Exam 1: The Investment Setting: Part A

Exam 1: The Investment Setting72 Questions

Exam 1: The Investment Setting: Part A6 Questions

Exam 2: Asset Allocation and Security Selection77 Questions

Exam 2: Asset Allocation and Security Selection: Part A3 Questions

Exam 3: Organization and Functioning of Securities Markets87 Questions

Exam 4: Security Market Indexes and Index Funds89 Questions

Exam 5: Efficient Capital Markets, Behavioral Finance, and Technical Analysis162 Questions

Exam 6: An Introduction to Portfolio Management114 Questions

Exam 6: An Introduction to Portfolio Management: Part A2 Questions

Exam 6: An Introduction to Portfolio Management: Part B2 Questions

Exam 7: Asset Pricing Models152 Questions

Exam 8: Equity Valuation83 Questions

Exam 9: The Top-Down Approach to Market, Industry, and Company Analysis216 Questions

Exam 10: The Practice of Fundamental Investing60 Questions

Exam 11: Equity Portfolio Management Strategies65 Questions

Exam 12: Bond Fundamentals and Valuation138 Questions

Exam 13: Bond Analysis and Portfolio Management Strategies125 Questions

Exam 14: An Introduction to Derivative Markets and Securities102 Questions

Exam 15: Forward, Futures, and Swap Contracts148 Questions

Exam 16: Option Contracts122 Questions

Exam 17: Professional Money Management, Alternative Assets, and Industry Ethics109 Questions

Exam 18: Evaluation of Portfolio Performance111 Questions

Select questions type

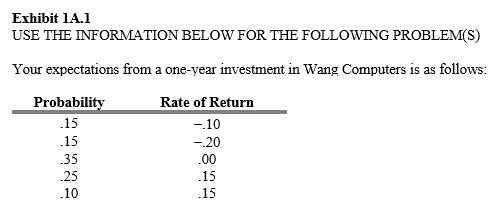

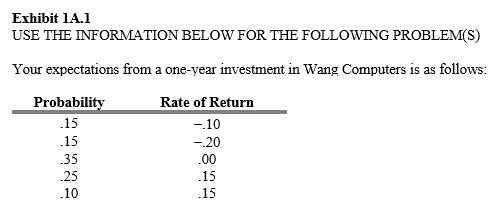

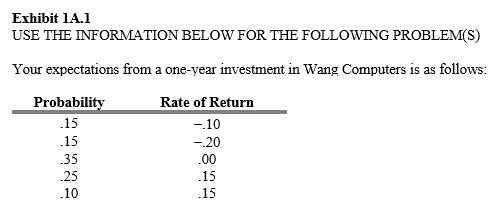

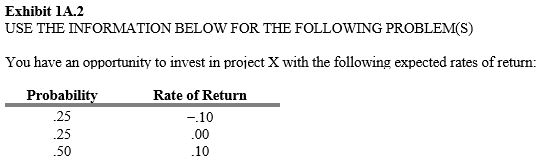

-Refer to Exhibit 1A.1. The expected return from this investment is

-Refer to Exhibit 1A.1. The expected return from this investment is

Free

(Multiple Choice)

4.8/5  (44)

(44)

Correct Answer:

D

-Refer to Exhibit 1A.1. The standard deviation of your expected return from this investment is

-Refer to Exhibit 1A.1. The standard deviation of your expected return from this investment is

Free

(Multiple Choice)

4.7/5  (43)

(43)

Correct Answer:

C

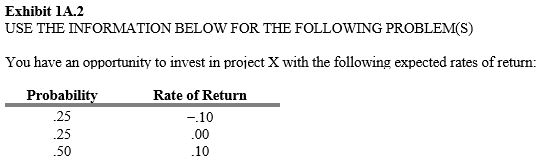

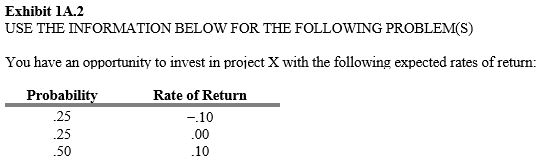

-Refer to Exhibit 1A.2. The expected return for project X is

-Refer to Exhibit 1A.2. The expected return for project X is

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

-Refer to Exhibit 1A.1. The coefficient of variation of this investment is

-Refer to Exhibit 1A.1. The coefficient of variation of this investment is

(Multiple Choice)

4.8/5  (35)

(35)

-Refer to Exhibit 1A.2. The standard deviation for project X is

-Refer to Exhibit 1A.2. The standard deviation for project X is

(Multiple Choice)

4.9/5  (41)

(41)

-An investment has a standard deviation of 12 percent and an expected return of 7 percent. What is the coefficient of variation for this investment?

-An investment has a standard deviation of 12 percent and an expected return of 7 percent. What is the coefficient of variation for this investment?

(Multiple Choice)

4.8/5  (34)

(34)

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)