Exam 12: Corporations: Organization, Stock Transactions, and Dividends

Exam 1: Accounting and Business248 Questions

Exam 2: Double-Entry Accounting219 Questions

Exam 3: Adjustments: Accruals and Deferrals205 Questions

Exam 4: The Accounting Cycle213 Questions

Exam 5: Accounting for Retail Businesses276 Questions

Exam 6: Inventories210 Questions

Exam 7: Internal Control and Cash201 Questions

Exam 8: Receivables186 Questions

Exam 9: Long-Term Assets: Fixed and Intangible248 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies182 Questions

Exam 11: Liabilities: Bonds Payable174 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends194 Questions

Exam 13: Statement of Cash Flows195 Questions

Exam 14: Financial Statement Analysis208 Questions

Exam 15:Investments121 Questions

Select questions type

When no-par stock is issued, Common Stock is credited for the selling price of the stock issued.

(True/False)

4.8/5  (31)

(31)

Which of the following is not a prerequisite to paying a cash dividend?

(Multiple Choice)

4.7/5  (37)

(37)

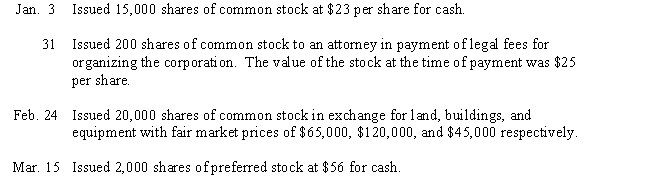

A corporation was organized on January 1 of the current year, with an authorization of 20,000 shares of 4%, $12 par preferred stock, and 100,000 shares of $3 par common stock.

The following selected transactions were completed during the first year of operations:

Journalize the transactions.

Journalize the transactions.

(Essay)

4.7/5  (32)

(32)

Using the following information, prepare the stockholders' equity section of the balance sheet. Seventy thousand shares of common stock are authorized and 7,000 shares have been reacquired.

Common Stock, \ 75 par \ 4,725,000 Paid-In Capital in Excess of Par 679,000 Paid-In Capital from Sale of Treasury Stock 25,200 Retained Earnings 2,032,800 Treasury Stock 600,000

(Essay)

4.9/5  (38)

(38)

The entry to record the issuance of 150 shares of $5 par common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to

(Multiple Choice)

4.9/5  (30)

(30)

Which of the following is not a right possessed by common stockholders of a corporation?

(Multiple Choice)

4.9/5  (44)

(44)

The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 40,000 shares were originally issued and 10,000 were subsequently reacquired. What is the number of shares outstanding?

(Multiple Choice)

4.9/5  (36)

(36)

The financial loss that each stockholder in a corporation can incur is usually limited to the amount invested by the stockholder.

(True/False)

4.8/5  (29)

(29)

On April 2 a corporation purchased for cash 5,000 shares of its own $10 par common stock at $16 a share. It sold 3,000 of the treasury shares at $19 a share on June 10. The remaining 2,000 shares were sold on November 10 for $12 a share.

(a) Journalize the entries to record the purchase (treasury stock is recorded at cost).

(b) Joumalize the entries to record the sale of the stock.

(Essay)

4.9/5  (33)

(33)

Which of the following amounts should be disclosed in the stockholders' equity section of the balance sheet?

(Multiple Choice)

4.9/5  (37)

(37)

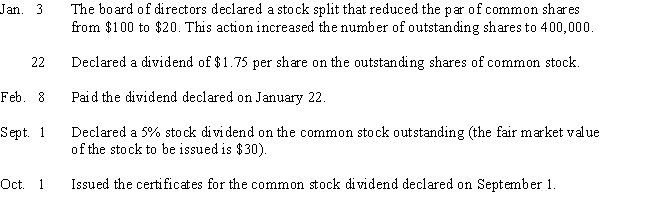

Journalize the following selected transactions completed during the current fiscal year:

(Essay)

4.9/5  (35)

(35)

On May 10, a company issued for cash 1,500 shares of no-par common stock (with a stated value of $2) at $14, and on May 15, it issued for cash 2,000 shares of $15 par preferred stock at $58.

Journalize the entries for May 10 and 15, assuming that the common stock is to be credited with the stated value.

(Essay)

4.9/5  (38)

(38)

Nexis Corp. issues 1,000 shares of $15 par value common stock at $22 per share. Journalize the transaction.

(Essay)

4.8/5  (41)

(41)

Prepare entries to record the transactions for Maine Corp.: (a) Issued 2,000 shares of par common stock at for cash.

(b) Issued 2,500 shares of common stock in exchange for land with a fair market price of .

(c) Purchased 400 shares of treasury stock at .

(d) Sold the 400 shares of treasury stock purchased in (c) at .

(Essay)

5.0/5  (35)

(35)

A corporation is a separate entity for accounting purposes but not for legal purposes.

(True/False)

4.7/5  (36)

(36)

Prepare entries to record the following: (a) Issued 1,000 shares of par common stock at for cash.

(b) Issued 1,400 shares of no-par common stock in exchange for equipment with a fair market price of .

(c) Purchased 100 shares of treasury stock at .

(d) Sold 100 shares of treasury stock purchased in (c) at .

(Essay)

4.8/5  (28)

(28)

In which section of the financial statements would Paid-In Capital from Sale of Treasury Stock be reported?

(Multiple Choice)

5.0/5  (38)

(38)

Financial statement data for this year and last year for Hanscombe Corp. are as follows: Current Year Last Year Net income \ 5,600,500 \ 4,988,000 Preferred dividends 60,000 60,000 Average number of common shares outstanding 125,000 110,000

Calculate earnings per share for each year.

(Short Answer)

4.7/5  (39)

(39)

Showing 121 - 140 of 194

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)