Exam 10: Standard Costs, Flexible Budgets and Variance Analysis

Exam 1: The Role of Accounting Information in Management Decision Making81 Questions

Exam 2: Cost Concepts, Behaviour and Estimation88 Questions

Exam 3: A Costing Framework and Cost Allocation45 Questions

Exam 4: Cost-Volume-Profit Cvp Analysis93 Questions

Exam 5: Job Costing Systems45 Questions

Exam 6: Process Costing Systems93 Questions

Exam 7: Absorption, Variable and Throughput Costing102 Questions

Exam 8: Activity Analysis: Costing and Management96 Questions

Exam 9: Relevant Costs for Decision Making122 Questions

Exam 10: Standard Costs, Flexible Budgets and Variance Analysis104 Questions

Exam 11: Operational Budgets87 Questions

Exam 12: Strategy and Control35 Questions

Exam 13: Planning and Budgeting for Strategic Success45 Questions

Exam 14: Capital Budgeting and Strategic Investment Decisions93 Questions

Exam 15: The Strategic Management of Costs and Revenues109 Questions

Exam 16: Strategic Management Control: a Lean Perspective46 Questions

Exam 17: Responsibility Accounting, Performance Evaluation and Transfer Pricing63 Questions

Exam 18: The Balanced Scorecard and Strategy Maps83 Questions

Exam 19: Rewards, Incentives and Risk Management45 Questions

Exam 20: Sustainability Management Accounting45 Questions

Select questions type

If a variance is unfavorable, it should be closed directly to cost of goods sold.

Free

(True/False)

4.7/5  (47)

(47)

Correct Answer:

False

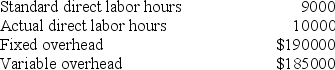

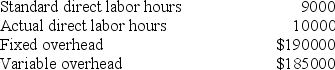

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:  The fixed overhead production volume variance was

The fixed overhead production volume variance was

Free

(Multiple Choice)

4.9/5  (35)

(35)

Correct Answer:

B

Burkett Company uses a standard cost system. Indirect costs were budgeted at $200,000 plus $15 per direct labor hour. The overhead rate is based on 10,000 hours. Actual results were:  The over- or underapplied overhead was

The over- or underapplied overhead was

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

C

Everett Ltd budgeted $1,488,000 for total overhead. The standard variable overhead rate was $2 per direct labor hour, or $6 per unit, based on an anticipated activity level of 600,000 direct labor hours. During the year 220,000 units were produced. Fixed overhead costs incurred were $300,000. The variable overhead budget variance was $19,800 unfavorable, and the actual variable overhead rate was $2.10 per direct labor hour. The fixed overhead allocated was

(Multiple Choice)

4.9/5  (33)

(33)

The fixed overhead budget variance can be broken down into two parts: the spending variance and the production volume variance.

(True/False)

4.9/5  (39)

(39)

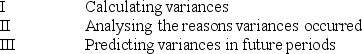

Variance analysis includes which of the following processes?

(Multiple Choice)

4.9/5  (30)

(30)

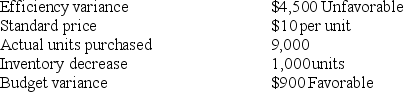

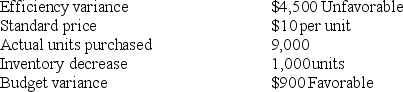

Pardee Ltd completed operations for the week and the accountant was preparing to make journal entries necessary to prepare a set of interim financial statements. Unfortunately, he discovered some of the data concerning direct materials had been lost. He was able to find the following:Efficiency variance  The standard quantity of direct materials allowed for the month was

The standard quantity of direct materials allowed for the month was

(Multiple Choice)

4.8/5  (32)

(32)

Brodie Co. uses a standard job cost system and a denominator volume of 25,000 direct labor hours for allocating overhead. The actual output was 12,000 units, which cost $185,700 for direct labor (23,000 hours), $27,525 for variable overhead, and $136,400 for fixed overhead. The standard variable overhead per unit is $2 (2 hours @ $1 per hour), and the standard fixed overhead per unit is $10 (2 hours @ $5 per hour). All variances are immaterial and are closed to Cost of Goods Sold at the end of the period. The entry to close the variable overhead variances includes a

(Multiple Choice)

4.9/5  (42)

(42)

The standard cost of direct materials is computed as the standard price per unit of input times the standard quantity per unit of input.

(True/False)

4.9/5  (40)

(40)

The direct materials price variance is the actual direct materials purchased at standard price less the actual direct materials purchased at actual price.

(True/False)

4.8/5  (31)

(31)

The direct labour efficiency variance is the difference between the standard amount of labour hours that should have been used and the amount actually used, multiplied by the standard labour price per hour.

(True/False)

4.8/5  (36)

(36)

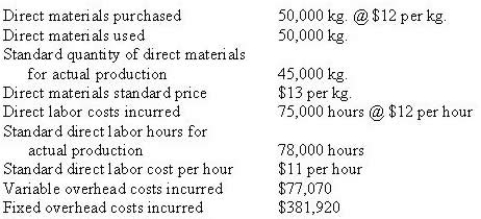

Mason Ltd uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include: The direct labor price variance is

(Multiple Choice)

4.7/5  (35)

(35)

If a variance analysis shows that operations are better than expected, managers should

(Multiple Choice)

4.8/5  (34)

(34)

The direct materials price variance is often based on materials purchased, rather than on materials used.

(True/False)

5.0/5  (35)

(35)

Mason Ltd uses a standard costing system. Overhead costs are allocated based on direct labor hours. The standard variable overhead and fixed overhead rates are $1 and $5 per direct labor hour, respectively. Data relevant for the current period include:  The purchase of direct materials would be recorded in direct materials inventory at

The purchase of direct materials would be recorded in direct materials inventory at

(Multiple Choice)

4.8/5  (36)

(36)

Pardee Ltd completed operations for the week and the accountant was preparing to make journal entries necessary to prepare a set of interim financial statements. Unfortunately, he discovered some of the data concerning direct materials had been lost. He was able to find the following:  The standard cost of the direct materials used was

The standard cost of the direct materials used was

(Multiple Choice)

4.8/5  (39)

(39)

If a variance is considered material, it should be allocated to work in process inventory, finished goods inventory, and cost of goods sold.

(True/False)

4.7/5  (34)

(34)

Showing 1 - 20 of 104

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)