Exam 15:Investments

Exam 1: Accounting and Business248 Questions

Exam 2: Double-Entry Accounting219 Questions

Exam 3: Adjustments: Accruals and Deferrals205 Questions

Exam 4: The Accounting Cycle213 Questions

Exam 5: Accounting for Retail Businesses276 Questions

Exam 6: Inventories210 Questions

Exam 7: Internal Control and Cash201 Questions

Exam 8: Receivables186 Questions

Exam 9: Long-Term Assets: Fixed and Intangible248 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies182 Questions

Exam 11: Liabilities: Bonds Payable174 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends194 Questions

Exam 13: Statement of Cash Flows195 Questions

Exam 14: Financial Statement Analysis208 Questions

Exam 15:Investments121 Questions

Select questions type

Define debt securities and equity securities. Include their similarities and differences in your discussion.

(Essay)

4.9/5  (42)

(42)

Ruben Company purchased $100,000 of Evans Company bonds at 100. Ruben later sold the bonds at $104,500 plus $500 in accrued interest. The journal entry to record the sale of the bonds would be

(Multiple Choice)

4.9/5  (49)

(49)

Prepare the journal entries for the following transactions for Batson Co. (a) Batson Co. purchased 1,200 shares of the total of 100,000 outstanding shares of Michael Corp. stock for per share plus a commission.

(b) Michael's total earnings for the period are .

(c) Michael's paid a total of in cash dividends to sharehol ders of record.

(Essay)

4.9/5  (38)

(38)

It is not possible for one company to influence the operating policies of another company unless it owns more than 50% interest in that company.

(True/False)

4.7/5  (35)

(35)

The investor carrying an investment by the equity method records cash dividends received as an increase in the carrying amount of the investment.

(True/False)

4.8/5  (39)

(39)

An equity investment in less than 20% of another company's stock is accounted for using the fair value method.

(True/False)

4.9/5  (36)

(36)

Ruben Company purchased $100,000 of Evans Company bonds at 100 plus $1,500 in accrued interest. The bond interest rate is 8% and interest is paid semiannually. The journal entry to record the purchase would be

(Multiple Choice)

4.9/5  (31)

(31)

GAAP requires trading and available-for-sale investments to be reported

(Multiple Choice)

4.8/5  (37)

(37)

On January 2, Todd Company acquired 40% of the outstanding stock of McGuire Company for $205,000. For the year ending December 31. McGuire earned income of $48,000 and paid dividends of $14,000.

Prepare the entries for Todd Company for the purchase of the stock, share of McGuire income, and dividends received from McGuire.

(Essay)

4.9/5  (31)

(31)

The corporation owning all or a majority of the voting stock of another corporation is known as the parent company.

(True/False)

4.9/5  (33)

(33)

Held-to-maturity securities are reported on the balance sheet at fair value.

(True/False)

5.0/5  (30)

(30)

On January 1, the Valuation Allowance for Trading Investments account has a zero balance. On December 31, the cost of trading securities portfolio was $64,200, and the fair value was $67,000.

Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments.

(Essay)

4.8/5  (33)

(33)

On March 1, Year 1, Chase Inc. purchases 35% of the outstanding shares of Glory Corporation stock for $325,000. On December 31, Year 1, Glory reports net income of $162,000. On January 15, Year 2, Glory pays total dividends to stockholders of $33,000.

Journalize the three transactions.

(Essay)

4.9/5  (42)

(42)

During the first year of operations, Makala Company purchased two trading investments as follows:

Security Shares Purchased Cost Oceanna Company 700 \ 29,000 Rockledge, Inc. 1,900 41,000

Assume that as of December 31, the Oceanna Company stock had a market value of $49 per share and Rockledge, Inc. stock had a market value of $20 per share. Makala had 10,000 shares of no-par stock outstanding that was issued for $150,000. For the year ending December 31, Makala had net income of $105,000. No dividends were paid.

(a) Frepare the current assets section of the balance sheet presentation for the trading securities as of December 31.

(b) Explain how the gain or loss would be reported on the income statement.

(Essay)

4.8/5  (37)

(37)

When a bond is purchased for an investment, the purchase price, minus the brokerage commission, plus any accrued interest is recorded.

(True/False)

4.7/5  (35)

(35)

As with other assets, the cost of a bond investment includes all costs related to the purchase.

(True/False)

4.8/5  (38)

(38)

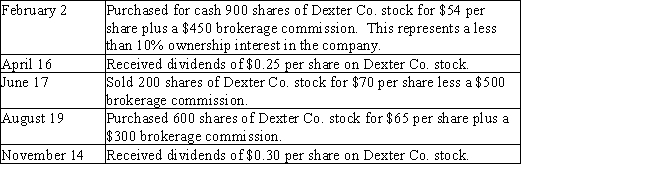

Journalize the entries to record the following selected equity investment transactions completed by Perry Company during the current year. Perry accounts for this investment using the fair value method.

(Essay)

4.9/5  (43)

(43)

Showing 61 - 80 of 121

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)