Exam 4: Internal Control Cash

Exam 1: The Financial Statements174 Questions

Exam 2: Transaction Analysis179 Questions

Exam 3: Accrual Accounting Income205 Questions

Exam 4: Internal Control Cash173 Questions

Exam 5: Short-Term Investments Receivables201 Questions

Exam 6: Inventory Cost of Goods Sold187 Questions

Exam 7: Plant Assets, Natural Resources, Intangibles211 Questions

Exam 8: Long-Term Investments the Time Value of Money189 Questions

Exam 9: Liabilities220 Questions

Exam 10: Stockholders Equity126 Questions

Exam 11: The Income Statement, the Statement of Comprehensive Income, the Statement of Stockholders Equity125 Questions

Exam 12: The Statement of Cash Flows125 Questions

Exam 13: Financial Statement Analysis125 Questions

Select questions type

Smart hiring practices and separation of duties is part of the control environment.

(True/False)

4.9/5  (33)

(33)

The following are examples of items that appear on a bank reconciliation. Classify each item as (a) an addition to the bank balance, (b) a subtraction from the bank balance, (c) an addition to the book balance, or (d) a subtraction from the book balance.

1. NSF check

2. Deposits in transit

3. Interest earnings

4. Bank error - the bank credited the company's account for a deposit made by another customer

5. EFT rent collection

6. Service charge

7. Book error - the company credited cash for $100 when the correct amount was $1,000

8. Outstanding checks

9. Bank collection of a note receivable on behalf of the company

(Essay)

4.8/5  (35)

(35)

All employees should have a background check before being hired, and should be properly trained and supervised.

(True/False)

4.8/5  (35)

(35)

Which is NOT a component of comparisons and compliance monitoring?

(Multiple Choice)

4.9/5  (27)

(27)

Creating bogus websites for the purpose of stealing unauthorized data is a(n):

(Multiple Choice)

5.0/5  (42)

(42)

A cash receipt from a customer for which there are not sufficient funds in the bank to cover the amount is a(n):

(Multiple Choice)

4.8/5  (38)

(38)

________ is the element in the fraud triangle results from either critical need or greed on the part of the perpetrator.

(Multiple Choice)

4.9/5  (42)

(42)

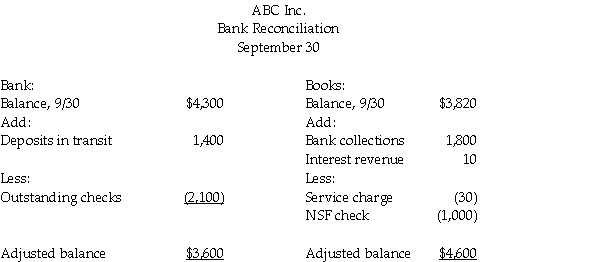

The owner of ABC Inc. has reason to believe that an employee has been stealing cash from the company. The employee receives cash from clients, makes the bank deposit, and also prepares the monthly bank reconciliation. To check up on the employee, the owner prepares his own bank reconciliation, as follows:

Does it appear the employee has stolen from the company? If so, how much? Explain your answer.

Which side of the bank reconciliation shows the company's true cash balance?

Does it appear the employee has stolen from the company? If so, how much? Explain your answer.

Which side of the bank reconciliation shows the company's true cash balance?

(Essay)

4.9/5  (35)

(35)

The two most common types of fraud impacting financial statements are:

(Multiple Choice)

4.8/5  (39)

(39)

The person to whom a check is paid is referred to as the drawee.

(True/False)

4.9/5  (44)

(44)

Access to sensitive data files should be protected by passwords and data encryption.

(True/False)

4.8/5  (36)

(36)

Cash equivalents include accounts receivable expected to be collected within 90 days or less.

(True/False)

4.8/5  (28)

(28)

Showing 81 - 100 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)