Exam 23: Flexible Budgets and Standard Cost Systems

Exam 18: Introduction to Managerial Accounting210 Questions

Exam 19: Job Order Costing170 Questions

Exam 20: Process Costing167 Questions

Exam 21: Cost-Volume-Profit Analysis238 Questions

Exam 22: Master Budgets172 Questions

Exam 23: Flexible Budgets and Standard Cost Systems204 Questions

Exam 24: Cost Allocation and Responsibility Accounting189 Questions

Exam 25: Short-Term Business Decisions181 Questions

Exam 26: Capital Investment Decisions142 Questions

Select questions type

Miami Fashions uses standard costs for their manufacturing division.From the following data,calculate the fixed overhead allocated to production based on direct labor hours (DLHr). Actual fixed overhead \ 34,000 Budgeted fixed overhead \ 21,000 Standard overhead allocation rate \ 9 Standard direct labor hours per unit 3 DLHr Actual output 2,000 units

(Multiple Choice)

4.8/5  (34)

(34)

The static budget,at the beginning of the month,for Onyx Décor Company,follows: Static budget:

Sales volume: 1,100 units; Sales price: $70.00 per unit

Variable costs: $32.00 per unit; Fixed costs: $38,000 per month

Operating income: $3,800

Actual results,at the end of the month,follows:

Actual results:

Sales volume: 980 units; Sales price: $75.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $34,200 per month

Operating income: $5,000

Calculate the flexible budget variance for sales revenue.

(Multiple Choice)

5.0/5  (35)

(35)

Which of the following is the correct formula for measuring a cost variance?

(Multiple Choice)

4.7/5  (39)

(39)

A company's production department was experiencing a high defect rate on the assembly line,which was slowing down production and causing wastage of valuable direct materials.The production manager decided to purchase a higher grade of materials that would be more reliable,but he was worried that the cost of the new materials might negatively affect operating income.This would produce a(n)________.

(Multiple Choice)

5.0/5  (38)

(38)

Lewis Marine Company manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor.Lewis uses standard costs to prepare its flexible budget.For the first quarter of the year,direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 4 pounds per unit; $6 per pound

Direct labor: 2 hours per unit; $19 per hour

During the first quarter,Lewis produced 5,000 units of this product.Actual direct materials and direct labor costs were $65,000 and $331,000,respectively.

For the purpose of preparing the flexible budget,what is the total standard direct labor cost at a production volume of 5,000 units?

(Multiple Choice)

4.8/5  (42)

(42)

Grand Canyon Food Products is famous for its frosted fruit cake.The main ingredient of the cake is dried fruit,which Grand Canyon purchases by the pound.In addition,the production requires a certain amount of direct labor.Grand Canyon uses a standard cost system,and at the end of the first quarter,there was an unfavorable direct materials efficiency variance.Which of the following is a logical explanation for that variance?

(Multiple Choice)

5.0/5  (34)

(34)

Allen Boating Company manufactures special metallic materials and decorative fittings for luxury yachts that require highly skilled labor.Allen uses standard costs to prepare its flexible budget.For the first quarter of the year,direct materials and direct labor standards for one of their popular products were as follows: Direct materials: 1 pound per unit; $11 per pound

Direct labor: 2 hours per unit; $18 per hour

Allen produced 2,000 units during the quarter.At the end of the quarter,an examination of the direct materials records showed that the company used 6,500 pounds of direct materials and actual total materials costs were $99,600.

What is the direct materials efficiency variance?

(Multiple Choice)

4.8/5  (44)

(44)

When using management by exception,the purchasing manager should be questioned for which of the following variances?

(Multiple Choice)

4.8/5  (37)

(37)

If both favorable and unfavorable variances exist,the variances are subtracted from each other.The variance is determined to be favorable or unfavorable based on which one is the larger amount.

(True/False)

4.9/5  (37)

(37)

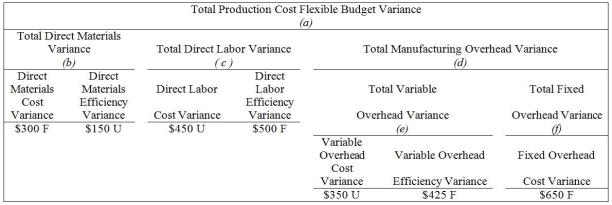

Based on the following,what is the total manufacturing overhead variance for the total production cost flexible budget variance?

(Multiple Choice)

4.9/5  (35)

(35)

Caterlebe Productions uses a standard cost system.On December 31,the account balances include the following:

Sales Revenues: $750,000

Cost of Goods Sold (standard costing): $400,500

Selling & Admin expenses: $150,000

Variances:

Sales revenue variance \ 6,000 F Direct materials cost variance 400 U Direct materials efficiency variance 375 F Direct labor cost variance 675 U Direct labor efficiency variance 150 F Variable overhead cost variance 250 U Variable overhead efficiency variance 800 F Fixed overhead cost variance 420 U Fixed overhead volume variance 100 F Prepare a standard cost income statement.

(Essay)

4.8/5  (27)

(27)

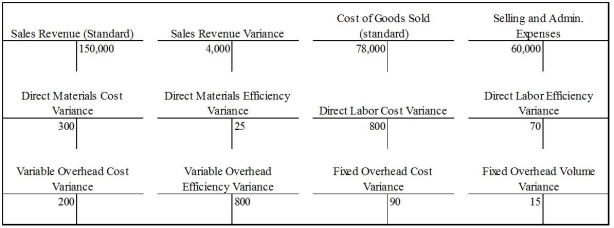

Maroon,Inc.uses a standard cost system.On December 31,the last day of the accounting period,the account balances include the following:  What is the standard net operating income of the company for the year ended December 31?

What is the standard net operating income of the company for the year ended December 31?

(Multiple Choice)

4.9/5  (33)

(33)

When a manufacturing company uses a standard cost system,an unfavorable variance is a contra expense.

(True/False)

4.8/5  (33)

(33)

Melissa Antiques Company has collected the following data for one of its products: irect materials standard (4 pounds @ 1//b.) \ 4 per unit Direct materials flexible budget variance - unfavorable \ 14,500 Actual direct materials used 100,000 pounds Actual units produced 19,000 units What is the direct materials efficiency variance?

(Multiple Choice)

4.8/5  (32)

(32)

The static budget is used to compute flexible budget variances as well as cost and efficiency variances for direct materials and direct labor.

(True/False)

4.8/5  (39)

(39)

A static budget presents financial data at multiple levels of sales volume.

(True/False)

4.7/5  (33)

(33)

Wood Designs Company,a custom cabinet manufacturing company,is setting standard costs for one of its products.The main material is cedar wood,sold by the square foot.The current cost of cedar wood is $6.00 per square foot from the supplier.Delivery costs are $0.30 per square foot.Carpenters' wages are $20.00 per hour.Payroll costs are $3.00 per hour,and benefits are $6.00 per hour.How much is the direct materials standard cost per square foot?

(Multiple Choice)

4.8/5  (34)

(34)

Companies conduct time-and-motion studies and use benchmarks from other companies when developing standards.

(True/False)

4.7/5  (31)

(31)

Showing 141 - 160 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)