Exam 11: The Income Statement, the Statement of Comprehensive Income, and the Statement of Shareholders Equity

Exam 1: The Financial Statements140 Questions

Exam 2: Recording Business Transactions164 Questions

Exam 3: Accrual Accounting and the Financial Statements144 Questions

Exam 4: Internal Control and Cash110 Questions

Exam 5: Short-Term Investments and Receivables110 Questions

Exam 6: Inventory and Cost of Goods Sold106 Questions

Exam 7: Property, Plant, and Equipment, and Intangible Assets129 Questions

Exam 8: Long-Term Investments and the Time Value of Money97 Questions

Exam 9: Liabilities96 Questions

Exam 12: The Statement of Cash Flows127 Questions

Exam 13: Financial Statement Analysis116 Questions

Select questions type

A statement of shareholder's equity does not include details about a company's issuance of stock.

Free

(True/False)

4.8/5  (39)

(39)

Correct Answer:

False

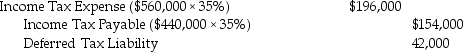

JetNew has a tax rate of 35%. The controller has just calculated JetNew's accounting income (pre-tax) to be $560,000 for 2013. Taking into account the differences in calculation, JetNew's taxable income is $440,000. Prepare the journal entry to record JetNew's taxes for 2013 under IFRS.

Free

(Essay)

4.8/5  (43)

(43)

Correct Answer:

Corrections to the beginning balance of Retained Earnings for errors found within the current period are called prior-period adjustments.

Free

(True/False)

4.8/5  (37)

(37)

Correct Answer:

False

An audit report is addressed to the board of directors and shareholders of a company.

(True/False)

4.8/5  (34)

(34)

Gail. Inc. has 100,000 common shares outstanding and 10,000 $5.00 preferred shares at the beginning of 2013. The company issued an additional 50,000 common shares on July 1, 2013. Gail Inc.'s net income for the year ended December 31, 2013 was $300,000; its comprehensive income was $450,000. Gail Inc. paid dividends of $50,000 during the year. What was Gail Inc.'s basic EPS for 2013?

(Multiple Choice)

4.8/5  (35)

(35)

On January 1, 2013, Automatic Train Corporation had 30,000 common shares outstanding issued at $10 each. On June 1, 2013, Automatic Train Corporation issued 12,000 shares of its common shares at $15 per share. On November 30, 2013, Automatic Train Corporation repurchased 3,000 shares of its common shares for $17 per share. The balance in Common shares on December 31, 2013, as shown on the statement of shareholders' equity, is:

(Multiple Choice)

4.9/5  (33)

(33)

In a standard Statement of Management Responsibility for the Financial Statements, management indicates:

(Multiple Choice)

4.8/5  (35)

(35)

Flexity Corporation, whose income tax rate is 35%, has taxable income of $592,600 and pretax accounting income of $494,000. The entry to record the income tax includes a:

(Multiple Choice)

4.9/5  (39)

(39)

All of the following might be found on a statement of shareholders' equity except:

(Multiple Choice)

4.8/5  (33)

(33)

Under the accrual method of accounting, revenues and gains are recorded when they occur, regardless of when the company receives or pays cash.

(True/False)

4.9/5  (44)

(44)

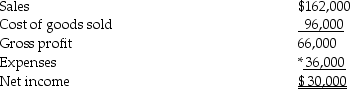

The statement of earnings for Bancroft Company for the year ended December 31, 2013 appears below.

*Includes $6,000 of interest expense and $3,200 of income tax expense.

Additional information:

1. Average number of common shares outstanding in 2013 was 15,000 shares.

2. The market price of Bancroft's shares was $36 per share at the end of 2013

3. Cash dividends of $6,000 were paid; $1,200 of which were paid to preferred shareholders.

*Includes $6,000 of interest expense and $3,200 of income tax expense.

Additional information:

1. Average number of common shares outstanding in 2013 was 15,000 shares.

2. The market price of Bancroft's shares was $36 per share at the end of 2013

3. Cash dividends of $6,000 were paid; $1,200 of which were paid to preferred shareholders.

(Essay)

4.9/5  (38)

(38)

Over the past two decades, research has shown half of financial statement fraud has involved improper revenue recognition. What are the more common revenue recognition schemes?

(Essay)

4.8/5  (42)

(42)

The amount of cash dividends declared during the period and the amount of cash dividends paid during the period are reflected in the statement of shareholders' equity and the cash flow statement, respectively.

(True/False)

4.8/5  (32)

(32)

Equipment was purchased at a cost of $20,000 at the beginning of 2009. It has been depreciated at $2,000 per year over its ten-year estimated useful life. The company is preparing its 2013 financial statements (the net book value of the equipment is $12,000); management now estimates that the remaining useful life is three years and at the end of that time the residual value will be $3,000. Assuming that the company continues to use the straight-line method of depreciation, how much will be charged to depreciation expense in 2013?

(Multiple Choice)

4.9/5  (42)

(42)

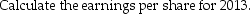

The following statement of shareholders' equity for the Q8 Corporation is missing explanations of the events that led to the changes in the shareholders' equity accounts. Write a brief explanation for each change.

(Essay)

4.8/5  (44)

(44)

A change in accounting estimate must be accounted for is accounted for retrospectively.

(True/False)

4.9/5  (32)

(32)

Under ASPE, when pretax accounting income exceeds taxable income:

(Multiple Choice)

4.8/5  (41)

(41)

Automatic Train Company, whose income tax rate is 40%, has taxable income of $856,000 and pretax accounting income of $813,000. Under IFRS the entry to record the income tax includes a:

(Multiple Choice)

4.7/5  (36)

(36)

Showing 1 - 20 of 71

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)