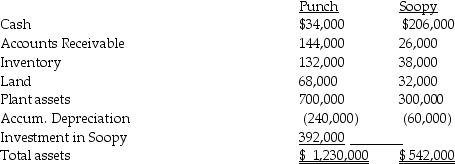

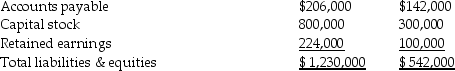

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of total liabilities will be reported?

-What amount of total liabilities will be reported?

(Multiple Choice)

4.9/5  (32)

(32)

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What amount of Inventory will be reported?

-What amount of Inventory will be reported?

(Multiple Choice)

5.0/5  (37)

(37)

Which of the following will be debited to the Investment account when the equity method is used?

(Multiple Choice)

4.9/5  (25)

(25)

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the reported amount for the noncontrolling interest?

-What is the reported amount for the noncontrolling interest?

(Multiple Choice)

4.9/5  (37)

(37)

On January 1,2014,Persona Company acquired 80% of Sule Tooling for $332,000.At that time,Sule reported their Common stock at $150,000,Additional paid in capital at $45,000,and Retained earnings at $105,000.Sule also had equipment on their books that had a remaining life of 10 years and were undervalued on the books by $40,000,but any additional fair value/book value differential is assumed to be goodwill.During the next three years,Sule reported the following:

Required: Calculate the following.

a.How much excess depreciation or amortization would be recognized in the consolidated financial statements in each of these three years?

b.How much goodwill would be recognized on the balance sheet at the date of acquisition,and at the end of each year listed?

c.How much investment income would be reported by Persona under the equity method for each of the three years?

d.What would be the balance in the Investment in Sule account at January 1,2014,and at the end of each of the three years listed?

Required: Calculate the following.

a.How much excess depreciation or amortization would be recognized in the consolidated financial statements in each of these three years?

b.How much goodwill would be recognized on the balance sheet at the date of acquisition,and at the end of each year listed?

c.How much investment income would be reported by Persona under the equity method for each of the three years?

d.What would be the balance in the Investment in Sule account at January 1,2014,and at the end of each of the three years listed?

(Essay)

4.8/5  (41)

(41)

At the beginning of 2014,Parling Food Services acquired a 90% interest in Simmons' Orchards when Simmons' book values of identifiable net assets equaled their fair values.On December 26,2014,Simmons declared dividends of $50,000,and the dividends were unpaid at year-end.Parling had not recorded the dividend receivable at December 31.A consolidated working paper entry is necessary to

(Multiple Choice)

4.9/5  (38)

(38)

Under the equity method of accounting parent-retained earnings and the consolidated-retained earnings are equal.

(True/False)

4.9/5  (39)

(39)

The depreciation on buildings is presented under investing activities on the consolidated cash flow statement.

(True/False)

4.8/5  (32)

(32)

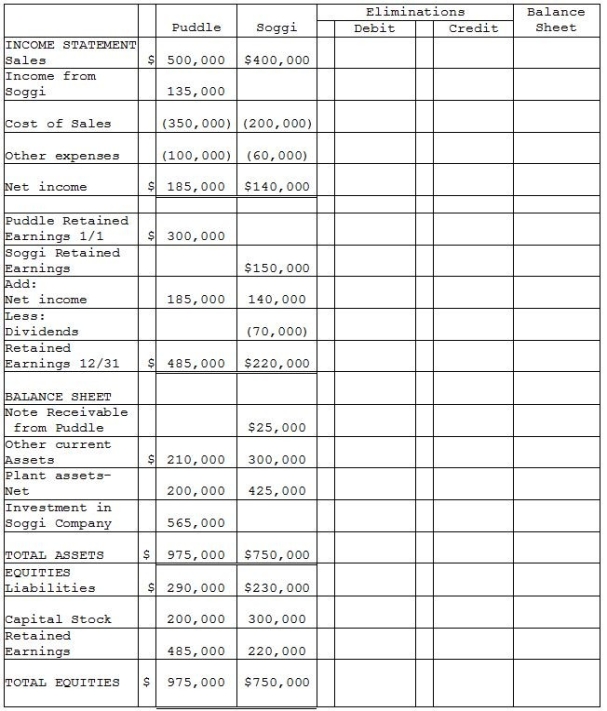

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1,2014 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2014,Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi,and on December 31,2014,Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5,2015,but receipt of payment of the note was not reflected in Soggi's December 31,2014 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

(Essay)

4.8/5  (43)

(43)

Use the following information to answer question(s) below.

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the amount of total assets?

-What is the amount of total assets?

(Multiple Choice)

4.8/5  (35)

(35)

In contrast with single entity organizations,consolidated financial statements include which of the following in the calculation of cash flows from operating activities under the indirect method?

(Multiple Choice)

4.8/5  (38)

(38)

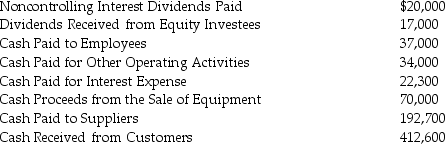

Parakeet Company has the following information collected in order to prepare a cash flow statement and uses the direct method for Cash Flow from Operations.The annual report year end is December 31,2014.

Required:

1.Prepare the Cash Flow for Operations part of the cash flow statement for Parakeet for the year ended December 31,2014.

Required:

1.Prepare the Cash Flow for Operations part of the cash flow statement for Parakeet for the year ended December 31,2014.

(Essay)

4.9/5  (43)

(43)

A parent company uses the equity method to account for its wholly-owned subsidiary.Which of the following will be a correct procedure for the Investment account?

(Multiple Choice)

4.9/5  (34)

(34)

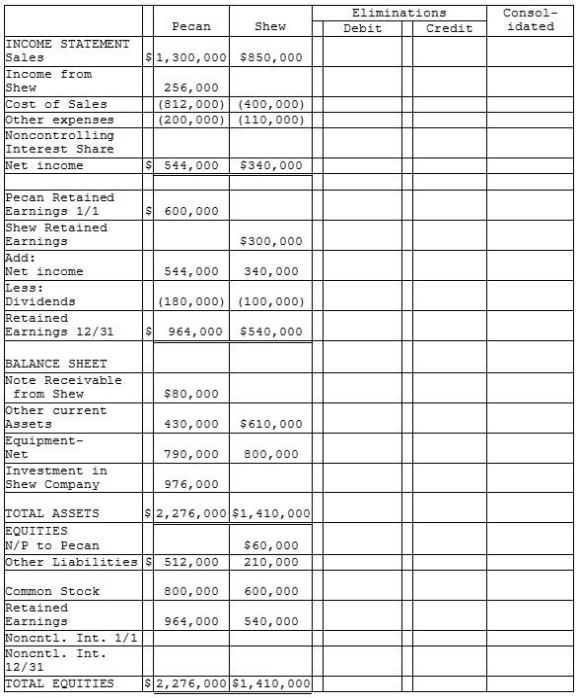

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2,2014 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2014,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2014,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2015,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

(Essay)

4.9/5  (38)

(38)

The trial balance approach to consolidation workpapers brings together the adjusted trial balances for affiliated companies.

(True/False)

4.8/5  (38)

(38)

Showing 1 - 20 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)